If there is one message that seemed to surface through last month’s crucial meetings of the Communist Party of China it is continuity. The inference that might best be taken is no significant change from the path on which the party has led China in recent years should be expected.

That path, despite the oft-used slogan “Socialism with Chinese Characteristics for a New Era,” has been a restructuring of the economy toward capitalism, albeit a gradual entry on Chinese terms and keeping the “commanding heights” of the economy in state hands. If we attempt to grasp the meaning of the communiqués and reports issued surrounding the party’s 20th National Congress, it would be better to observe through a holistic lens rather than fixating on personalities.

The Western corporate media obsessively dwelled on President Xi Jinping’s third term, as if nothing else was of note or as if President Xi is an all-powerful sole dictator single-handedly deciding the fate of 1.4 billion Chinese. To be sure, communiqués, internal press reports and speeches repeatedly stressed the party leader’s “core position” and urged all Chinese to fully study and implement “Xi Jinping Thought” along with the ritualistic panegyrics to the party. There appears to be no doubt as to his leadership, both through the extravagant praises for him and that the top leadership body, the Politburo Standing Committee, appears to consist solely of those aligned with him.

But nobody in a country ruled by a communist party is a sole dictator, excepting the unique circumstances of the Josef Stalin dictatorship and Enver Hoxha in Albania. Given the opaqueness of the Communist Party of China (CPC) it is impossible for us to say with any certainty what is going on behind closed doors. Is President Xi truly all-powerful, or does he lead a faction that has gained majority backing among party leaders? Does his third term, breaking two decades of precedent, represent not a grab for power but rather a reflection of opinion alignment behind closed doors and a desire for continuity in a time when more difficulties are almost assuredly coming? Certainly this is possible.

Let’s turn away from parsing personalities and instead examine key communiqués and reports, and how we might reasonably interpret them.

Prominently continuing to honor all past leaders

The most important document to read is arguably the Resolution of the 20th National Congress of the CPC on the Report of the 19th Central Committee adopted at the closing session of the Congress on Oct. 22. The very first paragraph reads:

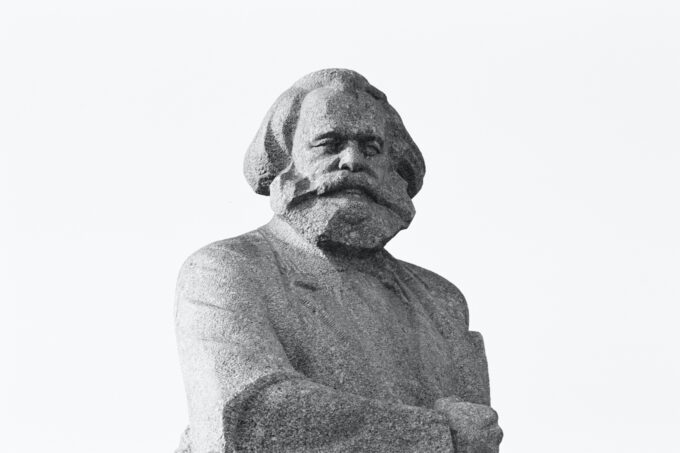

“The Congress has held high the great banner of socialism with Chinese characteristics; adhered to Marxism-Leninism, Mao Zedong Thought, Deng Xiaoping Theory, the Theory of Three Represents, and the Scientific Outlook on Development; and fully applied Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era.”

This list is repeated five paragraphs later. Why would this be significant? That it is the opening of the resolution is significant because it is nearly identical to the equivalent statement issued in 2017 when the 19th Communist Party Congress adopted the report of the then outgoing Central Committee. Then, as now, every Chinese leader is mentioned. The “Scientific Outlook on Development” is the product of President Xi’s predecessor, Hu Jintao, who declared that China must end its reliance on cheap labor and invest more in science and technology. The “Theory of Three Represents” was laid down by former President Hu’s predecessor, Jiang Jemin. (Incidentally, this tends to throw cold water on the idea that former President Hu was “ejected” from the Congress; if the current leaders were intent on “humiliating” him as corporate media commentaries assert, why would the party enshrine his policy in their most important communiqués?)

