Research Unit for Political Economy, 16 May 2020

Government officials stick to the version that national income will grow in 2020-21, even bizarrely claiming that it will grow by 1-2 per cent in the April-June quarter, two-thirds of which period will have been under the lockdown. It is now amply clear to any real-world observer that the economy will not grow in 2020-21, but shrink; the question is to assess: by how much. This assessment may be useful in order to gauge the extent of suffering of people and the damage to the nation’s productive capacity, and accordingly to assess how much the Government should spend to alleviate that suffering and revive productive capacity.

Why does the Government persist in unreal optimistic predictions of growth? Because it carries out the above two steps backwards: it first assesses how much it can spend without angering foreign investors, then understates the economic loss so as to justify such a low increase in Government expenditure. Since the Government has decided (in the economic packages of March 27 and May 12) to make only a tiny increase in expenditure, its official economists must claim that GDP growth will remain positive, only slowing in one quarter, followed by a rapid recovery to earlier levels.

The Prime Minister’s speech of May 12

On May 12, the Prime Minister announced what he called a Rs 20 lakh crore (Rs 20 trillion) package, amounting to 10 per cent of GDP. At first glance, the figure seems huge. The media have by and large swallowed the Government claims about the size of the package, and inundated us with details of sundry schemes and slogans.

The package, however, turns out to be empty. For three days the Finance Minister has held press conferences reading out laundry lists of assorted schemes, virtually devoid of actual Government expenditure. There is little point in our discussing the details; they merely confirm that the Government’s response to the biggest economic crisis in post-1947 India will rank among the most meagre in the world. Instead of spending in order to provide services and to compensate people for the effects of the lockdown, most of the measures announced relate to making more credit available to different sections (which will flow to big business, if the past is any guide). The burden of even such paltry measures has thus been thrown onto the shoulders of the public sector banks. However, even before Covid-19, big businesses were not interested in investing, for lack of demand. Banks have no interest in lending to medium, small and micro units. And for small and micro-units, loans are no solution for the devastating loss suffered due to the lockdown: this is akin to knocking down someone’s home and offering her/him a loan to re-construct it.

Contrary to the “10 per cent of GDP” headline figure, then, there will be either no increase in expenditure, or a very small increase, perhaps 1-2 per cent of GDP. The current chief economic advisor, K.V. Subramanian, indirectly admitted this on May 14, saying that “A good part of stimulus is utilising leverage [i.e., lending] to deliver…while at the same time ensuring that the fiscs [i.e., Government spending] remain actually under control.”[1]

The real scale of the crisis

By contrast, the Indian government’s former chief economic advisor, Arvind Subramanian, has been critical of the Government’s meagre spending plans. He forthrightly admits that the GDP will not grow this year, but shrink, and argues for increasing Government spending. Subramanian and another economist, Devesh Kapur (hereafter S-K), guess that a two-month lockdown would reduce GDP by about 8.25 per cent of annual GDP. To remedy this they suggest a stimulus package of 5 per cent of GDP, or Rs 10 lakh crore. Of this 5 per cent of GDP, they say, 2 per cent would go toward the increased health costs the Government would have to incur this year, and 3 per cent would go towards “cushioning household income and firms’ costs”.

No doubt S-K call for the Government to increase its spending. However, they gravely understate the impending GDP loss, and therefore the funds needed for revival. Even with the scant data available, it is quite clear by now that GDP will shrink much more drastically than the figure they take as their basis.

To get a sense of this, let us look at the components of GDP. One of the two ways GDP can be measured is total expenditure. The components of this are private consumption (C), private investment (I), Government spending (G), and net exports (NX). Within these, private investment includes both corporate investment and household investment (mainly the productive investments of small units and farmers, and residential investments). Government spending includes both consumption expenditure and investment. The sum of all of these is GDP (Y).

C + I + G + NX = Y

What do we know about the state of each of these?

(i) Private consumption accounts for the bulk of India’s GDP – about 56-57 percent. It had slowed, long before Covid-19, due to the reigning recession in the country and the consequent fall in people’s real incomes.

Now, however, surveys of the lockdown period indicate that consumption has collapsed dramatically, with vast numbers unable to obtain even essential needs such as food. Discretionary spending would thus have fallen even more sharply (see box above). Due to the lockdown, even the upper classes are restrained from spending, leading to a rise in bank deposits.

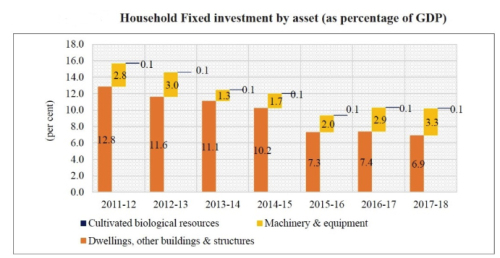

(ii) Investment was already shrinking before Covid-19 – by 4.1 per cent in the September 2019 quarter and 5.2 per cent in the December 2019 quarter. The corporate sector already had large spare capacity, with capacity utilisation at less than 69 per cent by the end of 2019. Hence it was uninterested in making physical investments, and accordingly production of capital goods (investment goods) fell by 14 per cent in 2019-20. Household investment has been declining for several years now.

