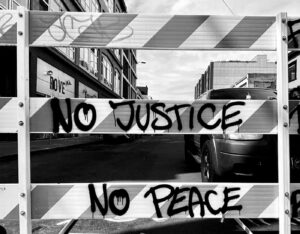

Those who take the meat from the table

Teach contentment.

Those for whom the contribution is destined

Demand sacrifice.

Those who eat their fill speak to the hungry

Of wonderful times to come.

Those who lead the country into the abyss

Call ruling too difficult

For ordinary men.

– Bertolt Brecht

[Today, it is more than obvious that demonetisation was a disaster. Not only did it fail to achieve any of its goals, even after the goalposts were shifted, together with the sudden and unplanned roll-out of the GST, it was responsible for pushing the Indian economy into a slowdown even before the corona pandemic hit the economy in 2020. That is why, today, the BJP prefers to remain silent and no longer showcases it as one of its big achievements.

But many people continue to believe that even if it failed, demonetisation was a sincere attempt by the Modi Government to tackle black money and corruption. Therefore, we are re-publishing this article we had published in Janata Weekly four years ago.]

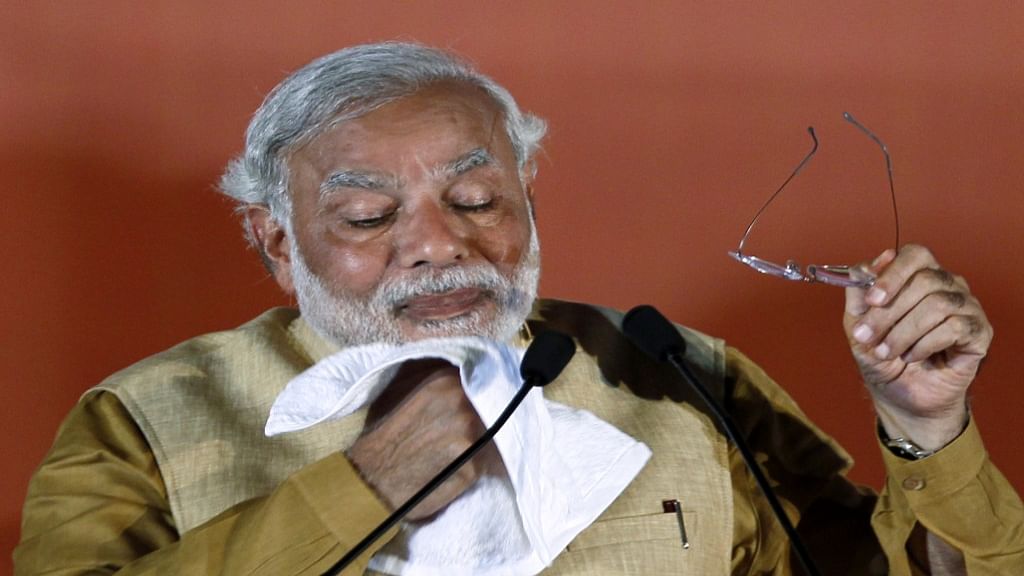

Exactly a year ago, in a televised address on November 8, 2016, Prime Minister Narendra Modi announced that currency notes of Rs 500 and Rs 1,000 denominations would no longer be legal tender from midnight that night. The Prime Minister stated that this step was being taken to curb counterfeiting and funding of terrorism with fake notes, and most importantly, to crack down on black money in the country.

The total currency in circulation in the country at that time was around Rs 17.9 lakh crore. Of this, around 86%, or around Rs 15.44 lakh crore, was in Rs 500 and Rs 1,000 notes. This meant that till the government replaced the abolished currency with new currency notes, the economy would have to make do with 14% of the currency has to serve the task of the whole. Even though the Prime Minister claimed that the step was being planned for more than nine months,[1] the monumental inefficiency of the Modi Government becomes evident from the fact that it had made no advance preparations for quick replacement of the old notes with new notes. According to a newsreport that quoted former Finance Minister P. Chidambaram and also a former Reserve Bank of India (RBI) Deputy Governor, even if the government printed note for note, given the capacity of the four currency note printing presses in the country, it would take at least six to seven months for these printing presses to print new notes to replace all the scrapped notes.[2] Once printed, the notes had to sent to the remotest corners of the country—5,93,731 inhabited villages, 4,041 towns, 3,894 census towns and 1,456 urban patches.[3]

The sudden move without adequate preparation for its consequences led to chaos across the country. People were first forced to queue up outside banks for hours to exchange/deposit their old notes. After that, they had to stand outside banks almost daily in long queues to withdraw their money, because the banks were short of cash and were permitting people to withdraw only Rs 2,000–4,000 at a time. The worst hit were the daily wage workers, as they had to forgo a day’s wages in order to stand in the queues. It took several months for the cash crunch to ease. By then, around 120 people had died of exhaustion waiting in these queues.

The Modi Government claims that all these travails faced by the people were a small sacrifice for the gains of demonetisation. The BJP in fact made demonetisation a key poll plank during the UP Assembly elections, claiming it to be a ‘pro-poor’ move that showed the resolve of the government to fight black money and corruption. Many people believed these claims, and the BJP won the state elections with an unprecedented majority. On the first anniversary of demonetisation (November 8, 2017), the BJP has announced plans to commemorate it as ‘anti-Black Money Day’.

Examining Government Claims

Let us examine the claims of the government about the benefits of demonetisation one by one.

i) Will It Overcome the Problem of Terrorist Financing and Curb Terrorism?

Terrorists need financing. Modi and Jaitley argued that demonetisation would curb terror funding by eliminating fake notes circulating in the economy, and thus help reduce incidents of terrorism.

What has happened on the ground, one year later? Data from 10 months before the note-ban (January-November 2016) and the 10 months after shows a 38% rise in the number of terrorist incidents in Jammu and Kashmir. The number of security personnel killed has risen by 2%.[4] Clearly then, demonetisation has not helped curb terrorism in any way.

A simple analysis reveals that this was only to be expected. Terrorists use both banking channels and fake notes. The major part of their financing is done through banking channels, using various innovative techniques. That cannot be curbed by demonetisation. And so far as fake notes are concerned, to the extent that terrorism is financed from abroad, state actors are involved in printing these fake notes. They have sophisticated facilities to print fake notes. They can easily duplicate the new notes too, and they did it within days! The Indian Army recovered fake Rs 2,000 notes from two terrorists killed in Bandipore district of Jammu and Kashmir, less than a fortnight after they came into circulation.[5]

ii) Has It Overcome the Problem of Counterfeit Notes?

