Anjan Basu

The most astonishing thing about the Yes Bank crisis is that everyone knew it was coming, and yet everyone seems to have been taken by surprise when it did arrive.

Consider the circumstances. Rana Kapoor, the private sector lender’s founder–CEO, was ejected out of his position in January 2019, after a bitter struggle with the Reserve Bank of India.

In the very first reporting period after his departure, that is, in the quarter ended March 31, 2019, the bank posted a net loss of Rs 1,507 crore. The corresponding period in the immediately preceding year saw the bank book a profit of Rs 1,179 crore. This indeed was the first time ever since its launch in 2004 that Yes Bank (YB) registered a loss. There were other tell-tale signs, too.

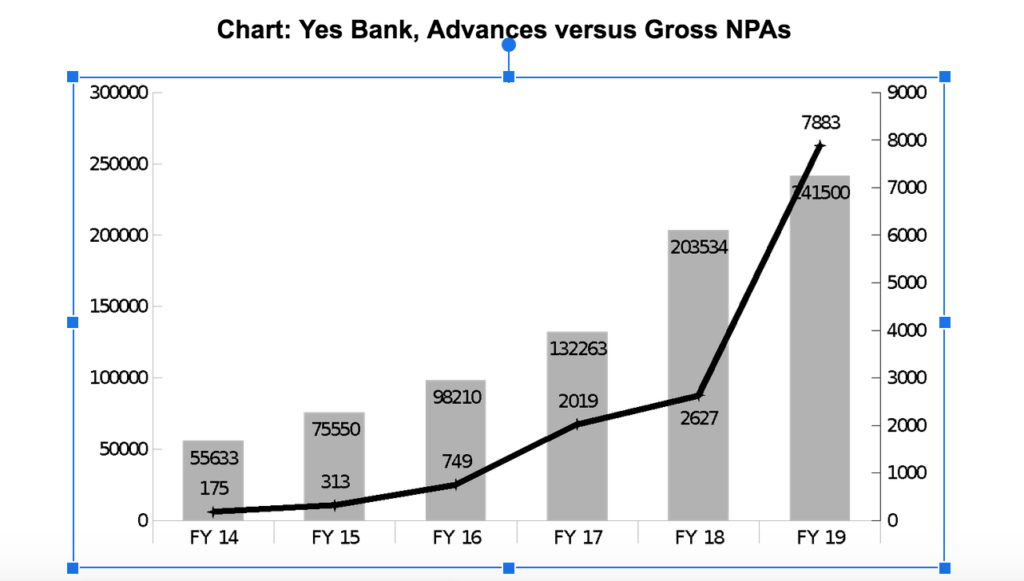

While the bank had reported a gross non-performing assets ratio of 2.10% in the last quarterly results published on Kapoor’s watch (Oct–Dec 2018), in the three succeeding quarters after he moved out, the ratio climbed to 3.22%, 5.01% and 7.39% respectively. In other words, in the nine months since he left the bank, the NPAs had fattened by over 350%, an improbable eventuality unless there were serious reporting issues involved here.

And Kapoor had not given up yet. He insisted on being given a place on the bank’s board, fought for it noisily in full public view, and induced at least two of the bank’s directors and the head of the search panel, set up to identify his successor, to resign in a huff. He made grand statements about how he would never unload his stake in the bank he had helped set up himself. And then, once again in full public view, he proceeded to sell himself pretty much out of that entire stake, making a neat pile in the bargain.

Finance minister Nirmala Sitharaman was right to claim that the RBI was “seized of the matter (of YB’s problems) since 2017”. She did not deem it necessary, however, to explain why her government and the RBI had stopped way short of real remedial action—the kind of action initiated now, in March 2020—for all these months. Our ‘mainstream’ media and the broad analysts’ fraternity did not, of course, ask her such inconvenient questions.

The RBI had been put on notice about the grave governance issues in YB as early as its Annual Financial Inspection (AFI) of the bank’s books as of March 31, 2017.

That AFI reported a staggeringly large under-stating of YB’s NPAs by its management—by as much as 75%: NPAs of Rs 8,377 crore had been reported as Rs 2,018 crore, surely a record of sorts. Clearly, the bank’s auditors were also not doing their bit. The market was also rife in these months with reports of YB obliging virtually every prospective corporate borrower with approval of credit lines pretty much on tap. Some of our public sector banks themselves marvelled at the ease with which some of their own troubled credit exposures to corporate were, inexplicably, taken over by YB in that period.

And yet, the RBI did not consider it necessary to order a forensic audit of the bank’s finances by a reliable outside agency. Such an audit would have helped crystallise the issues embedded in the Yes Bank balance sheet, and, by extension, would have provided a clear picture of the governance issues as well. Instead, the RBI deputed one of its retired deputy governors as an additional director on the bank’s board. It is easy to see why this move achieved precious little. Though Kapoor was gone, the top management team stayed pretty much in place in all vital areas of the bank’s working. That team was invested in continuity, not in disruptive action. And the deputy governor had in any case to rely on the bank’s entrenched reporting systems, which perhaps shielded quite as much as they revealed.

There is no denying the fact that YB seemed for a long time to be everyone’s favourite—the government’s as much as the analysts’, the investing public’s as well as the big media houses’. The bank was often the preferred event partner—even event sponsor—for a very large variety of public events featuring industry barons, media moguls, senior bureaucrats and celebrities. Kapoor had managed to put the bank firmly in the public’s imagination by way of such extravagant PR ventures.

The government had every reason to feel happy with him: post-demonetisation, when most lenders struggled to register even modest growth numbers in their loan books, YB did spectacularly well. In the two years between 2016 and 2018, its loans and advances surged by over 100%. Let us also not forget that Kapoor had been among the first bankers off the block to praise the demonetisation misadventure—he had called it ‘a masterstroke’.

How serious are YB’s problems as of now?

It is difficult to make a proper assessment, for reliable recent information is scarce. But the indications point to a grim scenario. In the last available quarterly results (for June-Sept 2019), NPAs had climbed by over Rs 9,200 crore since March 2019; the net loss was Rs 600 crore and the provision coverage ratio (loan loss provisions as a percentage of sticky loans) stayed at a quite unsatisfactory 43%.

And many industry watchers think the NPAs continue to be under-reported, that the gross NPA ratio may actually have capped 20%, and so the impact on the bank’s profitability is likely to be that much greater. Both JP Morgan and Macquarie Capital consider YB’s net worth (roughly Rs 25,000 crore) to have been largely impaired and put a value of no more than Rs 1 on the bank’s scrip.

Macquarie suggests that, out of a total loan book of over Rs 200,000 crore, at least 15% carries credit ratings of ‘BB’ or lower (‘junk’) while another 25% has ratings not above ‘BBB’, the lowest investment grade. Assuming a substantial write-off in the ‘BB’ (or lower) portfolio and an additional 10/15% provisions to be likely made on the ‘BBB’ portfolio, ‘the current Net Worth is near-zero’, Macquarie opines.

(Anjan Basu worked for one of India’s largest commercial banks for over three decades. )