Eric Toussaint

Over the last ten years Greece has been a prime example of how a country and a people can be deprived of their liberty through clearly illegitimate debt. Since the 19th century, from Latin America to China, Haiti, Greece, Tunisia, Egypt and the Ottoman Empire public debt has been used as a coercive force to impose domination and pillage. Visibly, it is the combination of debt and free trade that constitute the fundamental factors subordinating whole economies as from the 19th century. Local elites allied themselves with big financial powers in order to subject their own countries and peoples permanently to methods of power that transfer wealth towards local and foreign creditors.

Contrary to commonplace ideas, it is generally not the indebted weaker countries that are the cause of sovereign debt crises. These crises break out first in the biggest capitalist countries or are the result of their unilateral decisions that produce effects of great magnitude in the indebted countries. It is not so-called “excessive” public spending that builds up unsustainable debt levels, but rather the conditions imposed by local and foreign creditors. Real interest rates are abusively high and so are bankers’ commissions. The indebted countries unable to keep up with repayments have to continually find new loans to repay old loans. In the past, when that became impossible, the great powers had licence to resort to military action to ensure they were repaid.

Debt crises and their outcomes are always directed by the big banks and the governments that support them.

Over the last two centuries, several countries have successfully repudiated debts by arguing that they were either illegitimate or odious. Mexico, the USA, Cuba, Russia, China and Costa Rica have all done this. Conflict involving debt non-payment has given birth to a judicial doctrine known as Odious Debt which is to this day pertinent.

Historical examples

Creditors, whether powerful states, multilateral organisations that serve them or banks, have become very adroit at imposing their will on debtors. From early in the 19th century Haiti, the first independent black republic, was an early testing ground. The island gained freedom from the yoke of the French empire in 1804, but Paris did not abandon its claims on the country and obtained from Haiti payment of a royal indemnity granted to the former colonial slave owners. The 1825 agreements signed by the new Haitian leaders created a monumental debt of independence untenable from 1828 and which took a full century to pay off, thus preventing any real development.

Debt was also used to subjugate Tunisia under France in 1881 and Egypt to the British in 1882. The lending powers used unpaid debt to impose their will on countries that had so far been independent. Greece too, was born in the 1830s with a burden of debt that held it in the sway of Russia, France, and the British. Newfoundland, which had become the first autonomous dominion of the British Empire in 1855, well before Canada and Australia, had to renounce its independence in 1933 because of the grave economic crisis in order to face up to its debts and was finally incorporated into Canada in 1949. Canada agreed to take charge of 90% of Newfoundland’s debt.

Debt during the 1960s and 70s

The process was repeated after the Second World War, when the Latin American countries had need of capital to fund their development and first Asian, then African, colonies gained independence. The debt was the principal instrument used to impose neocolonialist relations. It became frowned upon to use force against a debtor country, and new means of coercion had to be found.

The massive loans granted as from the 1960s, to an increasing number of peripheral countries (not least those in which the Western powers had a strategic interest such as Mobutu’s Congo, Suharto’s Indonesia, the military regimes in Brazil, Yugoslavia and Mexico) oiled a powerful mechanism that took back the control of countries that had begun to adopt policies that were truly independent of their former colonial powers and Washington.

Three big players have incited these countries into debt by promising relatively low interest rates:

- the big Western banks seeking to put massive amounts of liquidities to work;

- the developed countries seeking to stimulate their economies after the1973 oil crisis;

- the World Bank seeking to increase US influence and to fend off the increasing expansion of the private banks.

Local elites also encouraged higher debt and made gains, contrary to the populations, who derived no benefit.

The debt crisis of the 1980s

At the end of 1979, the US decided to increase its interest rates. This had an effect on the rates applied to indebted Southern countries whose borrowing rates were variable and had already been subject to sharp rises. Coupled with low export commodities prices (coffee, cacao, cotton, sugar, ores, etc.,) which caused reduced revenues for the countries, the trap was sprung.

In August 1982, Mexico, among other countries announced that they were unable to assure debt repayments. So, the International Monetary Fund (IMF) was asked, by the creditor banks, to lend the countries the necessary funds at high interest rates, on the double condition that they continue debt repayments and apply the policies decided by the IMF “experts”: abandon subventions on goods and services of primary necessity; reduce public spending; devalue the currency; introduce high interest rates in order to attract foreign capital; direct agricultural production towards exportable products; free access to interior markets for foreign investors; liberalise the economies, including the suppression of capital controls; introduce a taxation system that aggravates inequalities, including VAT increases; preserve capital gains and privatise profitable publicly owned industries; this list is not exhaustive.

These structural adjustment loans were aimed at the suppression of independent economic and financial policies in the peripheral countries and tying their independence to the World markets. Also, to ensure access by the industrialised economies to the raw materials and they needed. By gradually putting the developing countries into competition with each other the economic model based on exports and the extraction of raw materials for foreign markets is reinforced, which in turn reduces production costs and increases profits, favouring the developed economies.

So, a new form of colonialism sprang up. It was no longer necessary to maintain an administration and an army to put the local population to heel; the debt did the job of creaming off the wealth produced and directing it to the creditors. Of course the colonialists continued to interfere in local politics and economic policies whenever they considered that it suited them.

