Two big things happened in the month of November in El Salvador, one of Latin America’s smallest countries. First, on Nov 7, the country’s Vice President Félix Ulloa announced that China had offered to buy up all $21 billion of El Salvador’s distressed sovereign debt.

“China has offered to buy all our debt, but we have to be careful,” Ulloa told Bloomberg on the sidelines of an event in Madrid. “We are not going to sell to the first bidder, we have to see what the conditions are like first.”

If China were to actually do this, it would represent a watershed moment for the region. As Bloomberg noted, “anything close to that by a leading sovereign creditor hasn’t happened since the late 1980s, when the US moved to bail out Latin America.” [But what Bloomberg failed to mention is: that bailout was, in large part, an indirect rescue of Wall Street’s finest, many of which had invested heavily in the sovereign debt of LatAm economies. As even the Federal Reserve admits in its official account of the debt crisis, by the time the crisis broke, in 1982, “the nine largest US money-center banks held Latin American debt amounting to 176 percent of their capital; their total LDC debt was nearly 290 percent of capital.”]

However, shortly after Ulloa made those remarks in Madrid, they were rapidly rebutted by other Salvadorian government officials. Ulloa himself later said that his comments had been taken out of context.

But then three days later, on November 10, the second big thing happened: Salvadoran President Nayib Bukele announced on Twitter that his country “will sign a free-trade agreement with China” after meeting with Beijing’s ambassador. Before making that announcement, his government cancelled a pre-existing free trade agreement with Taiwan. Shortly following the announcement, China’s Commerce Ministry said the two countries plan to conclude the agreement as swiftly as possible.

“Since the establishment of bilateral ties, the two sides have reached important consensus at the head-of-state level to promote deepening all areas of trade and the economy and obtain rich results,” said China’s Commerce Ministry on Thursday. “On this basis, to delve further into the potential of two-way cooperation … China and El Salvador wish to start processes related to free-trade talks as soon as possible and make our utmost effort to finish those processes as soon as possible.”

Close to Default

The announcement comes as El Salvador is looking to restructure its external debt to avoid falling into default. The Salvadorian government has around $670 million in bonds due on January 24. That debt is currently rated CCC+ by S&P Global Ratings, seven notches below investment grade. Fitch has already warned investors to expect some form of default in January.

The country is nursing significant losses from the government’s madcap bet on bitcoin late last year when the cryptocurrency was close to its record top. Bukele made bitcoin legal tender in September 2021, just two months before the collapse began, and invested an undisclosed sum of public funds in the cryptocurrency. Since then bitcoins have lost 67% of their value. Perhaps it’s no coincidence that Bukele announced the free trade agreement with China on the same day that FTX declared insolvency. From El País:

It is not known with certainty how much Bukele has invested in bitcoin, but based on the announcements he has made on social networks, it is estimated that the loss for public finances so far is around $70 million, says Ricardo Castaneda, economist at the Institute Central American Fiscal Studies (ICEFI). “This has a very high opportunity cost for a country like El Salvador, because it represents, for example, almost the total budget of the Ministry of Agriculture in a country where half the population suffers from food insecurity,” the economist points out, on the phone, from San Salvador. The smallest country in Central America, El Salvador, has a poverty rate of 26%, according to the World Bank.

It is against this backdrop that China has decided to enter the fray. The move will almost certainly raise hackles in the US, which is currently El Salvador’s largest trading partner and is already leery about China’s growing influence in its own “backyard”. El Salvador may be a relatively small fish, with a population of 6.5 million and a GDP of just over $30 billion, but its decision to cosy up to China could be hugely significant, for two key reasons.

First, precisely because El Salvador is such a small country.

And what’s more, it is in the US’ direct neighborhood and its economy is totally dollarized. Yet the Bukele government still felt emboldened enough to scrap its established trade agreement with Taiwan — the US’ strategic outpost in East Asia — in order to sign a trade agreement with the US’s biggest geopolitical rival, China. There are now four countries in Central America that have scrapped their trade agreements with Taiwan in recent years, the other three being Costa Rica, Panama and Nicaragua.

