After Rajasthan and Chhattisgarh, Punjab is the latest State that has announced its plan to revert to the Old Pension Scheme (OPS). Many have argued that this is a fiscally irresponsible move. We argue why and how we must go back to the OPS.

The OPS is an assured inflation-indexed monthly family pension till you (and your spouse) live(s). The OPS level is linked to the last pay you drew. The NPS is a corpus from which you can draw a pension after retirement. Its value is determined by the market prices in which the corpus is invested.

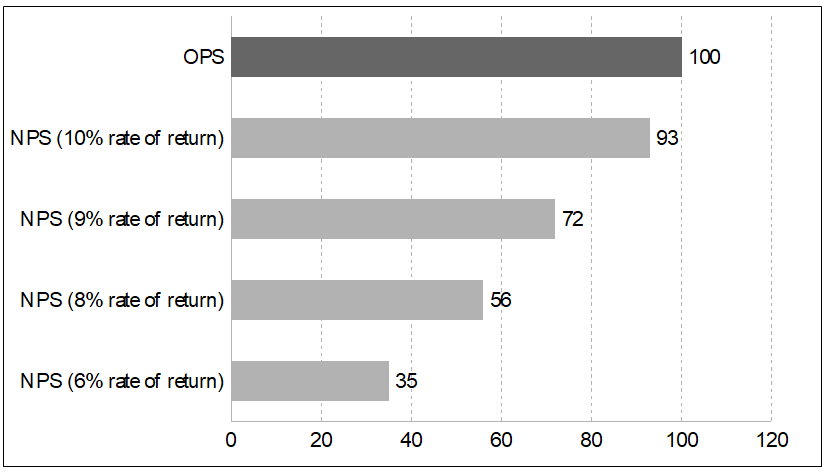

There are many issues with the NPS. One, as Chart 1 shows, the amount of monthly pension you would draw (for the same contribution during service) with three hypothetical market rates of return is significantly lower for NPS.

Chart 1: Amount of Monthly Pension, NPS vs OPS

Two, it is dependent on the vagaries of the market prices of equity/bonds in which the corpus is invested. To be sure, the markets do not crash often and in the long run they go up rather than down. But it is still a lottery. If there is a crash, the downside has to be absorbed by the retirees. According to a 2008 OECD study, the global financial crisis had wiped a total of $5 trillion off the value of private pension funds in rich countries compared to the start of the year. It’s true that this is the value of assets on paper, but such a fall can, and did, induce withdrawals among panic-stricken retirees who didn’t have age on their side to be in the long game of speculation.

Three, the OPS is a fixed government expenditure irrespective of an economic slowdown or a stock market crash, which makes it a good counter-cyclical policy measure during a crisis. In fact, the Sixth Pay Commission in India did precisely this during the Great Recession of 2008.

