As the curtains fell on 2024 and the common folk geared for year-end festivities, Finance Minister Nirmala Sitharaman reminded Indians that after the feast comes the reckoning.

It’s not as dark as it sounds, only a bit grey.

Days ahead of Christmas, Sitharaman announced a different treatment of popcorn—not in the way it’s made, but in the way it’s taxed. On 21 December, the Goods and Services Tax (GST) Council, led by Sitharaman, clarified:

- ready-to-eat popcorn, containing salt and spices, will be taxed at 5 percent,

- if the salty/spicy popcorn is pre-packaged and labelled, it will attract 12 percent GST,

- and if popcorn contains added sugar, such as caramel popcorn, it will attract 18 percent GST.

The Council attributed the high tax to added sugar, which, it said, “changes the character of popcorn into a sugar confectionary.” Combine this with 28 percent GST on aerated drinks (or 18 percent on mineral water for the wellness-oriented) and 18 percent GST on film tickets or even a Netflix membership, the post-feast reckoning will certainly burn a hole in your pocket.

Seven years after PM Modi’s first cabinet introduced GST, in order to simplify the indirect tax structure and usher in a ‘one nation, one tax’ regime, GST is a long way from fulfilling its objective. Former Chief Economic Advisors criticised GST Council’s recent move too. While Arvind Subramanian called it “veering to greater complexity, difficulty of enforcement & just irrationality,” Krishnamurthy V Subramanian said:

And who is bearing the brunt of this but India’s burgeoning middle class?

According to a 2023 Oxfam report titled Survival of the Richest: The India Story, the bottom 50 percent of India’s population pays six times more on indirect taxes as a percentage of their income compared to the top 10 percent.

A Group of Ministers (GoM) was constituted in September 2021 to rationalise GST rates. Yet, taxation on certain essential commodities, especially food and beverages, continues to be bizarre:

What’s in the Name? A Different Tax Rate

Although the salted popcorn vs caramel popcorn debate has led to a flood of memes on social media, it is only one of the many such disputes that reminds taxpayers of the complexity of GST.

Remember the roti vs paratha debate, which was fought between Vadilal Industries Ltd and the Gujarat’s Authority for Advance Ruling for nearly 20 months. It was finally decided that rotis would be taxed at 5 percent, while a packed/frozen paratha would attract 18 percent GST.

Similarly, is the popular Parachute coconut oil classified as an edible oil (attracting 5% GST) or a haircare product (attracting 18% GST)? Believe it or not, the judiciary pondered over the question for over 15 years, before giving its decision that Parachute oil is to be classified as an edible oil.

Here’s another pickle for you – is Nestle KitKat a chocolate or a biscuit?

“…Thus while all chocolate must necessarily contain cocoa, it is not every cocoa product or preparation that is chocolate,” the court observed while ruling that KitKat is classified as a biscuit, which meant a lower tax burden for Nestle.

Dabur India too was embroiled in a tax dispute regarding classification of Lal Dant Manjan as a tooth powder or medicinal drug. The tax authorities classified it as tooth powder.

“When GST was proposed, the objective was to replace multiple indirect taxes (such as Octroi, VAT, etc.) into a single tax regime for ease of movement of goods between states. Countries such as the USA and Singapore, which follow a similar structure don’t have different rates,” explained Deepanshu Mohan, Professor of Economics and Dean, OP Jindal Global University.

Currently, the GST Council has listed four slabs – 5%, 12%, 18% and 28%.

Mohan added that the aim of a single tax regime was to bring down the number of rates to two, or maximum three, where the third one applies to very specific goods or ‘sin goods’ such as tobacco and alcohol.

“For a progressive tax regime, the two rates should be within the 5-8% and 6-10% category such that the average GST paid should not be more than 10 percent,” he asserted.

Milk Tax-Free, Milkshake Taxed at 5%, Cheese at 12%: Double Whammy for Consumers

Fresh milk is exempt from GST. But if it contains artificial sugar or other sweetening agents, including milk powder or milk food for babies, it is taxed at 5 percent. However, condensed milk is taxed at 12 percent.

Again, if you buy UHT Milk, or milk which is heated at Ultra High Temperature (UHT), usually sold in cartons, it is taxed at 5 percent.

Similar rules apply for yoghurt—where fresh curd, lassi and buttermilk is exempt from GST however 5 percent GST will apply on yoghurt, kephir and other fermented or acidified milk, irrespective of if it contains added sugar or flavouring agents or added fruit, nuts or cocoa.

Birds’ eggs in shell are tax-free but egg-yolks in any form invite 5 percent GST. If you buy fresh chena or paneer, it is tax-free but if it is sold under a registered brand name, it is taxed 5 percent. The same rule applies to natural honey. Further, ghee, butter and cheese are taxed at 12 percent.

“A classic example of how such a taxation structure—with lower slabs on raw food and higher slabs on packaged and process food—affects cost is restaurant pricing. A salad will be relatively cheaper than say, a pizza, which contains cheese, imported toppings, etc. And the cost incurred by the restaurant is passed onto the consumer,” Mohan reasoned.

It is to be noted here that the 5 percent GST on restaurant bills does not include the hidden taxation on individual ingredients.