The RBI in its annual report released in August 2017 says that Rs 43 crore of fake notes were detected in fiscal 2017. This includes notes of all denominations.[6] That is a negligible amount. And when compared to the total value of currency in circulation, Rs 17.9 lakh crore, it becomes even more negligible—only 0.002%.

This is not unexpected; it is in tune with previous figures. For fiscal 2015-16, RBI data show that the total value of fake notes was Rs 29.64 crore, which was 0.0018% of the Rs 16.41 lakh crore currency in circulation.[7]

Was it worth giving citizens so much trouble in order to eliminate such a small amount of fake currency? And as the RBI itself admits, the new notes are being faked too, the above figure includes fake Rs 2,000 notes too.

Just to mention in passing, the problem of fake notes is a global phenomenon. In the USA also, there are a large amount of fake dollars in circulation; the dollar is in fact among the most counterfeited currencies in the world.[8] But for all his idiosyncracies, Trump has never even suggested demonetisation as a way of tackling it.

iii) Has it Significantly Curbed the Black Economy?

Both Modi and Jaitley have repeatedly claimed that demonetisation was an attack on the black economy. As mentioned earlier, the BJP is in fact commemorating the first anniversary of demonetisation as ‘anti-Black Money Day’. But figures released by the RBI belie their claim. The annual report of the RBI released on August 30, 2017 reveals that nearly Rs 15.28 lakh crore of the Rs 15.44 crore sucked out of circulation by demonetisation had returned to the banking system.[9] That is, only Rs 0.16 lakh crore, or 1% of the total currency circulating in the economy had not come back. This was the total black cash that the government has been able to wipe out by this ‘historic’ measure.

That 99% of the demonetised currency had found its way back to the RBI has actually been an open secret for quite some time. An article published in the eminent journal Economic and Political Weekly had shown, based on RBI data, that 98.8% of Rs 15.44 lakh crore had come back by January 13, 2017.[10] The RBI delayed acknowledging this for so long, to avoid embarrassment to its masters.

RBI data thus prove, beyond doubt, that demonetisation has completely failed in making a dent on the black economy. Official data themselves prove that Modi’s and BJP’s claims about demonetisation are nothing but bluster. The government has failed in achieving its third, and most important, objective of demonetisation too.

There is actually nothing surprising in this. Several pro-people economists such as Professor Arun Kumar had shown, immediately after the demonetisation announcement, that this was no way of curbing the black economy, and it would end in a complete failure. We had also made the same prediction in our booklet, Demonetisation: Yet Another Fraud on the People, published in January 2017.[11] All these predictions and analyses have been borne out. We summarise these analyses below.

Why Demonetisation was Destined to be a Failure

People think that black money means bundles of notes tucked away in suitcases or pillows or lockers. That is not the case. Then what is black money? For this, it is important to understand the difference between three terms: black money, black income and black wealth. All three are different, and together comprise what can be called the ‘black economy’. People mix up these terms, and use them interchangeably.

First you earn income; out of this, you consume one part, and save the rest. This saving you invest in various assets. That gives you your wealth. Wealth is held as a portfolio—you can invest it in real estate, gold, share market, etc. or hold it as cash. Thus, cash is only one component of your wealth, and a very small part of it.

Coming to the black economy, here, first, black income is generated through a whole range of activities. These activities can be entirely illegal, such as the drugs trade, or the manufacture of fake medicines, or the arms trade, and so on. Or they can be activities which are completely legal, but are undeclared (either wholly or in part), as people want to avoid taxes. These can include: under-reporting of income by doctors or lawyers to save taxes; under-reporting of profits by industrialists by means such as overstating costs (for example, by showing purchase of raw material at higher than actual prices) or understating production; and under-invoicing and over-invoicing in international trade.

It is not the case that only black activity or black business is carried out with cash, and white or normal activity is carried out by cheque or credit card or other such means. Normal business also requires cash. So, normal cash holding and black cash holding are not two different things. One may ask: that may be so, but is it not that black business is more dependent on cash transactions than white? The answer to this also is no. In both black and white business, cash is held for shorter or longer period, and then thrown into circulation, and this is equally so for both types of business. Therefore, if currency is demonetised, both white and black cash holdings are affected, and both are equally affected.

To put the same argument in another way, black businessmen are as much capitalists as white businessmen. It is only misers who hoard money; capitalists believe in investing money to earn more money. And so, black money holders, like white money holders, also try to expand their business by investing their black money/income. Therefore, just like white money holders, black money holders also will be holding only a small fraction of their total income in cash at any point of time.

The point we are trying to make is, only a part of the black income is held as cash. Most black money holders invest their incomes in assets, which yield returns, such as buying land or shares with it, or sending it abroad through various means. A Hindustan Times report of last year gave several arguments to show that black money hoarders keep very little of their earnings in cash. It in fact quoted a finance ministry official as saying that ill-gotten wealth mostly enters the formal economic system through real estate and shell companies.[12]

The part of black income that is kept in cash is what is actually black money, while that invested in assets is black wealth. Demonetisation at the most affects black money; it does not affect black income generation, nor does it affect black wealth one tiny bit.

Let us consider a concrete example of black income generation to understand this in greater detail. An especially important sector where black incomes are generated, and where black incomes are invested in a big way, is real estate. Funds are taken out of the country through various illegal means such as hawala channels, or over-invoicing of imports, or under-invoicing of exports, or transfer pricing. They are then brought back into the country as foreign investment or FDI (this is known as “round-tripping”) through channels such as the infamous Mauritius route. In this, sham corporations are registered in Mauritius, through which funds are routed into India, often through a mechanism called P-notes (participatory notes, where the ultimate investor is not identified to the Indian market regulator SEBI). The earnings on such investments are not taxed in India because India and Mauritius have a double tax–avoidance treaty (according to which a Mauritian entity investing in India does not have to pay capital gains tax in India, and only pays taxes in Mauritius), while at the same time the investors pay little or no taxes in Mauritius too because of the tax structure there. The amendments to the Indo–Mauritius Treaty done in May 2016 will not have much of an impact on this “round-tripping” of funds, as firstly, P-notes are exempted from this amendment, and secondly, there are other routes available through which such funds can be routed into India without attracting much tax, such as through Netherlands.[13] FDI flows into the real estate sector have zoomed in recent years—between 2005 and 2010, FDI in India’s real estate and housing market jumped 80 times. In 2010, nearly $5,700 million of foreign funds were invested in this sector. It is this infusion of black money into real estate that has contributed to the sharp and sustained rise in land prices, making housing unaffordable for an overwhelming majority of Indians.[14]

We have discussed the round-tripping of black money in some detail to explain how a major part of black incomes is invested via phoney legal means, through banking channels. Such black incomes would not be affected by demonetisation. That will only be curbed if the government takes steps to curb the illegal parking of funds abroad, and its round-trip back to India.

