The World Bank: An ABC

Éric Toussaint

[In 2020, the World Bank (WB) and the IMF are 76 years old. These two international financial institutions (IFI), founded in 1944, are dominated by the USA and a few allied major powers who work to generalize policies that run counter the interests of the world’s populations.

The WB and the IMF have systematically made loans to States as a means of influencing their policies. Foreign indebtedness has been and continues to be used as an instrument for subordinating the borrowers. Since their creation, the IMF and the WB have violated international pacts on human rights and have no qualms about supporting dictatorships.

A new form of decolonization is urgently required to get out of the predicament in which the IFI and their main stakeholders have entrapped the world in general. New international institutions must be established. Two articles by Éric Toussaint retrace the development of the World Bank and the IMF since they were founded in 1944. We publish the first of these articles in this issue; the next article will be published in a next issue.]

Introduction

What we call World Bank actually covers two bodies, the International Bank for Reconstruction and Development (IBRD) and the international Development Association (IDA). The World Bank is a sub-section in the World Bank Group that includes three more bodies: the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA) and the International Centre for Settlement of Investment Disputes (ICSID). Let see what is hiding behind those names and acronyms.

The International Bank for Reconstruction and Development (IBRD) was created at Bretton Woods (USA) in July 1944, by 45 countries that had met for the first UN monetary and financial conference. In 2019, it consists of 189 member countries, Nauru is the the most recent new member (since April 2016). [1]

Its initial objectives were to provide public money for the reconstruction of Western Europe after World War II, be a reliable ally of Washington and to buy goods produced by US companies. Later it turned to financing the development of countries of the South, playing the part of “a vital source of financial and technical assistance to developing countries” according to its own word. [2] The financing choices are in fact very selective and questionable.

Four other bodies were created to become the “World Bank Group”; they are assigned the following missions:

- 1956: The International Finance Corporation (IFC): financing the private sector in the South;

- 1960: The International Development Association (IDA).: Lends to the poorest countries;

- 1966: International Centre for Settlement of Investment Disputes (ICSID: supranational tribunal where a corporations may take legal proceedings against a State if it considers that a decision is unfavourable;

- 1988: The Multilateral Investment Guarantee Agency (MIGA): Guaranties the interests of private companies in the Southern countries.

Henceforth, mention of the World Bank will include IBRD and IDA.

An undemocratic leadership

Each of the member countries names a Governor, usually its finance minister. They meet as the Board of Governors, the senior decision making body, once a year (in autumn, two years on three in Washington) to set the main policies. The board makes the important decisions (admitting new members, preparing the budget, etc.). Also, the spring reunion in Washington (in common with the IMF) assesses the action of the World Bank and IMF.

For the day-to-day management of World Bank missions, the board of Governors delegates its authority to 25 Executive Directors. Eight countries, USA, Japan, Germany, France, UK, Saudi Arabia, China and Russia, name their own Executive Directors. The other seventeen Directors are appointed by seventeen surprisingly heterogeneous groups of countries: A rich country is grouped with Southern countries and of course it is the rich country that names the Executive Director to represent the whole group.

The Executive Directors normally meet three times a week and their meetings are chaired by a president elected for 5 years. Contrary to all democratic principles it is understood that the post is reserved for a US representative chosen by the President of the United States. The Executive Directors do no more than rubber stamp the choice.

The connivance between business, US big capital and the World Bank is immediately perceptible when we become aware of where all the thirteen US citizens who have succeeded each other at the post have come from.