That October 2017 party Congress confirmed that the role of the market would be “decisive” rather than “basic,” consistent with the CPC leadership switching the role of the market from “basic” to “decisive” in 2013 at a key Central Committee plenum. That would certainly seem to contradict the stress on Mao Zedong Thought, a major pillar that the party consistently upholds as a source of authority. That pillar is in contradiction with the era of Deng, who inaugurated China’s move from its Maoist path and toward the introduction of capitalism. It is in particular a contradiction with former President Jiang’s “Theory of Three Represents,” a declaration that the party should represent the most advanced productive forces, the most advanced culture and the broadest layers of the people. That is an assertion that the interests of different classes are not in conflict and that the party can harmoniously represent all classes simultaneously.

Because there is no way to reconcile these divergent programs, the consistent listing of all party leaders since the 1949 revolution can reasonably be read as a statement of continuity with the decades of China’s current capitalist path, stretching back to the early Deng years. Yet the Resolution of the 20th Congress, in apparent contradiction to China’s growing private sector, the stress on the “decisive” nature of markets and China’s integration into the world capitalist system, declared that Marxism remains central to the party’s work. The resolution states:

“The Congress stresses that Marxism is the fundamental guiding ideology upon which our Party and our country are founded and thrive. Our experience has taught us that, at the fundamental level, we owe the success of our Party and socialism with Chinese characteristics to the fact that Marxism works, particularly when it is adapted to the Chinese context and the needs of our times. [The party] has achieved major theoretical innovations, which are encapsulated in Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era. … Only by integrating the basic tenets of Marxism with China’s specific realities and fine traditional culture and only by applying dialectical and historical materialism can we provide correct answers to the major questions presented by the times and discovered through practice and can we ensure that Marxism always retains its vigor and vitality.”

Further, President Xi, in his keynote report to the 20th Congress, also stressed the importance of Marxism. He said:

“The sound theoretical guidance of Marxism is the source from which our Party draws its firm belief and conviction and which enables our Party to seize the historical initiative. … Taking Marxism as our guide means applying its worldview and methodology to solving problems in China; it does not mean memorizing and reciting its specific conclusions and lines, and still less does it mean treating it as a rigid dogma.”

Drawing on past triumphs to justify present policies

Understood properly, Marxism is a living body of work and not a catechism, and can only be applied with creativity and analysis of concrete conditions. Nobody can rebuke the Chinese for adapting it to their particular circumstances and need to develop rapidly. But at what point does a “socialist market” economy tip over to a capitalist-oriented economy? There is no bright line that can be drawn but at some point, the rubicon has been crossed. Then there is the matter of what lessons might be drawn. Another clue as to what might be expected from the party in the near future might be derived from a visit by the Politburo Standing Committee to Yan’an, the old revolutionary base in northwest China. A report by Xinhua, China’s news service, quoted President Xi as stating that “the firm and correct political direction was the essence of the Yan’an Spirit.”

The lesson to derive from that spirit, according to President Xi, is that progress depends on the party and that party leadership is unquestionable. Xinhua summarized his interpretation of that spirit as follows:

“All Party members must adhere to the correct political direction, resolutely implement the Party’s basic theory, line, and policy, thoroughly implement the Party Central Committee’s decisions and plans, so as to further advance the great cause pioneered by revolutionaries of the older generation. … All Party members must stand firmly with the people, act on the Party’s purpose, put into practice the mass line, maintain close ties with the people, take the initiative to apply the people-centered development philosophy to all work, and achieve solid progress in promoting common prosperity, so that the people share more fully and fairly in the gains of modernization.”

So there won’t be any slackening of party discipline, nor of any loosening of authoritarian party control over society. Nor will there be any swerving from the long-standing goal of achieving “common prosperity.” To return to the Resolution of the 20th Congress, the party states its goal as:

“[F]irst, basically realizing socialist modernization from 2020 through 2035; second, building China into a great modern socialist country that is prosperous, strong, democratic, culturally advanced, harmonious, and beautiful from 2035 through the middle of this century. [One of the main objectives in the next five years is to] Make new strides in reform and opening up; make further progress in modernizing China’s system and capacity for governance; further improve the socialist market economy; put in place new systems for a higher-standard open economy. We should continue reforms to develop the socialist market economy, promote high-standard opening up, and accelerate efforts to foster a new pattern of development that is focused on the domestic economy and features positive interplay between domestic and international economic flows.”