Estimating the Size of the Black Economy

Let us now try to make an estimate of the size of the black economy in India. This is not an easy exercise. Estimates of the black income generated every year vary from 25% to 75% of GDP.[15] An authoritative analysis has been made by Prof. Arun Kumar, an eminent economist who was Professor at the Centre for Economic Studies and Planning at the Jawaharlal Nehru University. He estimates the black income generation in India to be 62% of GDP. This is fairly close to the estimate made by a report of the National Institute of Public Finance and Policy in 2014 that estimated domestic black money as being equal to 70% of GDP.[16] The GDP for 2016–17 is estimated at Rs 150 lakh crore, so 62% of that would be roughly Rs 93 lakh crore. This then is the size of the black income that was generated in the economy in the year 2016-17. Black wealth would be several times this amount, as it has been accumulating over the years. Even assuming a low figure of say five times, this means black wealth would be around Rs 500 lakh crore.

Let us now make an estimate of the black money in circulation as cash in the economy. It is this ‘black cash’ that the government attempted to demobilise by demonetisation. The Rs 500 and Rs 1,000 notes in circulation in the economy totalled Rs 15.44 lakh crore. But not all the notes in circulation are a part of the black economy. Thus, for instance, a significant proportion of our GDP—around half, according to CSO estimates—is produced in the informal sector, and around 85% of the population relies on it.[17] While the incomes in this sector are mostly unrecorded, the dominant part of this is not ‘black’. It is true that the incomes in this sector do not fall into the direct tax net, but then in any case these incomes are too small to pay direct taxes; on the other hand, due to the tax structure of the Indian economy which collects more revenue from indirect taxes rather than direct taxes (70:30), they anyway are subject to indirect taxes.[18] In this sector come the income of farmers and small traders and daily wage workers and small service providers and other such sections of the population. Most of the transactions in this sector are in cash. Apart from this informal sector, a significant portion of the cash in the economy is in businesses, like petrol pumps, railway stations, airports, etc., and this too is not black. Therefore, of the total currency in circulation, assuming that half was in the informal sector, and of the remaining, at least 50–60% was in businesses as legal currency, that means just around Rs 3 lakh crore would be black money.19]

Table: Estimating Black Money in the Economy

| Total GDP of India in 2016 | ~ Rs 150 lakh crore |

| Estimated size of Black Economy | 62% of GDP |

| Total amount of Black Income generated every year | Rs 93 lakh crore |

| Total value of Rs 1,000 and Rs 500 notes (1) | Rs 15.44 lakh crore |

| Legal currency in circulation in informal economy (2) | ~ 50% of (1) |

| Legal currency in the formal sector (3) | 25–30% of (1) |

| Estimated Black Money in circulation in economy (1–2–3) | 20–25% of (1) |

| Total value of Black Money demonetised | 20 x 15.44 / 100 = ~ Rs 3 lakh crore |

| Black Money as % of Black Income generated every year | 3 / 93 x 100 = 3.2% |

This is the maximum amount that the government was seeking to wipe out by demonetisation—Rs 3 lakh crore. But this amount is just 3% of the total black income that would have been generated in the economy in fiscal 2016-17 (Rs 93 lakh crore), and 0.6% of the black wealth (assuming black wealth to be a low Rs 500 lakh crore). Even if the government had been fully successful in eliminating this Rs 3 lakh crore of black money, it would have eliminated only a very small fraction of the total black income generated in the economy in 2016-17, and an even smaller fraction of the black wealth.

The most fatuous thing about the demonetisation exercise of the Modi Government is that the government has taken no steps to attack the black income generation in the economy or the black wealth accumulated in the economy over the years. It has attempted to attack only a small part of the black economy—the black cash stored with the people. Even assuming that the government had succeeded in demobilising this Rs 3 lakh crore of black cash, black income is going to be generated in the year 2017-18 too, and the year after that, and so on. Be it narcotic drugs or charging capitation fees, or be it hiding of incomes by lawyers and doctors, or be it understating real estate deals or understating industry profits, or be it under-invoicing and over-invoicing in international trade, all this is going to continue in the coming years too.

Why the Government Failed to Eliminate Even Rs 3 Lakh Crore

The government permitted people to deposit Rs 2.5 lakh per person without questions being asked. Assuming that only the richest 3% people have black money, this means 3.6 crore people had black cash of totalling Rs 3 lakh crore. This works out to an average black money holding of less than Rs 1 lakh per person. Of course, not everyone in the riches 3% would have black income, and so many had black money more than the limit of Rs 2.5 lakh specified by the government. But they found innovative ways of converting their black money into white. Thus, on the day the demonetisation announcement was made, jewellery shops were reported to be open till 3 am, issuing backdated receipts for purchase of gold, jewellery, etc. People also resorted to stratagems like employers paying employees salaries for several months in advance, or giving money to the poor to deposit in their Jan Dhan accounts, to be returned later as white money. Of the 25 crore Jan Dhan accounts opened by the poor, 3 crore accounts had seen a total of nearly Rs 29,000 crore in increased deposits.

This explains why the government was not able to demobilise even Rs 3 lakh crore; it was able to wipe out only 5% of this, or Rs 0.16 lakh crore.

Past Experience Too Proves This

This is not the first time that demonetisation has been done. In 1978, the Morarji Desai Government had demonetised currency, but it had only demonetised high value notes—Rs 1,000, Rs 5,000 and Rs 10,000 notes. In 1978, Rs 1,000 was a lot of money. The step did little to curb the black economy. But at least it did not affect the ordinary people, as they did not use these high value notes; the notes demonetised accounted for only 0.6% of the currency in circulation; and so life went on as usual. However, even then, the then RBI Governor I.G. Patel had pointed out that “such an exercise seldom produces striking results” since people who have black money on a substantial scale rarely keep it in cash. “The idea that black money or wealth is held in the form of notes tucked away in suitcases or pillow cases is naïve.”[20]

Is Government Serious About Curbing Black Economy?

Many people will argue: even if demonetisation has not significantly curbed the black economy, at least the Modi Government has shown its willingness to attack it, and will soon come up with more steps to eradicate this menace.