Bukele may feel that he can get away with such a provocative step since he is far and away the most popular national leader on the American continent, consistently earning approval ratings of around 90%. In his fourth year in office, Bukele recently announced plans to seek re-election in 2024, despite the country’s constitution barring presidents from having consecutive terms.

Bukele’s overwhelming popularity is largely due to his government’s relentless, often brutal crackdown on the 18th Street and Mara Salvatrucha streets gangs that have made life insufferable for everyday Salvadorians and the country more or less ungovernable. Since Nayib Bukele became president in 2019, the number of homicides has more or less halved, though an explosion of violence in March this year forced the government to double down on the crackdown.

Bukele’s decision to stand for re-election set him on collision course with Washington, which already sanctioned several government officials last year. The announced free trade agreement with China is almost certain to escalate tensions. As the Salvadorian economist Luis Mondero told The Guardian, if Bukele were to bite the bullet and accept debt financing from China, it “would represent a total realignment of El Salvadoran foreign policy” away from the US and closer to China, Russia and Turkey.

Second, because it forms part of a much broader trend that is radically changing the economic and geopolitical contours of Latin America.

China already has free trade deals with Chile, Peru and Costa Rica and is negotiating future agreements with five other Latin American states.

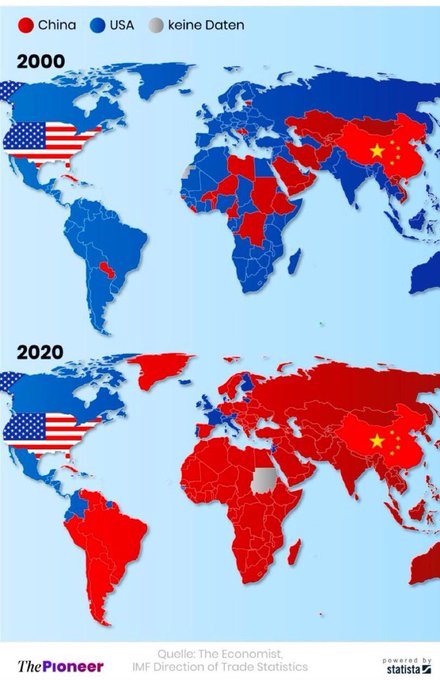

China has massively expanded its influence and economic footprint in the region. In the first 20 years of this century, China’s trade with Latin America and Caribbean grew 26-fold, from $12 billion to $315 billion. During that time, China surpassed the US as the larger trading partner of the two for most countries in Asia, Africa and South America. In the latter region only three countries — Colombia, Ecuador and Suriname — continue to trade more with the US than China.

As a trading power, the US holds complete sway over Central America, at least for now. And pound for pound, it is still Latin America and the Caribbean’s largest trading partner. But that is predominantly due to its huge trade flows with Mexico, which account for a whopping 71% of all US-LatAm trade. As Reuters reported in June, if you take Mexico out of the equation, China has already overtaken the US as Latin America’s largest trading partner. Excluding Mexico, total trade flows — i.e., imports and exports — between China and Latin America reached $247 billion last year, far in excess of the US’ $173 billion.

This has happened for a variety of reasons. China’s rise in the region coincided almost perfectly with the Global War on Terror. As Washington shifted its attention and resources away from its immediate neighborhood to the Middle East, where it squandered trillions of dollars spreading mayhem and death and breeding a whole new generation of terrorists, China began snapping up Latin American resources, in particular food, petroleum and strategic minerals like lithium.

Governments across the region, from Brazil to Venezuela, to Ecuador and Argentina, took a leftward turn and began working together across multiple fora. The commodity supercycle was born. Since then China has become the most important trading partner for nine countries in the region (Paraguay, Brazil, Chile, Argentina, Peru, Venezuela, Cuba, Uruguay and Panama). In total, 22 of the region’s 33 countries have signed up to China’s Belt and Road Initiative, including four in Central America (Nicaragua, Costa Rica, Panama and El Salvador).