The reference to “positive interplay between domestic and international economic flows” is another signal of continuity. In May 2020, the Politburo announced a policy of “dual circulation” development. This policy represents lessening China’s reliance on exports and imports — “international circulation” — and rebalancing with production for the domestic market. This is intended to lessen China’s reliance on imports for its production and become more self-reliant in the wake of U.S.-led Western hostility to Chinese technological development. Just last month, the Biden administration announced sweeping prohibitions on the sale of semiconductors, advanced computing chips, chip-making equipment and other high-technology products to curb China’s ability to indigenously develop these technologies.

“The plan places a greater focus on the domestic market, or internal circulation, and is China’s strategic approach to adapting to an increasingly unstable and hostile outside world,” according to an explanatory article in the South China Morning Post. “Officially, China will look inward to tap the potential of its huge domestic market and rely on indigenous innovation to fuel growth. But despite the increased emphasis on the domestic market and on self-reliance in some sectors, President Xi has said repeatedly that China will not completely close itself off from the outside world, and will instead open up more.”

The dual-circulation policy is also a response to an expected reduction in reliance on exports on the part of China’s export destinations in the wake of economic disruptions caused by the Covid-19 pandemic. The Morning Post writes, “It is essentially a defensive approach by Beijing to prepare for the worst-case scenario as the world undergoes significant geopolitical and economic changes. The coronavirus exposed how dependent the world was on China for critical supplies of medical equipment, with nations around the world vow[ing] to be more self reliant on such products, amid a push by the US for a sharp decoupling of the world’s two largest economies.”

Investment, not consumer consumption, continues to drive economy

The dual-circulation policy has been integrated into China’s 14th five-year plan, covering 2021 to 2025. But this policy doesn’t represent any jarring change from past policy, as China has long sought to re-balance its economy to improve consumer consumption. Progress here has been slow — household consumption there was reported at only 40% in 2021, little improved from 36% in 2007. (Household consumption is all the things that people buy for personal use from toothbrushes to automobiles.) By comparison, advanced capitalist economies tend to have household consumption account for 60% to 70% of their economies. China will remain an investment-dependent economy for some time to come.

The funds necessary for China’s massive domestic investments don’t come simply from trade surpluses; they also come from depressed living standards. That means low wages for most Chinese and increased inequality.

“[T]he vast majority of China’s citizens still have a disposable income of less than 5,000 yuan per month, and over two-thirds of the population make substantially less,” according to the China Labor Bulletin, a a non-governmental organization based in Hong Kong that “supports and actively engages with the workers’ movement in China.” For comparison, 5,000 yuan equals US$686. And even that paltry amount is well above the minimum wage. The Bulletin report says, “The highest monthly minimum wage as of July 2020 was in Shanghai (2,480 yuan), which was roughly double the minimum wage in smaller cities in provinces such as Hunan, Hubei, Liaoning and Heilongjiang. In setting this wage, local governments are focused on industry concerns and local investment rather than on ensuring a liveable wage for workers, and employers likewise still find ways to avoid paying the minimum wage.” For comparison, 2,480 yuan equals US$340.

Chinese regulations mandate that each region should set its minimum wage at between 40 and 60 percent of the local average wage, but very few cities have ever reached that target, the Bulletin report says. “Moreover, the discrepancy between the average and the minimum wage has actually increased over the last decade as higher wages for the privileged few has pushed the average wage up and wages for the lowest-paid have stagnated. In many cities such as Guangzhou and Chongqing, the minimum wage is now less than 24 percent of the average wage, while in Beijing, which has some of the highest-paid employees in the country, it is just under 20 percent.”

Similar to advanced capitalist countries, inequality is worsening in China. “The annual average per capita disposable income of the richest 20 percent in China’s cities increased by nearly 34,000 yuan in the seven years from 2013 to 2019, while the disposable income of the poorest 20 percent in urban areas grew by just over 5,500 yuan during the same period,” the Bulletin report says. The report makes a damning conclusion familiar to those living in places with harsh inequality like the United States:

“A superficial glance at China’s major cities seems to show a reasonably affluent society: young, hard-working, middle-class families, determined to make a better life for themselves. This illusion was shattered however in late 2017 when the municipal government of Beijing embarked on a 40-day high-profile campaign to clean out the city’s shanty towns and evict the so-called ‘low-end population’ who produce, market, and deliver the goods, services and lifestyle products that Beijing’s middle class families aspire to have. The evictions revealed the harsh truth that the affluence of China’s cities depends almost entirely on the impoverishment of the underclass.”