Developments in the 2000s

As from 2003–04, in a context of strong world demand, commodity prices started to increase. Exporting countries improved their foreign exchange incomes. Some developing countries increased their social spending but most preferred to buy US treasury bonds and so put their increased means at the disposal of the principal economic powers. This increase in developing countries’ incomes whittled down the weight of the World Bank and the IMF.

Another factor was the Chinese economic expansion. China had become the world’s principal sweatshop and was accumulating important financial reserves and using them to significantly increase funding to developing countries in competition with the offers of funding from the industrialised countries and the multilateral institutions.

During the 2000s, the reduction of interest rates by the Central Banks in the industrialised countries in the North decreased the costs of the debt in the South. Because of the 2007–8 financial crisis in North America and Western Europe, massive amounts of liquidities were injected into the financial system to save the big banks and corporations that were too heavily indebted themselves. A decrease in the costs of financing the debts of the developing countries followed naturally and the governments of developing countries gained a false sense of security.

The situation began to degrade in 2016–17 when the Fed started to raise its interest rates, from 0.25% in 2015 to 1.5% in October 2019 and tax breaks were granted by the Trump administration to big business to attract US foreign investment back to the US. What’s more, commodities prices slipped and exporter countries’ revenues slipped with them making debt repayments more difficult.

General view of the debt in the South

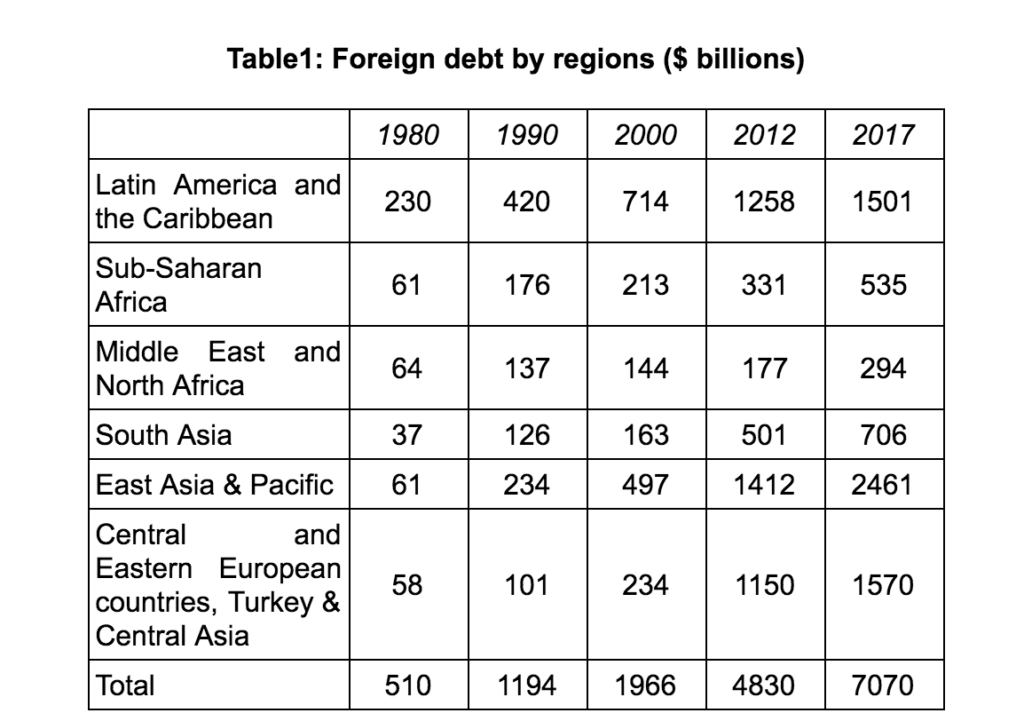

These last years have have seen a significant increase in constant values of foreign debt; between 2000 and 2017 it has tripled (Table 1).

Whatever the World Bank and the IMF may cheerfully repeat, the debt of developing countries is still a major obstacle to meeting their inhabitants’ basic needs and safeguarding human rights. Inequalities have sharply increased and progress in terms of human development has been very limited.

For instance, in sub-Saharan Africa, outgoing flow of capital via debt service and corporations garnering their profits are significant. In 2012, the profits repatriated from the poorest area on earth amounted to 5% of its GDP vs 1% in public aid to development. In this context, it is legitimate to raise the question: who is helping who?

If we take into account the plundering of Africa’s natural resources by private corporations, the brain drain of African intellectuals, embezzlement of goods by the African ruling class, manipulations of transfer prices by private corporations and other misappropriations, we cannot but be aware that Africa has been drained dry.

