External Accounts Situation

We begin our discussion of the Union Budget 2023–24 with a brief discussion of India’s external accounts situation. That this is an important aspect of our economy is obvious from the situation of our neighbouring countries, Sri Lanka and Pakistan, both of whose economies are in serious crisis because they are entrapped in an external debt crisis.

The Economic Survey devotes a full chapter to our external sector, and admits that “India’s external sector has been buffeted by shocks and uncertainties” arising from a volatile international situation, but says that there is nothing to worry, as “fortified shock absorbers of India’s external sector are in place to cushion the global headwinds …” However, the FM’s budget speech does not contain even a single line as regards the external accounts situation of our country!

This is simply amazing, as even though the Finance Minister is silent about it, a key aspect of our economic policy making is tackling our foreign exchange crisis — which is gradually worsening.

Let us briefly explain. As of end-September 2022, India’s external debt had gone up to $617 billion billion. That is huge — our country is one of the world’s most indebted countries. In contrast, India’s foreign exchange (forex) reserves stood at $532.66 billion as at end-September 2022 — more than $80 bn less. If we compare these figures to the corresponding figures of last year, India’s external debt in end-September 2021 was $593.1 billion, while our foreign exchange reserves exceeded $600 billion. Clearly, there is a significant change, for the worse.

The Economic Survey 2022–23 expresses confidence that our forex reserves are “formidable”. However, the foreign exchange reserves of a country like India do not represent the foreign exchange earnings of that country. They are merely the total foreign monies held by the government and central bank of India, including all the foreign capital inflows that have come into the country. This implies that if foreign investors start withdrawing their money from the country, the foreign exchange reserves will fall.

However, the statistics related to the Indian economy indicate that our vulnerabilities on external account are worsening. There are two grounds for this.

Worsening Current Account Deficit

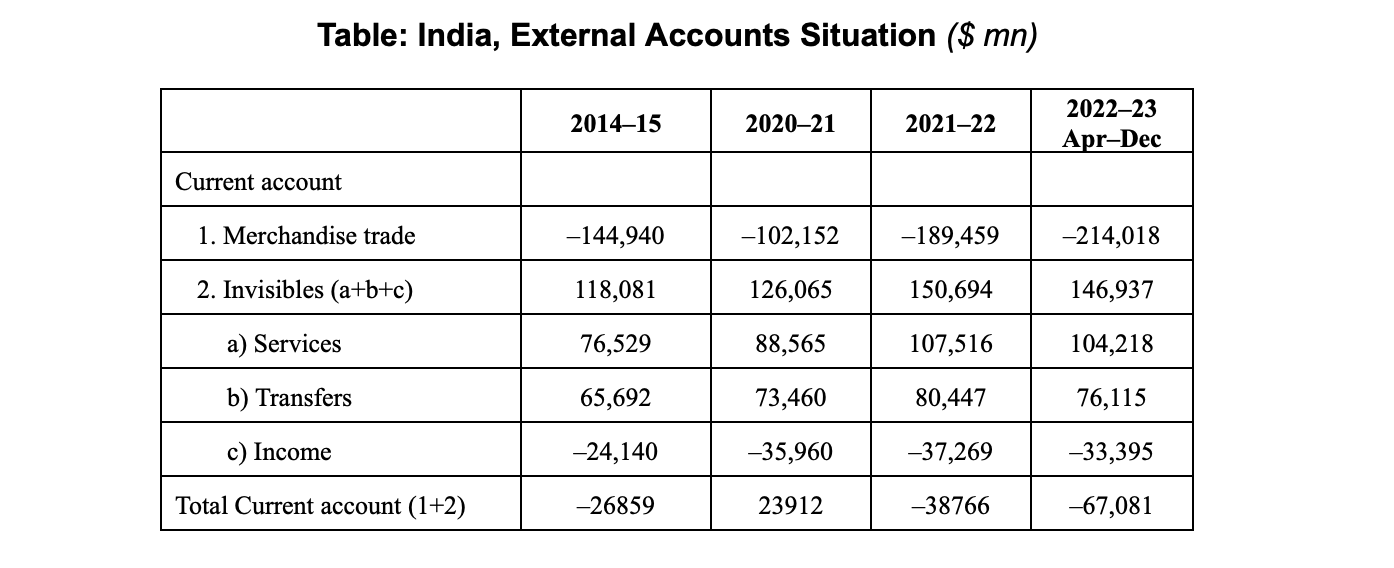

The merchandise trade deficit is rapidly worsening. It was already bad in 2021–22, at $189 billion. This financial year, it risen so sharply that during the first three quarters (April–Dec 2022), it was more than that for the corresponding period last year by as much as 60% ($214 bn, as against $135 bn in April–Dec 2021). The main reason for this huge rise in trade deficit is our rising imports. But an even more worrying sign is — non-oil imports constituted 74.5% of our total imports for April–Dec 2021, and this figure has remained high at 70.3% for April–Dec 2022 also.[1] As share of total imports, non-oil imports went up from 45 per cent in 2021–22 to more than 70 per cent by the second and third quarters of 2022.