There is no independent organization pushing against inequality. The All-China Federation of Trade Unions is the sole legal union confederation in China; independent unions are not tolerated. Although the ACFTU is tasked with protecting workers and sometimes stands up for them, overall it “has rarely been a staunch advocate for workers” and is “dedicated to ensuring ‘harmonious labour relations’ and smooth economic development for the nation.” Strikes are often carried out in defiance of the ACFTU but as a consequence tend to be localized and uncoordinated. The Bulletin has recorded 666 strikes thus far in 2022, roughly on pace with 2020 although down from 1,095 in 2021.

Development, but who is benefiting?

Who is enjoying the fruits of “smooth economic development”? China has 1,133 billionaires in 2022, up 75 from previous year, the most in the world and ahead of the U.S., according to the party newspaper Global Times. The paper celebrated this in its report, saying the high number of billionaires “underlined robust growth in various industries in China.”

Somehow that is not consistent with the construction of a socialist, egalitarian economy. Nor does it meet with disapproval from “think tanks” in the West that are dedicated to upholding and strengthening corporate domination.

Interestingly, separate papers recently issued by the Peterson Institute for International Economics and Citibank both predict further privatization in China, which, naturally, they approve. It’s good to remember here that although the corporate mass media routinely lies and passes off propaganda as news for popular audiences, those sources are truthful when the audience is big business; the bourgeoisie wants accurate information. (A nice example illustrating this is a general strike in Copenhagen in the late 1990s in which a key demand was a sixth week of mandatory paid vacation for Danish workers. I read not a word about it in general newspapers but there was daily coverage in the Dow Jones Newswire, an expensive service used by financiers, where I worked at the time.)

Although the state sector of the Chinese economy slightly increased this year, reversing a long trend of shrinkage, there seems little concern from capitalist boosters. The Peterson Institute, which has never seen a corporate-promoting so-called “free trade” agreement it didn’t like, declared that global commodity price increases and China’s property crisis were behind the “pause in the rise of the private sector.” It would be “simplistic and premature” to conclude 2022’s reverse is permanent, assuring its wealthy readers that “the drop in the previous private-sector advance should not be viewed as the start of a new trend of continuous decline, at least not yet.”

Nor are Citibank economists worried. A Citibank report similarly called the idea of a reversal of privatization “superficially attractive.” Rather, “support for private sector development is evident in a number of ways in recent years, from the effort to simplify the process of registering businesses to a new bankruptcy law and greater reliance on the court system to successfully adjudicate commercial disputes.” As to the “dual circulation” strategy, the bank notes that a fear that the U.S. might impose sanctions on China similar to those on Russia are driving China’s move toward self-reliance, and that reliance in turn will lead to reduced export opportunities for U.S., Germany, Japan, South Korea and Taiwan. That trend nonetheless dates back to the Trump administration’s moves against Beijing.

In contrast to continual forecasts in the corporate mass media predicting collapse for the Chinese economy, Citibank economists seem to believe China will be fine, in part due to the big trade agreement it signed in November 2020 with Asia-Pacific countries while subtly acknowledging growing critiques of runaway neoliberalism. “China’s engagement with the Regional Comprehensive Economic Partnership is a sign that even if the world is experiencing deglobalization, a growing regionalization might end up being the most likely replacement for the kind of globalization that now seems anachronistic,” the Citibank report says.

More state-owned enterprises would help Chinese workers

Corporate interests across the West would of course like more and faster privatization, as would the governments, especially the White House, that cater to those interests. But would that be a good idea? In contrast to standard discourse that mindlessly intones “private good, government bad,” when actual studies are conducted — naturally, only done by heterodox economists not interested in parroting propaganda for public consumption — a much different picture arises.

A study published in the March 2022 issue of Review of Radical Political Economics concludes that “a higher share of state-owned enterprises is favorable to long-run growth and tends to offset the adverse effect of economic downturns on the regional level.” The paper’s authors, Hao Qi and David M. Kotz, found that China’s state-owned enterprises (SOEs) in 2015 had average wages 65% higher than private enterprises; most SOE employees have access to social security, while only a few private-enterprise employees have access to it; and SOE working hours are less than in the private sector. (These findings should be no surprise to anybody familiar with conditions in China’s many sweatshops.)