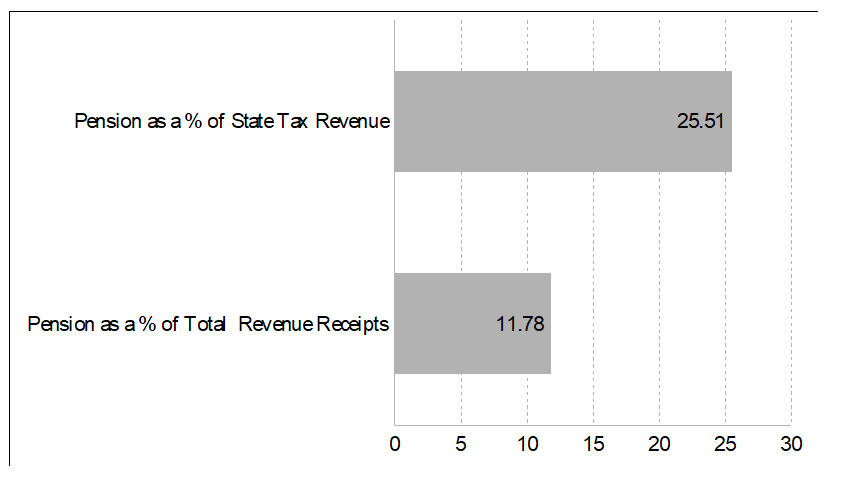

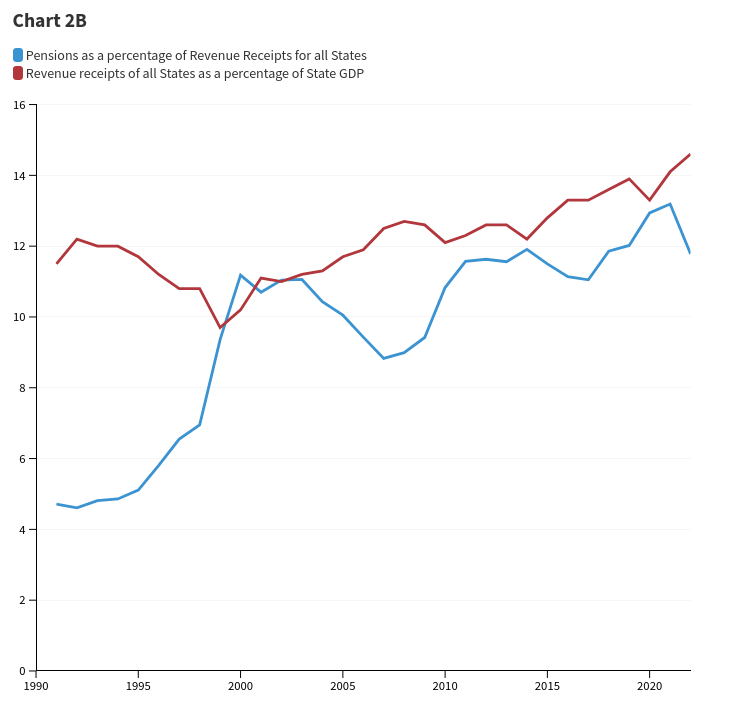

It has been argued that the OPS is a big hole in the exchequer’s pocket (25% of the States’ budget). This number is misleading because three other parts of States’ revenue receipts — tax the Centre collects on behalf of the States (SGST, a part of direct taxes, etc.); non-tax revenue that the States collect; and non-tax grant that the Centre shares with the States — have not been taken into account. Chart 2A shows that the OPS outlays, when calculated correctly, are less than half of 25%. Additionally, as Chart 2B shows, when the revenues (as a share of State GDP) go up, the share of pensions falls. So, shouldn’t the focus then be on mobilising revenues instead of cutting expenditures? But how?

Chart 2A

Chart 3 plots the tax-GDP ratio (State plus Centre’s taxes) for 18 of the G20 countries. India is the fifth country from the bottom and performs poorly among BRICS nations. Even within that, two out of three rupees comes from indirect taxes, for which the poor have to pay the same as the rich for a commodity. So, by increasing direct taxes — in particular corporate taxes — enough room can be created to ensure decent pensions for all.

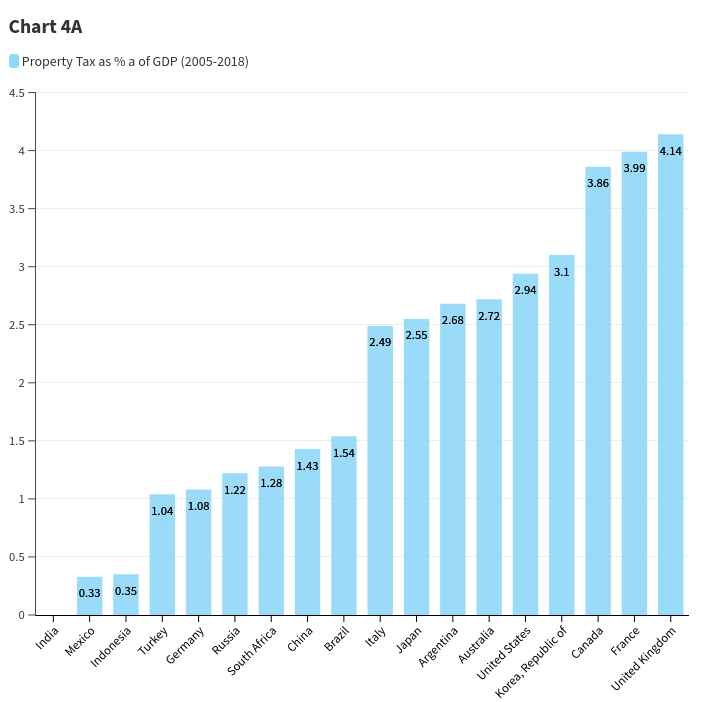

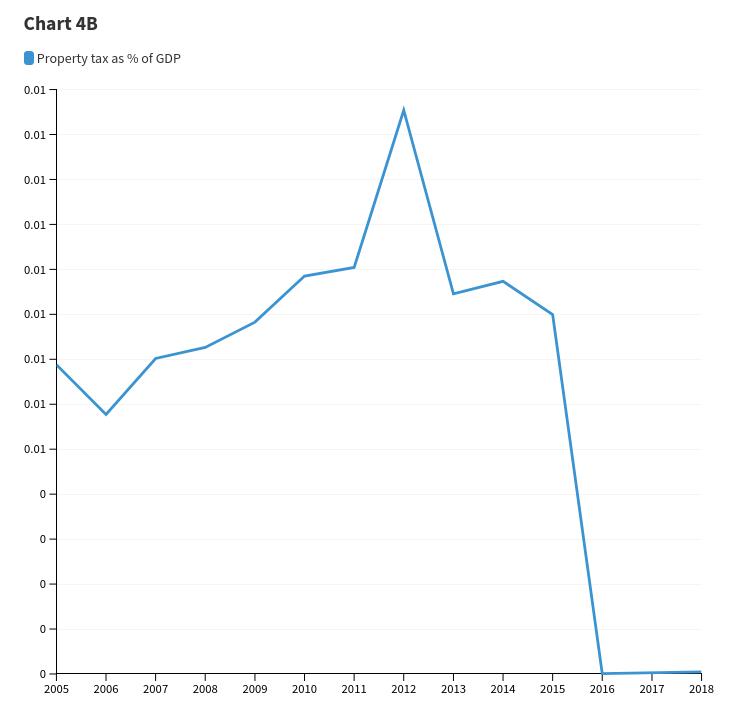

Not only is there enough room in corporate taxes, a lot more can be mobilised if India were to target property and wealth taxes, which are almost zero (Chart 4A). Not surprisingly, India ranks the lowest among the 18 of G-20 countries. At one point, India did have some property tax, however insignificant, which rose between 2005 to 2012 but has fallen precipitously since (Chart 4B).

Perhaps there is a need to rationalise the level of pensions under the OPS to make room for non-permanent workers. But doing away with the old pension altogether is like throwing the baby with the bath water.

(Rohit Azad & Indranil Chowdhury teach Economics at JNU and PGDAV College, Delhi University, respectively. Courtesy: The Hindu.)