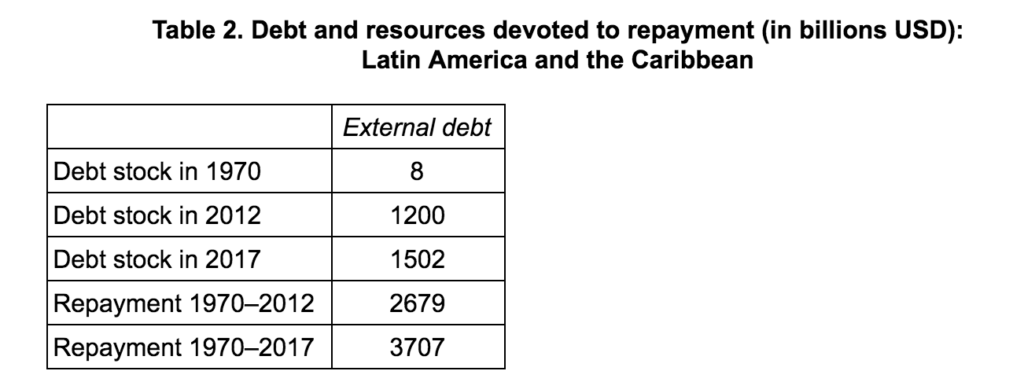

Likewise, in Latin America and the Caribbean, despite these countries having repaid $3730 billion over the period 1970-2017, their combined debt has has zoomed from 8 billion dollars to 1500 billion dollars (Table 2).

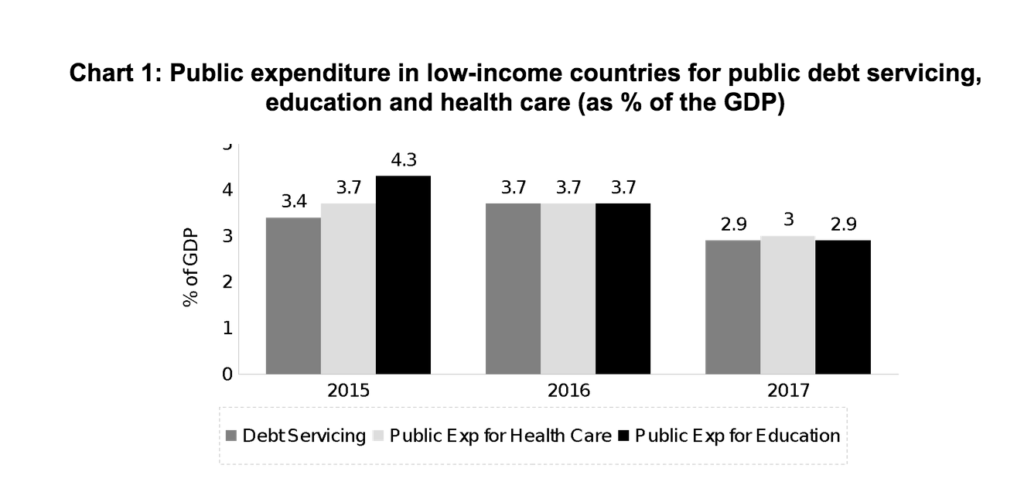

If we take into account the evolution of public expenditure of some fifty low-income countries from 2015 to 2017, we notice an increase of expenditure related to debt repayment, a decrease of health-related expenditure and a stagnation in terms of education (Chart 1).

It is Possible Not to Repay An Illegitimate Debt

It is quite possible to resist creditors, as evidenced by Mexico under Benito Juárez, who in 1867 refused to repay loans contracted by emperor Maximilian from the Société Générale de Paris two years earlier in order to finance the occupation of Mexico by the French army. In 1914, at the height of the revolution, when Emiliano Zapata and Pancho Villa were victorious, Mexico completely suspended payment of its external debt, which was considered to be illegitimate; the Mexican government only repaid symbolic amounts from 1914 to 1942, just in order to pacify creditors. From 1934 to 1940, President Lázaro Cárdenas nationalised the railway and the oil industry without any compensation; he also expropriated over 18 million hectares of landed estates to give them over to indigenous communities. His tenacity paid: in 1942, creditors renounced about 90% of the debt value and said they were satisfied with limited compensations for the companies they had been evicted from. Mexico was able to undergo major social and economic development from the 1930s to the 1960s. Other countries such as Brazil, Bolivia and Ecuador successfully suspended debt repayment from 1931. In the case of Brazil, selective suspension of repayment lasted until 1943, when an agreement made it possible to reduce debt by 30%.

More recently, in July 2007, in Ecuador, President Rafael Correa set up a committee to audit public debt. After fourteen months of work, its findings gave evidence that a large part of the country’s public debt was illegitimate and illegal. In November 2008, the government decided to unilaterally suspend repayment of debt securities sold on international financial markets and maturing in 2012 and 2030. Finally, the government of this small country won its case opposing North-American bankers who held those securities. It bought for $900 million securities that had been worth $3.2 billion. Through this operation Ecuador’s public Treasury saved about $7 bn on the borrowed capital and the remaining interests. It could then free resources to finance new social spending. Ecuador has not been targeted by international reprisals.

It is obvious that refusing to repay illegitimate debt is a necessary measure, but it is not enough to generate development. A consistent development programme must be implemented. Financial resources have to be generated through increasing the State’s resources through taxes that respect social and environmental justice.

[Eric Toussaint is an author, historian and political scientist, and is the spokesperson of the Committee for the Abolition of Illegitimate Debt. This article has been edited by us for reasons of space.]