Source: Economic Survey 2019-20. (The figure “0.1” in each year represents the investment in cultivated biological resources.)

In the present conditions, small units are in no position to invest, nor are people likely to buy or build new homes. The APU survey cited above (see box) found that, while most self-employed persons had lost their employment during the lockdown, those self-employed who continued to work saw a 90 per cent reduction in their income. Farmers are another important set of investors, but, according to the APU survey, 52 per cent of them either could not harvest or sell their crops, and another 35 per cent had to sell their crops at a depressed price. (The Finance Minister herself, in her presentation on May 15, mentioned that “Supply chains have been disrupted and farmers are not being able to sell their produce in the markets. Distress sale and reduction of price of perishable fruits and vegetables at the farm level needs to be prevented.”)

(iii) Net exports[2]: Exports are certainly not going to power any growth: the IMF’s World Economic Outlook (April 2020), has estimated that, in 2020, emerging market and developing country export volumes will shrink by 9.6 per cent.

(iv) Finally, there is Government spending. Indeed, in the recent period Government spending has been propping up GDP growth to a certain extent. Now, as other components of GDP shrink, so will tax revenue, if tax rates are maintained at the same level. If the Government does not raise more money (through either taxes or borrowing), it must actually reduce its expenditure.

On May 9, the Government announced it would raise additional borrowings of 2 per cent of GDP. This is very small: it might cover part of the amount that would be lost in tax revenues. If the Central government sticks by this, it looks possible that it may even shrink its total expenditure, and re-allocate some of the remaining expenditure towards the items listed in the Prime Minister’s economic package.

Meanwhile the state governments, who account for almost two-thirds of total Government spending in normal times, have not received their share of GST revenues yet from the Centre, let alone further Central assistance which they have requested; and their own revenues have utterly collapsed due to the lockdown. Accordingly they have slashed their spending drastically: Maharashtra, for example, has imposed a 67 per cent cut on all developmental expenditure, a freeze on hiring, a halt to farm loan relief (already sanctioned), and a 25 per cent cut in departmental expenses.

In sum, total Government spending (Centre + states) actually looks set to fall. This fall will reduce aggregate demand, and thereby intensify the depression.

The economist Keynes showed in the 1930s that, in capitalist economies, the only reliable tool in the hands of a government to revive an economy characterised by unemployment and idle productive capacity is to increase its own expenditure. It can influence the other components of GDP – increase private consumption and encourage private investment – by its own spending. Indeed, all thorough-going capitalist economies, even those that spout anti-Keynesian views in times of prosperity, turn to these methods in times of recession. Thus the US, which normally promotes neoliberal shrinking of government’s role, has nevertheless jacked up government spending massively in the 2008 crisis and again this year. The same medicine is forbidden for subordinate-rank economies like India, which must suppress expenditure even amid a depression.

Other indicators paint a grim picture

A range of other indicators bear out the gravity of the economic collapse. Organised industry may have shrunk by two-thirds in April and May.[3] Unorganised sector industry would have done much worse. Although the rabi harvest this year was good, there was widespread disruption of agricultural marketing operations, leading to losses for farmers. Indeed, ground-level surveys bring out a range of disruptions in agriculture and other rural economic activity. The index of services activity suffered an “apocalyptic drop”. Construction activity came to a standstill, as evidenced by the 91 per cent fall in cement freight transported by the Railways in April. Power consumption fell 20 per cent in April 2020 (over April 2019).

The unfolding of further consequences

These are all the immediate losses. What will happen after the lockdown is lifted (whenever that may be)?

There are two views. The current chief economic advisor foresees a “V-shaped” recovery, with economic activity bouncing back as soon as the lockdown is lifted. This is based on the hope that people have pent-up demand for various postponed purchases, and they will quickly make up the slowdown of one quarter.

However, any rational person can see that, even if there are not further lockdowns and continued effects of ‘distancing’, the events that have already taken place would result in a number of long-lasting negative effects. Supply lines for all sorts of inputs have been disrupted, and it will take a long time to restore them. Large numbers of labourers have left for their villages, and activity which depended on them will not revive for some time. Many owners of small businesses and self-employed persons may not be able to re-start operations for some time, for lack of working capital; they lack access to bank credit and hence to the Finance Minister’s grandiose schemes. Indeed, many may shut down permanently. Tourism, both of foreign visitors and domestic tourists, is likely to remain low for some time to come. (The direct and indirect contribution of tourism to GDP is estimated at 5.2 per cent in normal times.)