“It is a different inflationary process, wherein the cost of commodity is set including GST and the profit margin of a particular restaurant. It’s a double whammy for the consumer,” Mohan added.

Disproportionately High Taxes on Essential Goods and Services

Despite the government’s push towards ‘Nari Shakti’, essential goods for ensuring women’s health attract high rates of GST. While sanitary napkins, tampons, napkin liners were taxed at 12 percent until July 2018 but are exempted now, the raw materials required to make them are still being taxed at 18 percent (polyethylene film, glue, LLDPE-packing cover) and 12 percent (thermal-bonded non-wovens, release paper and wood pulp).

Again, when most education-related services (such as transportation, catering including mid-day meals) are exempt from GST, commercial training and coaching services attract an 18 percent GST rate.

In FY 2023-24, GST collected from these services was Rs 4,792 crore— nearly double of what was collected in FY 2021-22, as per a Parliament response.

Stationery goods don’t fall in the lowest slab either. For instance, all kinds of pencils, crayons, pastels, and drawing charcoals are taxed at 12 percent, while all kinds of pens attract 18 percent GST.

Health insurance services, barring a few central schemes, attract a GST of 18 percent, as do life insurance services. It is to be noted that the premium paid in life insurance policies represents two portions – risk coverage and savings; GST is only applicable on the risk portion of the premium.

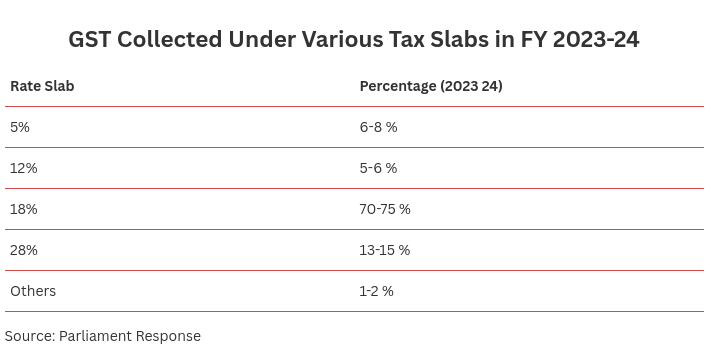

In fact, the maximum GST collections in FY 2023-24 was from the 18% slab, according to a Parliament response.

“Indirect taxes are fundamentally regressive. A higher tax implication on essential goods will inadvertently affect the poor, lower-middle and middle class,” Mohan stated. He used the example of taxation on petrol and diesel to further his point.

‘Govt’s Natural Instinct to Tax’

Remember in 2020, during the COVID-19 pandemic, when the cost of crude oil plummeted to record lows. Yet, Indians continued to pay a high price of fuel due to sellers’ inflation —taxes made up 54 percent of the price of petrol and 49 percent of the retail price of diesel, as per a 2021 report by PRS Legislative Research.

“Petrol and diesel are inelastically priced goods, i.e. their demand won’t change even if prices shoot up. Essential goods also work in a similar manner. A higher tax on them would lead to an inflationary spiral, burdening all income groups,” Mohan explained.

Interestingly, Puja Samagri, including Rudraksha, Wooden khadau, Panchamrit, Kalava, Vibhuti, etc. are exempt from GST.

Another announcement by the GST Council that invited public ire was to increase the GST from 12% to 18 % on sale of all old and used vehicles. This comes at a time when the Nitin Gadkari-led Union Transport Ministry has been discouraging the use of BS-IV standard vehicles and pushing for cleaner, safer, and more efficient vehicles are on our roads.

On being asked if this move was counterproductive, Mohan said, “It is the natural instinct of the government to tax. They saw a revenue potential here, just as they did with mutual funds when they realised more people were investing there instead of banks.”

Did the government see a similar opportunity on online aggregators as well? Did you know that any transaction you make on app-based delivery platforms such as Swiggy invite a GST on the platform fee? Similarly, online ticketing platform takes 18% GST on Convenience Fee.

Spare the Poor, Tax Luxury For More Revenue

The larger aim of GST was to increase tax revenue. But hiking GST rates and fuel taxes have invariably burdened the marginalised. According to the Oxfam report:

- the poorest 50% pay 64.3% of the total indirect taxes;

- the middle 40% pay 31.8% of the total indirect taxes;

- and the top 10% pay 3.9% of the total indirect taxes.

The report also argued that this form of taxation has widened existing economic inequalities.

“Since the implementation of GST, the share of direct taxes out of the total gross tax revenue receipt declined by 5 percent by 2020-21. Similarly, revenue from corporate taxes as a percentage of gross tax revenue declined by 8 percent. This indicates that reliance on indirect taxes has, in turn, increased,” the report stated.

To this, Mohan insisted that the Union Finance Ministry must share data on the actual tax revenue collected, so that there is more clarity.

Oxfam recommended that GST rates on essential commodities be lowered, while those on luxury goods be hiked to generate more revenue, which is progressive in nature and reduces the burden on the poor.

Agreeing with this, Mohan contended that while taxing the wealthy could be an unpopular move politically, taxing an individual based on consumption patterns rather than income could be a solution. “For instance, if one takes a vacation to Macao, it’s a luxury spend that could attract higher taxes.”

(Courtesy: The Quint. The Quint, launched in March 2015, is an Indian digital news and views platform.)