SOEs are not just good for employees; they are better for the economy as well. The authors write:

“SOEs have played a pro-growth role in the Chinese economy in several ways: first, SOEs play the role of an economic stabilizer, offsetting the adverse effect of economic downturns; second, SOEs promote technical progress by carrying out investments in riskier technical areas. In addition, SOEs have established a high-road approach to treating workers by providing workers with a living wage, which is crucial for the reproduction of labor power. We suggest that this high-road approach has a potential pro-growth role, which is favorable for the transition of the Chinese economy to a more sustainable growth model in the near future. SOEs appear to be less profitable than private enterprises; however, the higher profitability of private enterprises to a large extent results from the intense exploitation of their workers. If the profits of private enterprises are invested, the result is growth—but profits of private enterprises also go to dividends and non-productive uses such as speculative purchase of existing assets.”

The low wages paid by the private sector — which gives the appearance of those enterprises being more efficient — weakens the Chinese economy. An over-reliance on investment and exports are also de-stabilizing factors, the authors write.

“With low wages, the consumption demand of the economy has been insufficient, making the economy vulnerable to overinvestment, trade conflicts, and external shocks from the global economy. Thus, moving to a more sustainable growth model requires steadily increasing wages and consumption in aggregate demand and moving away from reliance on investments and exports. It is easier for SOEs to accept higher wages given their high-road approach to treating workers. Thus, SOEs can be the bridge that connects the old and a more sustainable new economic model.”

Noting that most economic literature “fails to consider that private enterprises treat their workers badly,” the role of SOEs in stabilizing economic growth is ignored. The study by Dr. Qi and Dr. Kotz concludes that “privatization would be harmful to economic growth in the long run. In our view, privatization would destroy a central pillar for China to be able to achieve sound economic growth under unfavorable conditions.”

Too much reliance on private sector counter-productive

Another heterodox economist, Michael Roberts, also argues that privatization would be counter-productive. “[I]t is China’s large capitalist sector that threatens China’s future prosperity,” he writes. Debt and rising housing prices are products of a reliance on the private sector:

“The real problem is that in the last ten years (and even before) the Chinese leaders have allowed a massive expansion of unproductive and speculative investment by the capitalist sector of the economy. In the drive to build enough houses and infrastructure for the sharply rising urban population, central and local governments left the job to private developers. Instead of building houses for rent, they opted for the ‘free market’ solution of private developers building for sale. Beijing wanted houses and local officials wanted revenue. The capitalist housing projects helped deliver both. But the result was a huge rise in house prices in the major cities and a massive expansion of debt. Indeed, the real estate sector has now reached over 20% of China’s GDP.”

There will not be a financial crash in China, Mr. Roberts writes, because the country’s big banks are in state hands and the government can order them to take whatever measures are necessary to stabilize the financial system, tools not available elsewhere. Nonetheless, the CPC’s “common prosperity” project has been launched due to the pandemic exposing “huge inequalities to the general public,” with China’s billionaires reaping benefits while ordinary people suffer lockdowns. The share of personal wealth for China’s billionaires doubled from 7% in 2019 to 15% of GDP in 2021, Mr. Roberts reports. What China needs, he writes, is more planning and accountability:

“These zig zags are wasteful and inefficient. They happen because China’s leadership is not accountable to its working people; there are no organs of worker democracy. There is no democratic planning. Only the 100 million CP members have a say in China’s economic future, and that is really only among the top. Far from the answer to China’s mini-crisis requiring more ‘liberalising’ reforms towards capitalism, China needs to reverse the expansion of the private sector and introduce more effective plans for state investment, but this time with the democratic participation of the Chinese people in the process. Otherwise, the aims of the leadership for ‘common prosperity’ will be just talk.”

Before and during President Xi’s reign, privatization and reliance on exports have increased. The reforms inaugurated in the Deng era and continuing into the 2000s brought forth special economic zones to draw in foreign direct investment (FDI), job security guarantees replaced with contracts, welfare provisions scrapped, privatizations, state-run companies converted to state-owned enterprises expected to maximize profits, 50 million laid off and an intensification of work. Fifty millions layoffs! The government has sought to retain the “commanding heights” of the economy while divesting itself of smaller and medium-sized enterprises through closings and bankruptcies, a policy begun in the late 1990s of “grasping the large and letting the small go.”