Eugene Meyer, the first President lasted no longer than eight months. He was editor of the Washington Post and was formerly tied to Lazard Frères. The second, John J. McCloy, was a big corporate lawyer well established on Wall St. He went on to be American High Commissioner for occupied Germany and Chairman of the Chase Manhattan Bank. The third, Eugene R. Black, was Vice President of Chase National Bank and went on to be special advisor to President Lyndon B Johnson. The fourth, George D. Woods, also a banker, was President of the First Boston Corporation. Robert S. McNamara had been the CEO of the Ford motor company, then defense secretary for Kennedy and Johnson. His successor, Alden W. Clausen, afterwards became President of the Bank of America (one of the US’s biggest banks, highly involved in the Third World debt crisis). In 1986 the post went to Barber Conable, former Republican member of Congress, then in 1991 to Lewis T. Preston, former president of the executive committee of JP Morgan. Between 1995 and 2005, the ninth President of the World Bank was J.D. Wolfensohn, former director of the investment banking section of Salomon Brothers in New York. After leaving the World Bank, in March 2005, he joined Citibank-Citigroup, one of the world’s biggest banks. Paul Wolfowitz, former number 2 at the Pentagon was involved in the 2003 invasion of Iraq by a coalition under US orders. Paul Wolfowitz was forced to resign over questions concerning his influence on the career of his girlfriend, who was also on the World Bank payroll. He was replaced by Robert Zoellick, who had been White House Deputy Chief of Staff under G. Bush Sr. United States Trade Representative, Deputy Secretary of State, and having worked for Goldman Sachs, he was heavily involved in the July 2007 subprimes crisis. From 2012 to 2019, Jim Yong Kim, also a US citizen, was at the head of the World Bank before resigning to join a private investment fund. David Malpass has officially headed the World Bank since April 2019. Malpass worked for the US Treasury Department and the State Department under Ronald Reagan before becoming Chief Economist at the big investment bank Bears Stearn up to its failure in 2008 as a consequence of its role in creating the subprimes’ speculative bubble! In August 2007, Malpass published an article in the Wall St. Journal reassuring readers on the well-being of the financial markets, going so far as to claim that “Housing and debt markets are not that big a part of the U.S. economy, or of job creation”. In May 2016 he joined the Donald Trump election campaign. He was rewarded by being given the posts of Under Secretary of the Treasury for International Affairs and then President of the World Bank.

Table: The 13 Presidents of the World Bank since 1946

| Name | Period in office | Antecedents |

| Eugene Meyer | June 1946 – December 1946 | Wall St. investment banker and editor of the Washington Post |

| John McCloy | March 1947 – June 1949 | Director of the Chase National Bank (which became Chase Manhattan) |

| Eugene Black | July 1949 – December 1962 | Vice-President of the Chase Manhattan Bank |

| George Woods | January 1963 – March 1968 | President of the First Boston |

| Robert McNamara | April 1968 – June 1981 | CEO of the Ford motor company and defense secretary for Kennedy and Johnson |

| Alden Clausen | July 1981- June 1986 | President of the Bank of America |

| Barber Conable | July 1986 – August 1991 | Congressman member of the Banking Commission |

| Lewis Preston | September 1991- May 1995 | President of JP Morgan and Co |

| James Wolfensohn | June 1995 – May 2005 | Bank H Schroder, then Salomon Brothers and President of James D. Wolfensohn Inc. |

| Paul Wolfowitz | June 2005 – June 2007 | Deputy Secretary of State |

| Robert Zoellick | July 2007 – June 2012 | Deputy Secretary of State under George W. Bush |

| Jim Yong Kim | July 2012 – February 2019 | Doctor, President of Dartmouth College ; head of the WHO Département VIH/SIDA ; joined Global Infrastructure Partners |

| David Malpass | February 2019 – present | Chief economist at investment bank Bear Stearns, Under Secretary of the Treasury for International Affairs under Donald Trump |