Unlike the US, China does not tend to meddle in internal politics in the region, or at least hasn’t until now. That may change if more and more countries begin to default on Chinese loans, as already happened in Ecuador in 2020. The US, apparently with zero self awareness, has made no bones about accusing China of deploying “debt trap diplomacy”. But for the moment the Chinese are happy to let the money do the talking — and so too are many Latin American governments.

And the money is talking loud and clear. In 2020, the region attracted $94 billion of Chinese investment. That is still less than half the $252 billion invested by US companies. In 2021, China’s trade volume with Latin America exploded year over year by a whopping 40%, partly because the region’s economy was rapidly recovering following the sharp fall off in activity in 2020. If anything, Beijing’s inroads into the region, including, notably, Mexico, are accelerating, according to data published earlier this month by Janes IntelTrak’s Belt & Road Monitor. From Forbes:

With one crisis after the next in South America, coupled with Washington largely ostracizing it as a solution to its Asia-centric supply chain woes, Chinese capital and corporate brands are making inroads like never before. If the post-World War II era in Latin America was the era of U.S. corporate power in countries like Brazil (GM and Coca-Cola), the post-2000 era is set to be won by the Chinese (Polestars and TikTok)…

The election of Luiz Inacio Lula da Silva likely means even closer ties to China as Lula will look to drum up business and investment to get production up quickly, and inflation and interest rates down.

In the last two weeks ending October 31, Latin America saw the highest number of Belt and Road Initiative (BRI) projects. These are largely Chinese state-funded development projects in infrastructure. Over that two-week period, China dished out around $5.3 billion in fresh capital, and Mexico got almost half of it — a $2.16 billion railroad project in Guadalajara.

On October 19, a 30-year operating license was given by Mexico’s Federal Telecommunications Institute to China Unicom — a state-owned telecommunications company that was banned from doing business in the U.S. over spying concerns in January 2022. The license gives China Unicom permission to provide services in the fixed and mobile telephone markets in Mexico.

Jiangsu Lixing General Steel Ball Company, an automotive parts manufacturer, said on October 24 that it would partner with American Industries Group (AIG), a privately-owned Mexican company, to establish a precision steel ball manufacturing plant in the country.

And Shanghai Carthane Company announced on October 27 that it would establish a manufacturing plant in Mexico to produce automotive polyurethane shock-absorbing components.

Chinese companies are also funding huge infrastructure projects. A case in point is the $3 billion invested by an alliance of Chinese state-owned companies, including Cosco Shipping, in the Chancay Port in Peru. Located 50 miles north of Lima, it will be the first Latin American port managed entirely by Chinese capital and is expected to become a vital hub for trade in the South Pacific. Other projects include lithium mines in the so-called “lithium triangle” and the so-called “interoceanic” railway project which, if built, will connect Peru’s Pacific coastline with Brazil’s Atlantic seaboard.

Lastly, it would be remiss to write a post on China’s growing influence in Latin America without mentioning the BRICS. As it currently stands, the BRICS grouping accounts for over 40% of the world’s population and over 25% of global GDP. But it is about to get a lot bigger. Following the grouping’s decision earlier this year to allow new members, more than a dozen countries have applied to join, according to Russian Foreign Minister Sergei Lavrov. They include Latin America’s third largest economy, Argentina, and Nicaragua.

The newly enlarged grouping would not only have greater economic clout; it would also control an even larger slice of the world’s natural resources — including 45% of known global oil reserves and over 60% of all known global gas reserves.

This is all happening at a time that both the US and the EU are refocusing their attentions on Latin America. As I noted in August, the region is back on the grand chessboard, as the race for resources and strategic influence intensifies in the new Cold War. For the moment, that race is being won quite handily by China.

(Nick Corbishley writes about financial, economic and political trends and developments in Europe and Latin America. Article courtesy: Naked Capitalism, an American financial news and analysis blog that “chronicles the large scale, concerted campaign to reduce the bargaining power and pay of ordinary workers relative to investors and elite technocrats”.)