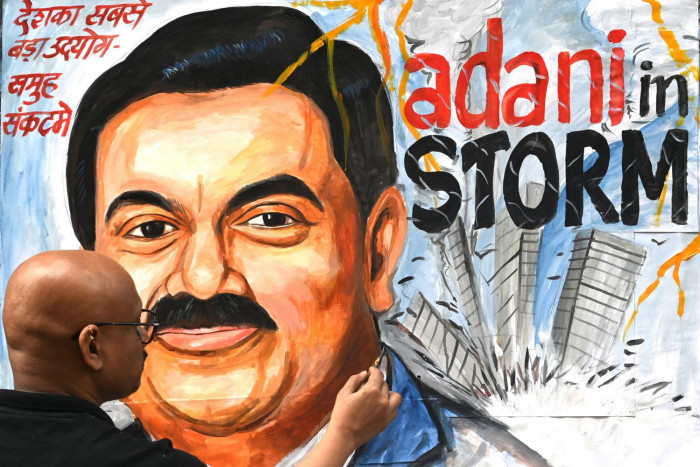

The recent allegations of accounting fraud and stock manipulation against Indian multi-billionaire Gautam Adani made by Hindenburg Research, a New York-based short-selling firm, has startled many in the financial world. The episode is a necessary reality check for those who are expecting India’s star to burn brighter in the global economic firmament as China’s dims.

The allegations have highlighted some of the systemic issues that plague the Indian economy and often go ignored, particularly its extreme inequality and corporate concentration. A small slice of the economy produces capital- and skill-intensive goods to meet the demands of the wealthy, whereas most other sectors by and large suffer from insufficient demand and weak productivity, resulting in low aggregate investment and high unemployment.

Economic wealth is concentrated in the hands of a few conglomerates. Marcellus Investment Managers has estimated that the 20 most profitable firms in India generated 14% of total corporate profits in 1990, 30% in 2010, and 70% in 2019. Most evidence suggests that increased profits were due to market power rather than innovation or large productivity gains, while some commentators consider this corporate inequality to be a factor underlying the disconnect between the Indian stock market and the real economy.

One could argue that the most profitable firms are not the same as before — there was considerable structural churn in the first two decades after economic liberalisation began in 1991. Significantly, regional capital had grown, particularly in the southern and western states, and competition among new business groups increased. This development coincided with the rise of powerful regional political parties, which played an increasingly assertive role in coalition governments.

But after the return in 2014 to a one-party dominant system, headed by Premier Narendra Modi, the merger of business and politics led to what the journalist Harish Damodaran has described as “conglomerate” capitalism. In most sectors, only two players, or at most three, control a combined market share greater than 50%, while protectionism has inhibited foreign competition.

It’s a classic case of crony capitalism, with favours and special regulatory dispensations often reserved for a select number of large firms. In some cases, rules and goalposts have been changed to help politically connected businessmen. This was obvious in Adani Group’s emergence, in a matter of a few months, as the largest commercial holder of airports, despite having no experience in the area. Adani’s rise was aided by a relaxation of prior rules and veiled threats against business rivals by government investigative agencies.

After complaints about predatory pricing practices by Reliance Jio in the telecom sector, the Telecom Regulatory Authority of India hastily amended the previous rules: No foul, no harm. Similarly, the Ministry of Commerce and Industry amended the regulations governing special economic zones to benefit Adani’s coal-fired power plant in Godda, and environmental regulations were waived for Adani’s mines. Even heavily indebted favoured businesses can easily raise domestic or foreign capital because their political connections facilitate regulatory approvals and an implicit “sovereign guarantee”.

Most of the industries in which crony capitalists operate produce non-traded goods or are highly regulated, which means that getting government favours is much more important than being successful in foreign foreign markets. It is no surprise that India’s tycoons have not produced a single global champion: they are happier wallowing in mostly rent-heavy industries.

The problem has only gotten worse. According to The Economist, India’s share of billionaire wealth derived from crony sectors rose from 29% to 43% between 2016 and 2021. Mr Adani’s net worth increased almost fourteenfold from 2014 until the recent scandal.

In recent years, public-sector banks have forgiven enormous debts, and many large “willful defaulters” have essentially robbed these banks with impunity. The government has also undermined the the Insolvency and Bankruptcy Code (IBC) — widely hailed as transformational legislation when it was enacted in 2016 — to preserve its ability to engage in selective regulatory forbearance. The recovery of loans under the IBC process has so far been absurdly low — the entire system has been brazenly gamed by the politically connected. Delayed court judgments are often due to evasive action by defaulting borrowers, even as they continue to strip assets. In any case, the accounting and regulatory standards are quite lax in the Indian corporate sector more generally, and some claim that nearly half the listed firms in the stock market have accounting problems. Crony capitalism pays off handsomely for the ruling Bharatiya Janata Party (BJP). Electoral bonds, introduced in 2017, were touted as a way to increase transparency and accountability; but they have done exactly the opposite, reportedly allowing copious funds to flow — without any limits or disclosure requirements — from a small number of conglomerates to the BJP. While these corporate donors remain anonymous to the public, the bonds are issued by State Bank of India, which means that the bank — and therefore the government – knows who buys them. In a climate of fear, potential business donors to opposition parties will remain hesitant.

The BJP no longer needs to raise money from an odd assortment of smaller donors — the liquor dealers or sugar barons or local real-estate magnates or construction contractors — as local parties did previously. Now the BJP simply doles out favours to the large national firms that funnel it ample money.

Some of these businesses also own media firms that effectively serve as government mouthpieces and cheerleaders in exchange for a steady stream of revenue from public advertisements. One of the Adani Group’s most brazen acts was a hostile takeover of the independent Indian news channel NDTV.

The Adani scandal has stoked a media firestorm, framed by a David-versus-Goliath narrative. (Findings were already known to Indian investigative journalists.) But global financial institutions and investors need to understand that Mr Adani is merely a symptom of a pervasive problem. India’s crony oligarchy is likely to keep much of the economy trapped in a low-productivity mire for quite some time.

(Pranab Bardhan is a professor at the University of California, Berkeley. His most recent books are ‘Globalisation, Democracy and Corruption: An Indian Perspective and Awakening Giants’, ‘Feet of Clay: Assessing the Economic Rise of China and India’. Courtesy: Project Syndicate, an international media organization headquartered in Prague, that publishes and syndicates commentary and analysis on a variety of global topics.)