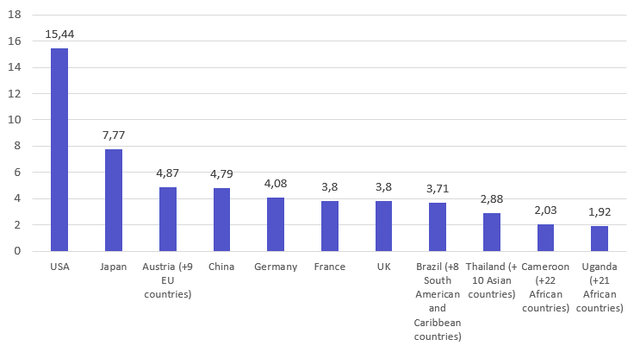

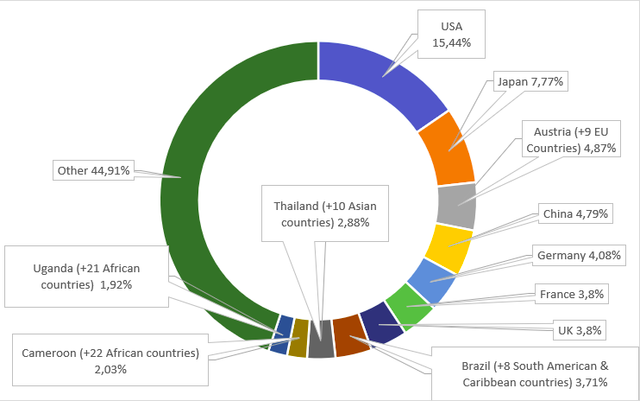

An unequal distribution of voting rights

All member countries are allocated a number of votes that determines the weight of their influence. A basic right of 250 votes is allocated to each country plus a supplementary part drawn from a precise and complex calculation. Unlike the UN General Assembly, where each country has one vote (not to be confused with the security council where five countries hold vetos), this system grants a voting power directly related to the financial participation. However, one country cannot unilaterally increase or decrease its funding level to increase or decrease its voting rights and weigh more. The system is watertight.

IBRD Directors voting rights in January 2020 [3]

| Country | % | Group presided by | % | Group presided by | % |

| USA | 15.44 | Austria | 4.87 | Switzerland | 3.05 |

| Japan | 7.77 | Mexico | 4.74 | Iceland | 3.05 |

| China | 4.79 | The Netherlands | 4.08 | Pakistan | 3.01 |

| Germany | 4.08 | South Korea | 3.99 | Thailand | 2.88 |

| France | 3.80 | Canada | 3.98 | Kuwait | 2.75 |

| UK | 3.80 | Brazil | 3.71 | Uruguay | 2.28 |

| Russia (+ Syria) | 2.82 | India | 3.54 | Cameroon | 2.03 |

| Saudi Arabia | 2.70 | Italy | 3.34 | Uganda | 1.92 |

| Nigeria | 1.61 |

Source: worldbank.org

Source: World Bank

The southern countries do not make the weight against the Northern countries, who maintain their controlling influence and systematically impose their viewpoint.

The difference between population and influence is clear:

| Country or group | Estimated population in 2020 (in millions) | Voting rights at IBRD in January 2020 (%) |

| Group presided by India | 1,566 | 3.54 |

| China | 1,439 | 4.79 |

| Group presided by Uganda | 480 | 1.92 |

| USA | 331 | 15.44 |

| Group presided by Cameroon | 326 | 2.03 |

| Russia (+ Syria) | 163 | 2.82 |

| Japan | 127 | 7.77 |

| France | 65 | 3.80 |

| Saudi Arabia | 34 | 2.70 |

Source: World Bank, United Nations

On top of this unfair allocation of voting rights the US has imposed an 85% majority vote for all major decisions. Being the only country to wield more than 15% of the voting rights it has a built-in veto on major decisions.