Even assuming this to be true and assuming that the government initially wanted to tackle black money only (and not black income generation), the method adopted, of demonetisation, was bizarre. To give an analogy, if there is a crime in a locality, this is like the police calling all the residents of the locality to the police station to investigate whose hands have bloodstains, or whose eyes are bloodshot, or who was where at the time of the crime, and so on. The correct way to pursue the case is to diligently investigate all the leads available, and then call in for questioning only those who are the suspects. Similar is the case with black money. If there is an honest tax administration that operates without interference, it can through painstaking efforts unearth substantial amount of black incomes and black wealth. Irrespective of how high and mighty a person is, if he/she is prosecuted and sent to jail for tax evasion/black activities, that will act as a deterrent to others. This is what is done in all countries that have taken some effective steps to curb the black economy, such as the US or UK—they have acted to curb the black economy by serious investigation and prosecution.

In contrast, the Modi Government, in the name of curbing black money, through demonetisation put into enormous hardship all people with cash, a majority of whom actually have white money. At the same time, it is wilfully not taking any action against those who really are deeply involved in black income generation and have huge hoards of black wealth. This is evident from so many examples.

For instance, black money is generated in election funding. It is estimated that probably nearly Rs 30,000 crore was spent by parties in the 2014 Lok Sabha elections. A major part of this was spent by Narendra Modi for his high-voltage electioneering. If the BJP was indeed serious about curbing black money, it should have declared the sources from where it got its funding, and pressurised other parties to declare their sources of funding too. Instead of making funding of political parties more transparent, the Modi Government has made it more opaque. In March 2017, the government got the Lok Sabha to pass amendments to the Finance Bill 2017 wherein it eased norms for contributions made by corporates to political parties. The government removed the funding limit of 7.5% of the company’s net profit for the past three years, thus allowing private companies to provide unlimited funding to their political benefactors. But what is far more worse is another provision approved by the Lok Sabha – the company no longer has to disclose the name of the political party to which it has made the donation![21]

A large part of the black money generated every year is parked in land and gold/jewellery. The government can easily monitor big land deals and gold–jewellery purchases, and put them under scrutiny. Then again, our intelligence agencies are tracking export deals on a daily basis. A Hindustan Times analysis of RBI data, gleaned from 1972 to 2015, shows that 1,88,605 export transactions were not remitted home, and involved exports worth Rs 17 lakh crore.[22] This means that the government has the details of the deals through which money is being funnelled abroad. If the PM wants, he can easily stop this outflow. As discussed above, a known way of storing black incomes is by sending the money abroad, and then bringing it back to invest in securities through ‘P-notes’, which do not require the buyer to reveal his/her identity. Both the UPA and the supposedly anti-corruption BJP have been reluctant to impose curbs on P-notes. Even after the government recently amended the Indo–Mauritius Double Taxation Avoidance Treaty, taxation of P-notes was left untouched.[23]

Another obvious step that the government can take is to go after those who have stashed their money abroad. In February 2012, the director of India’s Central Bureau of Investigation stated that an estimated $500 billion or Rs 24.50 lakh crore has been stashed away by Indians in foreign tax havens, more than any other country.[24] Modi had in fact promised to bring this back in his election speeches, to the point that people had actually believed that the government was going to deposit Rs 15 lakh in each of their Jan Dhan accounts. But after winning the elections, the BJP Government made a complete U-turn on the issue and has even gone to the extent of refusing to divulge the names of Indian having accounts in foreign banks in the Supreme Court. The BJP thus endorsed the previous UPA Government’s position on this issue, that it had earlier criticised. Commenting on the application moved by the attorney general on behalf of the government in the Supreme Court, senior advocate Ram Jethmalani, who was the petitioner in the case, stated, “The government has made an application which should have been filed by the criminals. I am amazed.”[25]

Actually, this is not surprising. Journalist Josy Joseph, author of the book A Feast of Vultures, writes that the biggest case of black money parked in offshore havens being investigated by Indian authorities is that of business tycoon Gautam Adani.[26] Considering the close relations between Adani and Modi, and the fact that Adani grew from being a small time businessman to one of India’s biggest business tycoons during just the decade when Modi was Chief Minister of Gujarat, it is obvious that Adani will never be prosecuted.[27]

In 2016, 11 million documents held by the Panama-based law firm Mossack Fonseca were leaked by an anonymous source, and obtained and made public by the International Consortium of Investigative Journalists. The documents show the myriad ways in which the world’s rich exploit secretive tax havens to hide their wealth. The leak, that became known the world over as the Panama Papers scandal, contained the names of 500 Indians who have links to offshore firms, including politicians, businessmen and films stars. The names include those of Amitabh Bachchan, Aishwarya Rai, DLF owner K.P. Singh, Garware family, Nira Radia, Harish Salve, and Gautam Adani’s elder brother Vinod Adani, to name a few.[28] A year before that, in February 2015, Indian Express released the list of 1,195 Indian account holders and their balances for the year 2006–07 in HSBC’s Geneva branch, in what has become infamous as the ‘Swiss Leaks’. The names included several prominent Indian businessmen—Mukesh Ambani, Anil Ambani, Anand Chand Burman, Rajan Nanda, Yashovardhan Birla, Chandru Lachhmandas Raheja and Dattaraj Salgaocar—and the top diamond traders of the country—Russell Mehta, Anoop Mehta, Saunak Parikh, Chetan Mehta, Govindbhai Kakadia and Kunal Shah.[29] The action so far? HSBC whistleblower Herve Falciani, talking to the media in November 2015, said the Indian government “had not used information on those illegally stashing away black money in foreign bank accounts, and still millions of crores were flowing out.”[30]

All this should not be surprising. Despite having come to power on the plank of anti-corruption and good governance, the Modi Government has actually been seeking to dilute anti-corruption legislations. Soon after coming to power, it made a U-turn on the issue of bringing political parties under the Right to Information (RTI) Act; it had earlier supported this. It has not been keen on operationalising the Lokpal Act despite it having been notified in the gazette in January 2014, and has not appointed a Lokpal even after two-and-a-half years in office, for which it was pulled up by the Supreme Court earlier this year (2016). Not only that, in July 2016, it diluted this Act and exempted bureaucrats from declaring assets and liabilities of their spouses and dependent children. Similarly, it has not operationalised the Whistleblowers Protection Act (WBP Act), despite it too having being passed by Parliament. This Act provides a mechanism for protecting the identity of whistleblowers—a term given to people who expose corruption. Nearly 60 people have been killed in the last few years for exposing corruption and wrongdoing in the government; had the law been operationalised, the lives of many of them could have been saved.[31]

Clearly, all the chest thumping by PM Modi about fighting corruption is just a lot of hot air.