Privatization and layoffs on China’s path toward capitalism

A couple of numbers illustrate how far-reaching China’s move toward capitalism has been. As late as the end of 2010, among China’s 100 largest corporations, 78% of aggregate market value was held by SOEs vs. 8% for the private sector. By June 30, 2022, it was 42% for SOEs and 45% for the private sector. That’s just the largest enterprises. When we look at the Chinese economy as a whole, SOEs accounted for about 25% of the economy in 2021, according to a source that wishes that total to be far lower. Finally, China’s debt is estimated at 350% of its gross domestic product, an extraordinarily high sum even if that is not an immediate problem given the country’s large trade surpluses.

China’s winding road toward capitalism needn’t be seen as intentional or the product of any cabal. A strong critic of China from a Left perspective, Ralf Ruckus, who is highly critical of what he calls China’s definitive return to capitalism, nonetheless offers this explanation: “This transition was not the result of a detailed master plan or blueprint but of a series of — often experimental — reform steps taken to improve the country’s economic performance, save the socialist system, and stabilize CCP rule. This is the meaning of the phrase ‘crossing the river by feeling the stones’ that Deng Xiaoping allegedly used to describe his understanding of the course of reform.”

Of course, none of us outside the party leadership, and certainly those of us outside the country, can know for sure what the long-term intentions might be. Our guides are the communiqués following important party meetings, the speeches of party leaders and, most importantly, the policies carried out and the concrete results of those policies.

President Xi had begun taking steps to reign in certain Chinese capitalists and has more frequently talked about Marxism, even before last month’s party gatherings. Whether these are the opening moves of a future reversal back toward socialism or simply an assertion of party rule will not be known for some time. Even if it were true that the moves toward capitalism since the 1990s are intended to be a temporary expedient, as some pro-China Leftists in the West like to argue, becoming more deeply entangled in markets and the world capitalist system carries its own momentum, a drift not at all easy to check. There are industrial and party interests that favor the path China has been on since the 1990s, and those interests represent a significant social force that would resist structural moves toward socialism.

Whatever long-term intentions the party leadership may have, its short-term tactical policies are likely to be driven by a need to counteract U.S.-led aggression against it, which implies a high likelihood of increased diversion of internal resources toward a continuing military buildup. Increased tensions between Beijing and Washington are not in the interests of working people on either side of the Pacific. The U.S. maintains its global hegemony through its stranglehold on the global financial system even more than through military strength, and that domination, while eroding, remains far from any danger of being toppled. China, then, will surely be focused on internal development for some time to come. That development is increasingly capitalist-based, a direction that is fraught with contradictions and dangers.

In the former Soviet bloc, socialism came to be seen as simply expropriation and building industry. But placing production in public or state hands is merely a pre-condition, not the actual content, of socialism. Moreover, China is moving toward, not away, from privatization. A fuller definition of socialism mandates that democracy be extended to economic and political matters, beyond what is possible in capitalism. Socialism can be defined as a system in which production is geared toward human need rather than private profit for a few; where everybody is entitled to have a say in what is produced, how it is produced and how it is distributed; that these collective decisions are made in the context of the broader community and in quantities planned to meet needs; political decision-making is the hands of the communities affected; and quality health care, food, shelter and education are human rights. There is no class, vanguard or other group that stands above society, arrogating decision-making, wealth and/or privileges to itself.

It is easy enough to point out that such conditions are far from reality in any capitalist country. But such conditions are far from reality in China as well. The Chinese nation must develop within a world capitalist system deeply hostile to any attempt at building an alternative, has its own strong cultural traditions, and must find its own path toward development while navigating a complex set of economic pressures. Nor can any expectation that any socialist path can be easy or short be realistic, as history as amply proven. At the same time we shouldn’t mechanically make assumptions because of the label a country’s ruling party uses to name itself. Better to analyze with a clear eye.

(Pete Dolack writes the Systemic Disorder blog and has been an activist with several groups. His first book, ‘It’s Not Over: Learning From the Socialist Experiment’, is available from Zero Books and his second book, ‘What Do We Need Bosses For?’, is forthcoming from Autonomedia. Courtesy: Systemic Disorder blog.)