Let us divide these negative effects into two types, although no such neat division may exist in the real world. One effect is linear: For example, if production of a particular input is stalled, a factory which uses that input may stop production, and lay off its workforce temporarily, without pay. A second effect is a vicious circle: Due to general lack of demand, many factories may lay off their workers; as a result, the workers would have less money to spend; this would reduce demand further, leading more factories to lay off their workers, and so on. Both types of effects are likely to operate. Unusually, this crisis affects not only demand but supply as well.

Thus activity will not return to its earlier levels immediately upon the lifting of the lockdown, rather it may travel in a downward spiral.

Realistic estimates of the drop in GDP

Given all this, it is certain that the economy will shrink sizeably in 2020-21. More real-world estimates of GDP loss are emerging. For example, former Union finance secretary Subhash Garg, argues that the loss of GDP in April-May alone would be at least Rs 20 lakh crore, or 10 per cent of annual GDP. Tejal Kanitkar and T. Jayaraman make use of an input-output model, which takes into account the interdependence of different sectors. Their conservative estimate is that 47-day lockdown would lead to a GDP loss of 23 per cent; a 67-day lockdown would lead to a GDP loss of 33 per cent. The noted economist Arun Kumar independently arrives at a similar estimate, namely that GDP for the year 2020-21 could fall by 35 per cent or more.

It is significant that the United States has a high percentage of digital workers in its workforce (and therefore would suffer less drop in output due to a lockdown); has a less restrictive lockdown than India; and has pumped in a large stimulus programme. Yet the financial firm Goldman Sachs estimates that for the April-June quarter, GDP in the US would drop by 25 per cent, and a senior monetary official (the head of the Federal Reserve Bank of St. Louis) suggested that the drop in that period would be 50 per cent. By comparison, India’s percentage of digital workforce is very low, and the unorganised sector makes up nearly half of GDP and more than four-fifths of employment. Is it conceivable that India’s GDP loss from its (more severe) lockdown would be less than that of the US?

Official statistics will not bring out the reality

It should be noted that the present official statistical methods will not properly capture the loss of GDP during the present crisis. One important reason for this is that the output of the unorganised sector is not directly observed, but indirectly estimated. This was brought out strikingly in 2017, when official statistics pulled off a magic trick by showing a rise in GDP growth in the wake of demonetisation, when it was clear that the reverse was the case. The RBI at the time admitted:

Hard data on the unorganised sector are collected only infrequently and then used for fixing the base period benchmark by the CSO (i.e., 2011-12 for the new GVA/GDP series). For subsequent years, estimates are extrapolated from the base year benchmarks using suitable proxy indicators from the organised sector or by applying past trends.

In any crisis which hits the unorganised sector more than the organised sector, such as the present Covid-19 crisis, this statistical method will underestimate the losses of the unorganised sector, and hence wind up overestimating GDP.

Finally, perhaps the real reason S-K underestimate the impending GDP loss, and thereby underestimate the sum required to address it, is that they too are keenly aware of the limits foreign investors and their credit ratings agencies will allow. They too are, in effect, working backward from those limits to get their estimates of GDP loss. All that S-K argue is for pushing the limits somewhat higher than the extremely low levels that the Indian government is adhering to at present.[4] Their frame is otherwise not basically different from that of the three RBI ex-governors who have recently warned against fiscal expansion.

Notes

[1] By way of comparison, let us look at the Great Global Financial Crisis of 2008. That crisis for India was multiples milder than the present one. GDP growth fell from 9.3 per cent in 2007-08 to 6.7 per cent in 2006-07, a fall of 2.6 percentage points – a mere ripple compared to the present crisis. The Central government increased its expenditure by 1.5 percentage points, contributing to a revival of GDP growth in 2009-10 itself. (In fact, tax revenues also came down by 2 percentage points, resulting in a widening of the Centre’s fiscal deficit by 3.5 percentage points in all.) This is similar to the expansion being planned today by the Government – in the face of a catastrophic depression, one which may result in the shrinkage of the economy by one-third.

[2] Net exports (exports minus imports) are always a negative figure for India, since our import bill is larger than what we earn from exports. In the recent period, imports have dropped by an even larger figure than exports, and hence the trade deficit narrowed from $16.4 billion in April 2019 to $6.8 billion in April 2020. As a result, the figure for net exports is a smaller negative figure than earlier. For this peculiar reason, net exports may even contribute a bit to the figure for GDP growth.

[3] In March 2020, with just one week of lockdown, the Index of Industrial Production showed a fall of 16.5 per cent.

[4] Subramanian says: “One [fear] is that our credit rating will go down…. Now remember that this is a situation that all countries are confronting. Secondly, … categorically around the world we know this as an exogenous shock nobody was responsible for. Finally we have to be clear of how we are perceived after the crisis and will depend upon how we behave after the crisis. If government policy is reasonably responsible going forward, which I think it will be, then affordability is not an issue. So I think we can afford this.” Indian Express, May 3, 2020.

(Research Unit for Political Economy is a trust based in Mumbai that brings out material seeking to explain day-to-day issues of Indian economic life in simple terms and link them with the nature of the country’s political economy.)