Modi Changes Narrative to Cashless Economy

The point we wish to make is that the real purpose of the demonetisation exercise is not to curb the black economy. Had the government been serious about it, it could have easily gone after those responsible for generating and storing black incomes both inside the country and abroad.

This is also borne out by changes in the government tune. On November 8, when the government issued its first press release announcing demonetisation, the release spoke extensively on the black money issue, and made no reference to moving towards a cashless society. PM Modi’s speech, also delivered on the same day, where he announced the decision to ban Rs 500 and Rs 1,000 notes from the banking system, also projected that the major focus of demonetisation was war on black money, terror funding and corruption. He too did not make any major reference to shifting to a cashless economy.

Just a month after this so-called ‘war on black money’ was launched, the government shifted its rhetoric to pushing for a cashless economy. In his Mann Ki Baat speech on November 27, Prime Minister Narendra Modi shifted his focus from the drive against black money to exhorting the people to make the transition first to a ‘less-cash economy’ and then later a ‘cashless’ economy. He urged people to start using cash substitutes like debit cards and digital wallets. The RBI Governor, after maintaining a stoic silence for nearly 20 days after the note ban announcement, too shared his mann ki baat on the same day, and urged people to migrate to a cashless society.[32] The government now began pushing its departments to shift from cash transactions to cashless transactions; for instance, the Urban Development Ministry has announced that people will have to make e-payments in matters of property tax, professional tax, utilities like water, power & gas, fee and licensing charges, etc. On December 8, the finance minister announced a slew of incentives to encourage people to move towards cashless transactions, including: waiver of service tax on digital payments of less than Rs 2,000; discounts on petrol and diesel purchases, suburban railway tickets and toll payments at Toll Plazas on National Highways if payment is made through digital means; and issuance of ‘Rupay Kisan Cards’ to farmers to enable them to make digital transactions, as well as installation of two PoS machines (swipe machines) free in 1 lakh villages with population of less than 10,000.[33]

According to the RBI, cash in circulation (CIC) to GDP ratio in the economy has fallen from 12.2 per cent of India’s GDP in March 2016 to 8.8 per cent by end-March 2017. The government has been touting this figure as one of the successes of demonetisation, claiming that a lower CIC to GDP ratio is indicative of lesser corruption.[34]

The government is lying again. There is no connection between a cashless economy and tax evasion and generation of black incomes. Currency notes are not necessary in generation of black money. Most of the black activities/tax evasion/ corruption in an economy are indulged in by the rich or the big corporations. And they use all kinds of legal accounting gimmicks to do so, using banking channels.

Japan is supposed to be a less corrupt economy than India. Yet, its CIC to GDP ratio is much more than India, 19.4%.[35]

On the other hand, in the USA, according to the Federal Reserve, as much as $1.48 trillion is in circulation as cash, which works out to approximately 8% of its GDP. This figure is less than India.[36]Nevertheless, hundreds of the biggest US corporations have used all kinds of accounting gimmicks to show their profits as having being earned by subsidiaries in offshore tax havens, so as to avoid paying US taxes. According to one estimate, at least 303 of the Fortune 500 US corporations collectively hold a whopping $2.4 trillion of profits offshore, and thus are avoiding paying up to $695 billion in US federal income taxes.[37]

The situation in Europe is no different. In the Eurozone countries, cash is 10.63% of GDP. Yet, tax evasion in Britain every year totals around 16 billion pounds, while the French Parliament says that tax evasion costs France between 40 and 60 billion euros a year.[38]

Therefore, the new drive of the Modi Government to push towards a less-cash economy will not affect tax evasion and will not affect the black economy one bit.

On the other hand, instead of cash transactions, as the number of online transactions increases, it increases the risk of online frauds. One study found that the value of global online fraudulent transactions is expected to reach $25.6 billion by 2020, up from $10.7 billion last year. Just a month before Modi announced the demonetisation drive, India’s biggest internet banking security breach occurred. Over 3 million debit cards and their pin numbers were stolen by hackers, enabling the miscreants to steal personal information and do fraudulent transactions. Several banks, including State Bank of India, Yes Bank, ICICI Bank and Axis Bank, were hit by the attack. Newsreports say that banks have reported total fraudulent withdrawals of Rs 1.3 crore because of the security breach. Considering India’s huge illiteracy and poverty levels, if the poor are forced to shift to using debit/credit cards, it is going to be very easy for tricksters to defraud people of their hard-earned money.[39]

Impact of Demonetisation on the Economy

While demonetisation has not achieved any of its announced objectives, it has had a devastating impact on the economy, especially the unorganised sector, which is almost completely dependent on cash transactions. The three biggest components of India’s vast unorganised sector are:[40]

- Agricultural sector, on which 53% of the population depend for their livelihoods;

- Small-scale or unorganised retail sector, which accounts for around 9% of total employment;

- Small-scale or unorganised manufacturing sector, which accounts for 7.5% of total employment.

All these sectors were already struggling for survival as a result of the economic reforms launched in India in the name of globalisation since 1991. These reforms have further accelerated under the Modi Government. Now, its demonetisation decision and drive towards a cashless economy has only further crippled these sectors. PM Modi expecting the pavement tea-seller or a roadside fish-seller to have a PoS machine with which to accept payment from the credit card of a daily wage worker, or expecting a street hawker to sell a dozen bananas and accept payment through Paytm, or expecting a small farmer to make payment to his labourers by cheques, or expecting the owners of India’s tiny manufacturing units to pay their daily wage workers, who are paid daily on a piecemeal basis, by electronic transfer every day, is akin to Marie Antoinette asking Parisians to go eat cake.

We take a brief look at the impact of demonetisation on the three unorganised sectors mentioned above.

