Carnival games are rigged in favour of their owners. It seems ostensibly easy to win. But it isn’t. Somehow you will miss the target or click the wrong tab. So was the Hindenburg expose on Adani. The evidence they poured out, and the zeal with which the Supreme Court took it up, convinced all that Adani’s dream run was over. But on its first anniversary, he is back on the top or almost there.

The Bomb of Jan 24, 2023

Allegations of rampant fraud in the Adani Group released by Hindenburg were marked with intricate details. People read in disbelief that the chartered accountants who are validating the accounts of many of Adani’s companies are kids, not even 25 years old. These were the main allegations:

- The shares that the Adani group says it has sold to the public are actually held by Adani in disguise.

- Adani secretly bought these shares in the name of 13 shell companies abroad.

- By buying and selling these shares using these companies, its price was inflated.

- The money for this is being secretly funnelled out of the country to overseas companies.

- Adani’s wealth is growing by crores because of this increase in share price.

- Adani has taken a huge amount of debt by pledging the majority of the shares.

- All the clandestine operations from abroad are spearheaded by Vinod Adani (brother of Gautam Adani)

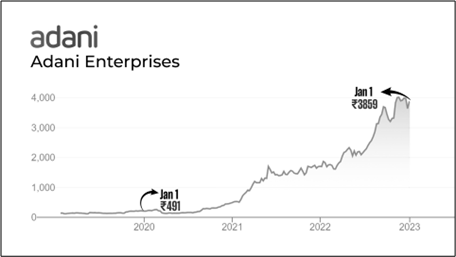

For example, the share price of Adani Enterprises jumped from Rs 491 on January 1, 2020, to Rs 3858 three years later. A 686% increase!

Some media houses (not from the mainstream) and a few economists explained the rest. Adani group bought its own shares – of Adani Enterprises—using shell companies on a large scale. This spiked the demand for shares. The company then pledged the shares it held officially and bagged hefty loans.

This money will be loaned to another company of the Adani Group. The company expands its operations and becomes a public limited company and enters the stock market. That company’s shares are also jacked up through the aforementioned strategy. And the cycle continues. By 2023, there were ten public limited companies in Adani’s empire. Although no one could point to any concrete evidence, this theory was endorsed by many in the light of the Hindenburg Report.

The stock market crashed on the allegations. Adani companies suffered huge losses. They even had to abandon a new public issue of Adani Enterprises. The Supreme Court appointed a committee to investigate the allegations, rejecting the government’s recommendation as to who should be in it. Later, the Securities and Exchange Board of India (SEBI) were also roped in to conduct a timely investigation.

Twist in the second half

Three months later, the Special Investigation Team backed out, lamenting that information on overseas companies is hard to acquire. The committee felt that they had hit a wall and hoped that SEBI could do something. Adani shares started to recover slowly as the investigation dragged on. Big investors again came to back Adani.

Meanwhile, a group of journalists were probing ‘beyond the wall’. Three members of the Organized Crime and Corruption Reporting Project – Anand Mangnale, Ravi Nair and NBR Arcadio published their report on 31 August 2023.

The report unearthed details of two of the 13 racketeering companies mentioned in the Hindenburg report in Mauritius. Emerging India Focus Fund and E.M. and Regent Fund. The money came from four other companies and an investment fund called Global Opportunities Fund. (Note the name Global Opportunities Fund. It comes up later in this story.)

They also identified two people who had invested money in these companies that scooped up Adani’s shares. Nasser Ali Shaban Ali and Chang Chung-LIng. Both have close business ties with the Adani family. Through these companies, Adani’s shares were bought in large quantities when the price was low and sold when the price fell. At one stage, they had up to 14 percent shares in four companies of the Adani Group.

These two companies were advised to buy shares of Adani Group by another company, Excel Investments. Vinod Adani, the elder brother of Gautam Adani was the signatory on behalf of Excel Investments!

But how the money reached Mauritius from India and whether the money was sent by Adani group remains unclear. Meanwhile, the OCCRP published a letter written in 2014 by the directorate of revenue intelligence (DRI) chief about money laundering. It was about a case of over-invoicing registered against Adani group. The letter, written to SEBI, accuses Adani of smuggling money to Mauritius. However, the case was dropped after 2014.

In the letter, DRI Director General Najeeb Shah discusses the possibility of the money sent abroad being used to buy shares from the Indian stock markets. Here too, the name of Global Opportunities Fund is mentioned as the company that bought shares from India. The crux of their investigative report is the journalists’ discovery that this company has ties to the aforementioned Nasser Ali Shaban Ahali and Chang Chung-lin. If this is not enough, Chang’s address in Singapore is the same as that of Vinod Adani (Gautam Adani’s brother).

The stock market rumbled again. However, the SEBI authorities neither acknowledged nor denied the authenticity of the letter.

Still investigating

A year after the publication of the Hindenburg report, SEBI has still not finished investigating. Even after the details and leads provided by the report and the evidence dug out by the follow-up investigation of OCCRP, not even a single case is registered. In the meantime, it went to the court and got two extensions. Then asked once more, claiming that the investigation on 22 out of 24 issues is over. The remaining two, the investigators claimed, will be completed soon and all will be filed together. In spite of not even filing an interim report, the apex court bought that argument. The demand for a new investigation team, by concerned citizens, was rejected. Three more months were allowed to complete the investigation. The bench of the Chief Justice also stated that it has faith in the ability and impartiality of SEBI. The ruling came just 3 weeks before the Hindenburg anniversary. Adani Group responded as if the investigation against them was over. The media too joined the bandwagon. As a result, Adani shares jumped again. In the last year all together, Adani Group has recovered somewhat from the catastrophic crash. 93 billion dollar losses were recouped. The total equity value of the ten companies under the group increased from $82 billion to $175 billion. However, it is still 60 billion dollars short of its earlier glory. The threat to its bonds, which threatened the company’s existence, is over. The company’s debentures have regained the market’s confidence. A vast majority of them are trading higher than the levels touched last year after the Hindenburg report. Two and a quarter billion dollars in debt is repaid. Investments of 5 billion dollars also came from abroad.

Gautam Adani once again overtook Ambani to become the richest man in Asia as the share price of Adani companies increased. Now he is the 12th richest in the world. There are reports that Adani’s family has set up a new special purpose vehicle in Dubai’s International Finance Centre to protect their wealth.

The Carnival games are back. People are flocking in. They have forgotten the last season.

(Centre for Financial Accountability (CFA) engages in critical analysis, monitoring and critique of the role of financial institutions, and their impact on development, human rights and the environment, amongst other areas.)