The European Union countries, who could between them, up until now [4], make up 15% generally stay in line with Washington. On the one occasion when they did threaten to use their bloc vote it was in their own selfish interest.[5] It is imaginable that one day a group of southern countries manage to build a bloc vote to oppose a US candidate to the Presidential seat. However, up to now the US Treasury is the uncontested master on board, with the power to block any change contrary to its interests. That the World Bank is in Washington at a stone’s throw from the White House is no coincidence. Over time, adjusting the voting rights has allowed China to gain some more weight. But the US have made sure their veto has been maintained. [6]

Doubtful financing choices

IDA (International Development Association) is officially an ordinary association, woven into the IBRD that directs it. In 2020, IDA had 173 member countries, of which 77 [7] filled the conditions for being granted loans, that is an annual income per head of population inferior to $1,175 in 2019 (figure updated annually). These countries take on long term low interest loans (30 to 40 years with grace periods of 5 to 10 years). The funding comes from the rich countries that replenish the available resources every three years and also from gains on loans made to intermediary countries.

Other Southern countries’ borrowing may be from the IBRD at close to financial market rates to fund projects that strict banking practices would approve as potentially profitable, just like an ordinary bank. The World Bank’s creditworthiness is guaranteed by the rich countries who are the biggest stakeholders; this makes it possible for it to borrow funds on the financial markets at favorable interest rates. The IBRD then lends those funds in 15 to 20 year loans.

This privileged situation allows the IBRD to cover running costs and even to make a good profit: between $680 million and $1 billion for the 2011-2015 period. Of the $44.6 billion granted in 2015, $19 billion were granted by IBRD. [8]

With debt growing, the World Bank has, in coordination with the IMF, developed its action in a macro-economic perspective to impose the application of ever more structural adjustment programs and liberally advises countries subjected to IMF therapy when providing direct funding of these reforms through its specific loans.

The growing influence of national and international development banks

Beside the World Bank there are other multilateral development institutions such as the China Development Bank (CDB) or the Brazilian Development Bank (BNDES), which is a national social and economic development bank. Their influence is not to be neglected as they are now doing more lending than the World Bank.

Between 2005 and 2013 the CDB granted more than $78 billion to Latin American countries alone. In 2007, the total of CDB outstanding loans reached the gigantic sum of $1427 billion. The total for BNDES was $175 billion. [9]

Just like World Bank loans, these loans are also most questionable. CDB loans have higher interest rates than World Bank loans, they come with aid conditions and payments in commodities. A majority of BNDES assisted projects have caused population movements and have had a negative impact on the environment. These institutions have no regard for Human Rights either.

Not forgetting the BRICS bank that was created as an alternative to the World Bank and the IMF.

Regional Development Banks are aligned with the World Bank

Numerous regional banks exist: the African Development Bank (AfDB); the Asian Development Bank (AsDB); [10] the Inter-American development Bank and also the European Investment Bank (EIB). These banks are in no way alternatives to the World Bank. They are aligned to the same policies with the same criteria and their results are alike.

Endnotes

[1] To become members of the IBRD, countries first have to be members of the IMF.

[2] See https://www.worldbank.org/en/about/what-we-do

[4] That is, including the voting rights of the UK up to 31st December 2019.

[5] See, the threat of a coalition between Belgium, the Netherlands, Switzerland and Norway in June 2005, https://www.cadtm.org/IMF-threat-on-G8-proposal-of-debt

[6] For a detailed analysis of the weight of the United State on the World Bank see Éric Toussaint, World Bank: a never ending coup d’etat, 2006, chapters 5 to 9.

[7] India must be added to these 77 countries; it is no longer eligible for IDA support since the end of exercise 14 but will receive exceptional transitional support for the period covered by IDA 17 (2015-2016-2017).

[8] See « The World Bank Group A to Z » : https://openknowledge.worldbank.org/handle/ 10986/20192

[9] Strengthening the Foundations? Alternative Institutions for Finance and Development – Kring – 2019 – Development and Change – Wiley Online Library https://onlinelibrary.wiley.com /doi/10.1111/dech.12464

[10] The African Development Bank and the Asian Development Bank have both the same acronym they are distinguished by a small f and a small s.

(Eric Toussaint is a historian and political scientist. He is the spokesperson of the CADTM International, and sits on the Scientific Council of ATTAC France. Translated by Vicki Briault and Christine Pagnoulle, CADTM.)