Impact on Agriculture

The majority of the Indian peasants are small farmers with landholdings of less than one hectare. The globalisation reforms have pushed the agricultural sector into deep crisis, so much so that they have driven more than 3 lakh farmers into committing suicide since the reforms began, the largest recorded wave of such deaths in history.[41]

Now, demonetisation has further worsened this crisis. It was announced just when the kharif crop was being harvested and sowing for the rabi crop was about to begin. This pushed farmers into a difficult situation. Business at the mandis fell by anywhere from 25% to 70%, as there were no buyers—the cash crunch affected shopkeepers, hotels and restaurants, and even the small street vendors. And so, traders at the mandis did not have cash to pay to the farmers for their produce (or they forced farmers to sell at half the price); even if they paid in cheque, farmers were not able to encash them as banks faced a cash crunch. The other source of funding for farmers, disbursal of loans by village-level credit cooperative societies, was also affected due to restrictions imposed by the RBI on these institutions. And so, farmers did not have the money to buy seeds and fertilisers, and to hire tractors and other equipment, and pay their labourers—affecting their sowing for the next crop.[42]

Because of the government’s push towards a cashless economy, traders in mandis continue to be unwilling to pay for agricultural produce in cash, because of which the agricultural crisis has continued. It has resulted in falling farm prices, because of which deflation has hit agriculture. The Central Statistics Office’s (CSO) GDP data for April-June shows that the annual growth in gross value added from agriculture during the quarter was only 2.3% in real terms (i.e. at constant prices), as against 6.9 per cent for October-December. But farm prices fell by 2% during this quarter, due to which the value of agricultural production rose by only 0.3% in nominal terms (that is, at current prices unadjusted for inflation).[43] It is this worsening crisis, made worse by the government insistence on providing social sector benefits through Aadhar, that has led to an intensifying farmers’ movement across the country in recent months.[44]

Impact on Small-Scale Retail

India has more than 1.49 crore retail outlets, the highest in the world, of which the overwhelming number are small retailers. Small-scale retail was already under severe attack because of the gradual opening of the various branches of this sector to foreign direct investment as a part of the globalisation policies.[45] Demonetisation has had ruinous consequences for it. According to the Confederation of All India Traders—one of the largest trade associations in India—businesses in markets across the country reduced by a whopping 75% in the immediate months following the demonetisation announcement. The reason was simple—people simply didn’t have the cash to buy even essentials; even if they had cash, it was a Rs 2,000 note that most small traders were unable to accept as they did not have enough change.[46]

Impact on Unorganised Manufacturing Sector

Since India began globalisation in 1991, despite the massive entry of giant Western corporations into the economy, and despite the Indian economy having expanded at a rapid rate of 7.3% per annum during the decade 2000–10, it has not led to a generation of formal or organised sector manufacturing jobs. Two decades later, the total manufacturing sector employment in India in 2010 was only 50.7 million, or 11% of the total workforce; of this, barely 16 million were organised sector jobs, the remaining 34.5 million were unorganised sector jobs—that is, jobs in tiny units or home-based manufacturing (this includes jobs such as workers making papads or rolling bidis in their homes).[47]

Even though the overwhelming number of jobs in the manufacturing sector continue to be in the unorganised sector, for the last two decades, this sector has been struggling for survival due to globalisation policies such as ending of reservations for small units and decline of low interest bank credit for the small sector.

Demonetisation simply devastated this already struggling sector. Nearly 80% of the micro/small enterprises in the country were badly hit. They are very small units, and have innumerable backward and forward linkages, all of which are in cash. The drying up of cash pushed these industries to the wall. To give an example, take the brass industry of Moradabad, Uttar Pradesh. The raw material for brass is supplied by people who deal in scrap. They buy scrap from various places in cash, and sell it to the consolidator who buys it in cash. The next stage is the melting of scrap; it is turned into brass slab or bar. After that comes the making of moulds—for instance, of a flower vase or a tap. The brass is melted and poured into these moulds. After this stage, there are craftsmen who make designs on it, then comes the stage of polishing, then of lacquering. Each of these stages is based exclusively on cash. At each stage, the workers are paid in cash, daily, on a piecemeal basis. They earn, and spend it, on a daily basis. Demonetisation and the resulting cash crunch brought this thriving industry, which had a total turnover of Rs 6,000 crore, to a standstill. Likewise, the hosiery industry of Ludhiana, the bangle industry of Faridabad, the garment industry of Tirupur, the chikankari industry of Lucknow, and so many other industries, employing lakhs of workers, were also badly affected; thousands of units shut down, lakhs of workers were rendered unemployed, and forced to go back to their villages.[48]

The gross impact? The Centre for Monitoring Indian Economy (CMIE) recently estimated that roughly four million jobs were lost post-demonetisation during the four month period from January to April 2017[49]—in an economy already suffering from a huge unemployment crisis.

Economy Slowing Down

The destructive effect of demonetisation on the informal sector caused demand to fall, production to decline in several sectors, and rise in unemployment. These adverse impacts continued for several months, as money supply was not restored for several months. The obvious consequence—the economy has been continuously slowing down. Official data show that the India’s GDP or gross domestic product slowed down to 5.7% on a year-on-year basis during the April-June quarter of 2017-18. More significantly, this was the sixth consecutive quarter for which the GDP growth has slowed down. It had touched a high of 9.1% in January-March 2016 quarter. After that it has continuously slowed down, to 7.9%, 7.5%, 7.0% and 6.1% in the subsequent quarters, to 5.7% in Q1 of 2017-18.[50]

Prof. Arun Kumar in fact argues that this latest GDP growth rate figure is a huge over-estimate. He points out that this official estimate is largely based on data provided by the corporate sector and some other organised sectors of the economy. It does not include data from the unorganised sectors of the economy, whose non-agriculture component contributes to 31% of the GDP, and which was hit hard by demonetisation and now the government decision to roll-in GST. While there are no official surveys that capture the extent to which this sector was hit by demonetisation, private surveys indicate that that this sector was badly affected. Basing himself on data provided by these private surveys, Prof. Arun Kumar argues that it is possible that the GDP growth rate has actually fallen to way below 5.7%, and in all probability is near-zero.[51]

Then Why Demonetisation?

If demonetisation is not going to lead to a reduction in the black economy—and the government obviously knows this—then what is the real motive behind the demonetisation exercise and now the push towards a less-cash economy?

After coming to power, the BJP made a complete U-turn on all the promises made by it during the elections, and has continued with the same policies of globalisation–liberalisation–privatisation that have been implemented in the country for the last more than two decades. The only difference—Modi is implementing them at an accelerated speed. The sole aim of these policies is to run the economy solely for the naked profiteering of giant foreign corporations, and their junior partners, the big Indian business houses. These policies are being implemented at the behest of the governments of the developed countries led by the USA, and the international financial institutions controlled by them, the World Bank and the International Monetary Fund (or IMF). The reason why the Indian Government is dutifully implementing their dictates is because of our huge foreign debt, which under the Modi Government has now topped $485 billion. (Discussing this issue in greater detail is beyond the scope of this booklet.[52])

As with the other important policies being implemented as a part of globalisation, Washington is behind Modi Government’s demonetisation exercise too! This may sound incredible to our readers, especially the Modi bhakts, but there is enough evidence to substantiate this. All evidence points to the fact that PM Modi’s demonetisation and cashless drive has been implemented at the behest of US Government’s development agency USAID.

Ever since the Modi Government came to power, it has been bowing to US pressure and implementing policies to benefit US corporations, such as: amending the Land Acquisition Act (on which the government had to backtrack due to a countrywide protest movement); diluting India’s nuclear liability law so that US nuclear corporations can set up nuclear plants in India without having to worry about paying indemnities in case of design defects causing a nuclear accident; and amending insurance laws to permit increased inflow of foreign capital into India’s insurance sector.[53] The push to demonetisation is a continuation of this surrender to US corporate interests.

In October 2016, the USAID and the Indian Finance Ministry entered into an agreement known as Catalyst: Inclusive Cashless Payment Partnership with the goal of effecting a quantum leap in cashless payments in India. The partnership was based on a report commissioned by USAID in 2015, and presented in January 2016, titled Beyond Cash. The study and subsequent plans were kept a secret[54]—this explains Modi’s statement that preparations for demonetisation had been going on for many months before the November 8 announcement.

Who are the real beneficiaries of this partnership and drive towards a cashless economy? This is revealed by USAID itself. In a press release following the release of the Beyond Cash report, it declared, “Over 35 key Indian, American and international organisations have partnered with the Ministry of Finance and USAID on this initiative.”[55] These organisations are mostly IT companies and payment service providers who stand to benefit from the increased digital payments and from the associated data generation. They include Microsoft, credit card companies such as Mastercard and Visa, the internet services company eBay Inc., the financial services corporation Citigroup, among others. India’s digital payments industry is estimated to have the potential of growing to a whopping $500 billion by 2020, but only if millions of Indians can be drawn into the digital payments net![56]

USAID and its partner corporations are well aware that this policy would likely spell disaster for India’s small traders and producers, and people in remote regions; Beyond Cash had analysed the impact of demonetisation extensively.[57] But they are not bothered. In today’s world dominated by big corporations, profit maximisation is all that matters, even if these profits come drenched in the blood of lakhs of poor and starving people.

There is no doubt. While one may have strong disagreements with the overall orientation and policy framework of the various governments that have come to power at the Centre since Independence, the present BJP Government led by Narendra Modi is undoubtedly the most anti-people of them all.

References

- Jayati Ghosh, The Political Economy of Demonetising High Value Notes, November 15, 2016, http://www.macroscan.org.

- “Demonetisation: Journey of Rs 500, Rs 2000 Note from Printing Press to Your Pockets”, November 22, 2016, http://www.financialexpress.com.

- For definitions, see: Census of India 2011: Urban Agglomerations and Cities, http://censusindia.gov.in.

- Sreenivasan Jain and Sonal Matharu, “Did Notes Ban Curb Cash, Terrorism And Boost Formal Economy? A Fact Check”, September 2, 2017, https://www.ndtv.com.

- Vivek Chadha, “Demonetisation and Beyond: Addressing the Finance of Terrorism”, November 18, 2016, http://www.idsa.in; Vappala Balachandran, “Black Money and Terror”, November 23, 2016, http://indianexpress.com; “Jammu and Kashmir: Rs 2,000 notes recovered from terrorists killed in Bandipora”, November 22, 2016, http://indianexpress.com.

- Abhishek Waghmare, “Is Modi winning fake currency war? A data you shouldn’t miss”, September 1, 2017, http://www.business-standard.com.

- Devanik Saha, “Just how many fake notes were actually detected in India last year?”, November 25, 2016, https://scroll.in.

- “Will Making Transactions Cashless Completely End Black Money Hoarding?” NDTV, November 21, 2016, https://www.youtube.com.

- Sonal Matharu, “Did Demonetisation Help? Digital Payments Back To Pre-Notes Ban Levels”, September 01, 2017, https://www.ndtv.com.

- Arun Kumar, “Demonetisation is a Clear Case of How Public Policy Should Not be Made”, September 4, 2017, https://thewire.in.

- Demonetisation: Yet Another Fraud on the People, Lokayat publication, January 2017, available on Lokayat website, http://lokayat.org.in.

- Appu Esthose Suresh, “Why Govt’s Demonetisation Move May Fail to Win the War Against Black Money”, November 12, 2016, http://www.hindustantimes.com.

- “What the Changes in the Tax Treaty with Mauritius Mean for India, Investors”, May 12, 2016, http://indianexpress.com.

- “India’s Land, and Not Switzerland, is Where the Hunt for Black Money Should Begin”, June 9, 2014, http://scroll.in.

- Jayati Ghosh, The Political Economy of Demonetising High Value Notes, op. cit.

- Manas Roshan, “’This is Tough, But Done for the Wrong Reasons’: The Economist Arun Kumar on Demonetisation and Black-Money Generation”, November 16, 2016, http://www.caravanmagazine.in.

- Jayati Ghosh, The Political Economy of Demonetising High Value Notes, op. cit.

- Of Bold Strokes and Fine Prints: Analysis of Union Budget 2015–16, Centre for Budget and Governance Accountability, March 2015, pp. 18–19, http://www.cbgaindia.org.; Jorge Martinez-Vazquez, “Taxation in Asia”, Asian Development Bank, 2011, p. 4, ttp://www.adb.org.

- Manas Roshan, op. cit.

- Jayati Ghosh, The Political Economy of Demonetising High Value Notes, op. cit.; Jahnavi Sen, “Decision to Demonetise Currency Shows They Don’t Understand Capitalism: Prabhat Patnaik”, November 12, 2016, http://thewire.in.

- Dinesh Unnikrishnan, “Finance Bill: Modi govt just made political funding more opaque; transparency remains a promise”, March 23, 2017, http://www.firstpost.com.

- Appu Esthose Suresh, “In 44 years, India Lost At Least Rs 17 Trillion to Tax Havens”, November 2, 2016, http://www.hindustantimes.com.

- “No Change in Tax Treatment of P-Notes Post India–Mauritius treaty: Hasmukh Adhia”, May 12, 2016, http://indianexpress.com.

- “$500-Billion Stashed Away Abroad by Indians: CBI”, February 13, 2012, http://www.thehindubusinessline.com.

- Dhananjay Mahapatra, “Now, Modi Govt Too Refuses to Name Foreign Bank Account Holders”, October 18, 2014, http://timesofindia.indiatimes.com.

- “What Exactly is Black Money, and Can Demonetisation Make a Dent in It?” November 12, 2016, http://www.thenewsminute.com.

- Siddharth Varadarajan, “The Cult of Cronyism”, March 31, 2014, http://newsclick.in; Lola Nayar, Arindam Mukherjee, Sunit Arora, “All Along the Waterfront”, March 10, 2014, http://www.outlookindia.com.

- “Panama Papers: From Amitabh Bachchan to Adani’s Brother, Names of 500 Indians Leaked”, April 4, 2016, http://www.business-standard.com; “Exclusive: Panamagate India”, April 8, 2016, http://www.theindianeye.net.

- Ashish Mehta, “Surgical Strike? This was Aspirin for Cancer”, November 9, 2016, http://www.governancenow.com; Ritu Sarin, “Exclusive: HSBC Indian List Just Doubled to 1195 Names. Balance: Rs 25420 Cr”, February 9, 2015, http://indianexpress.com.

- Ashish Mehta, ibid.

- Gaurav Vivek Bhatnagar, “Modi Government Fares Poorly in Two-Year Report Card on Taking Anti-Corruption Legislations Forward”, May 5, 2016, https://thewire.in; “Parliament Panel Slams Modi Govt for Not Implementing Lokpal”, April 28, 2015, http://www.firstpost.com; “BJP Reverses Stand on Bringing Parties Under RTI”, August 1, 2014, http://www.livemint.com.

- “Demonetisation: How Narendra Modi Changed Narrative from Black Money to Cashless Economy”, November 28, 2016, http://www.firstpost.com.

- “Government’s Digital Push: Top 11 Incentives for Cashless Transactions”, December 8, 2016, http://timesofindia.indiatimes.com; “Govt Forcing Move to Cashless Transactions Rather Than Changing Spending Habits”, November 27, 2016, http://indianexpress.com.

- Sreenivasan Jain and Sonal Matharu, “Did Notes Ban Curb Cash, Terrorism And Boost Formal Economy? A Fact Check”, September 2, 2017, https://www.ndtv.com.

- Ibid.

- Jennifer Spencer, “Jaitley Right–and Wrong–On Currency in Circulation”, http://factchecker.in; “US Currency in Circulation”, https://ycharts.com.

- “Fortune 500 Companies Hold a Record $2.4 Trillion Offshore”, March 4, 2016, http://ctj.org.

- “Will Making Transactions Cashless Completely End Black Money Hoarding?” op. cit.; “UK Tax Fraud Costs Government £16bn a Year, Audit Report Says”, December 17, 2015, https://www.theguardian.com; “Tax Evasion Costs France Between 40 and 60 Billion Euros Per Year”, October 12, 2015, http://www.humaniteinenglish.com.

- Mayank Jain, “As Data for More Than 32 Lakh Debit Cards Gets Leaked, Here are Seven Things You Must Do Immediately”, October 21, 2016, https://scroll.in; Anand Adhikari, “19 Banks Impacted by the Debit Card Data Fraud”, October 21, 2016, http://www.businesstoday.in; Arindam Mukherjee, “When Fraud Goes Online”, December 19, 2016, http://www.outlookindia.com.

- Santosh Mehrotra et al., “Turnaround in India’s Employment Story”, Economic and Political Weekly, August 31, 2013, http://www.epw.in.

- For more on this, see: Spectre of Fascism, op. cit.., pp. 54–59; Neeraj Jain, Globalisation or Recolonisation? Lokayat publication, 2006, available on internet at www.lokayat.org.in.

- “At Delhi’s Azadpur Mandi, Lack of Money is Slowly Choking Business and Also Workers”, November 18, 2016, http://thewire.in; “Demonetisation Impact: Vegetables, Fruits Trade Halves in Mumbai”, November 19, 2016, http://www.firstpost.com; “RBI’s No Exchange Rule for Cooperative Banks Hits Farmers”, November 18, 2016, http://economictimes.indiatimes.com; “Crisis of Credit: An Omission Most Untimely and Unfair”, December 9, 2016, http://indianexpress.com; “Vegetables Growers Hard Hit by Demonetisation”, December 8, 2016, http://www.business-standard.com.

- Harish Damodaran, “Distress in farms: GDP data confirms deflation is here”, September 2, 2017, http://indianexpress.com.

- Astha Kapoor, “How demonetisation and Aadhaar worsened Indian farmers’ plight”, June 9, 2017, https://www.dailyo.in.

- For more details on this issue, see: “FDI in Retail: Development for Whom?” in Neeraj Jain, Essays on Contemporary Indian Economy, Aakar Books, Delhi, 2016.

- “How Demonetisation has Hit Small Traders Hard”, November 15, 2016, http://www.financialexpress.com; “Demonetisation: Small Businesses Hit Hard”, December 5, 2016, http://timesofindia.indiatimes.com; “Widespread Distress as Demonetisation Hits Small, Medium Businesses Hard”, November 24, 2016, http://www.millenniumpost.in.

- Santosh Mehrotra et al., op. cit.

- “Ludhiana Hosiery Industry Badly Hit by Demonetization”, November 21, 2016, http://www.business-standard.com; Ajaz Ashraf, “Interview: Demonetisation has Hit 80% of Small Businesses, the Sector is Staring at Apocalypse”, December 6, 2016, https://scroll.in; Saher Naqvi, “Textile Market in Tirupur Badly Hit Post-Demonetisation”, December 3, 2016, https://www.cmie.com.

- Mahesh Vyas, “1.5 million jobs lost in first four months of 2017”, July 11, 2017, https://www.cmie.com.

- “GDP growth falling for 6 consecutive quarters: Why India slipped after overtaking China”, September 1, 2017, http://indiatoday.intoday.in.

- Arun Kumar, “India’s Troubling and Official Growth Numbers Are Only the Tip of the Iceberg”, October 3, 2017, https://thewire.in.

- For more on this, see other publications of Lokayat, such as: Spectre of Fascism, Lokayat publication, September 2016, www.lokayat.org.in.

- Norbert Haering, “A Well-Kept Open Secret: Washington is Behind India’s Brutal Experiment of Abolishing Most Cash”, January 3, 2017, https://rwer.wordpress.com.

- Norbert Haering, ibid.

- “’Beyond Cash’ Identifies Barriers and Solutions to a Digital, Inclusive Economy in India”, Press Release, January 20, 2016, https://www.usaid.gov.

- “Digital Payments in India Seen Touching $500 Billion by 2020”, July 28, 2016, http://www.livemint.com.

- Norbert Haering, op. cit.

(Neeraj Jain, an electrical engineer by education, is an activist with Lokayat, a socialist activist group based in Pune, and Associate Editor of Janata. He is the author of several books and booklets.)