This is not good news for our external trade balance — the huge non-oil imports suggests that the slogan of Atmanirbhar Bharat has remained an empty slogan, and that imports are replacing domestic production. This not only affects our domestic production and employment, but is indicative that our external trade deficit is going to worsen as the domestic economy is becoming import dependent.

The merchandise trade deficit was traditionally balanced by trade in services, which was a major source of foreign exchange for the economy. Till 2020–21, it covered as much as 86% of our merchandise trade deficit, but after that it has sharply fallen — to 58% for April–Dec 2021 and only 46% for April–Dec 2022. Consequently, our overall goods and services trade balance has sharply deteriorated, rising from –13.6 billion in 2020–21 to –$118 bn in the first 9 months of 2022–23. That is a huge jump indeed!

The situation is made worse by rising outward payments on the “income” or “primary income” account, the major part of which is profits taken out by foreign capital (called investment income). This has also been steadily going up — from $24 billion in 2014–15 to $37 billion in 2021–22 to $33.4 billion in the first 3 quarters of FY 2022–23 (this was $28.9 bn in April–Dec 2021).

The biggest saviour of our current account situation is the steady flow of remittances from Indian workers abroad, which constitutes the overwhelming part of what are called “Transfers”. Transfers have indeed increased steadily, from $73.5 bn in 2020–21 to $80.4 bn in 2021–22 to $76.1 bn in April–Dec 2022–23. But this has not been enough to counter the growing deficits on the other two elements (see Table 1).[2]

The result is that the current account, which was briefly in surplus for the second quarter of 2020, has been worsening ever since. The deficit was $25.3 bn for April–Dec 2021, and has nearly tripled to $67 bn for April–Dec 2022. As a percentage of GDP, the CAD was 1.1% of GDP in April–Dec 2021, and has gone up to 2.7% of the GDP in April–Dec 2022.

Despite these figures released by the government, the Economic Survey hides its head in the sand and claims that concerns over the current account deficit and its financing have ebbed as the year rolled on.

Rising Trade Deficit Despite Depreciating Rupee

An even bigger cause for concern is that the trade deficit and CAD are rising despite a sharp fall in the exchange value of the Indian rupee as compared to the dollar. The Indian rupee depreciated over 11% in 2022 against the dollar — its poorest performance since 2013. It was the worst performer amongst all Asian currencies. The rupee closed 2022 at 82.61 to the US dollar, down from 74.29 at end of 2021.[3] However, this fall has not helped improve the trade deficit. That is probably because as the RBI itself admits, an important reason for our trade deficit is the lacklustre performance of our exports, because of the slowing down of the world economy. All indications are that this global slowdown is going to continue in the near future. It follows therefore that the merchandise trade balance will continue to remain as adverse as in the second quarter of 2022–23 for quite some time.

A falling rupee and a worsening CAD is just the crisis needed for speculators to trigger a fall in our reserves and send the economy into a severe crisis. As per the RBI, India’s forex reserves fell by $70 billion in 2022 to stand at $562.9 billion in end-December 2022.[4]

The current turmoil in Indian stock markets, and specifically the concerns about Adani group enterprises, will not be helpful in attracting or retaining footloose foreign capital at least in the short term. This will make it even more difficult to finance the CAD.

So, the Economic Survey’s optimism regarding our external accounts is not grounded in facts, there is actually plenty to worry, the optimism is mere bravado.

Rather than confront this crisis facing the Indian economy, the Modi Government is meekly bowing to the dictates of foreign capital. This is the reason why it is permitting giant foreign corporations to take control of the most crucial sectors of the economy, like agriculture and retail. This is going to adversely impact the livelihoods of crores of people who depend for their livelihoods on these sectors. Even more disastrous for the economy and the people is Modi Government’s push to gradually privatise India’s public sector insurance companies and banks, and even allow foreign corporations to take control of these institutions — this will endanger the safety of the huge amount of people’s savings deposited with these institutions, apart from adversely affecting national development.

This is also the reason why the Indian government refused to increase its spending and give reasonable relief to the people even at the peak of the pandemic crisis.

It is therefore no cause for surprise that the FM remained silent on our country’s external accounts situation in her budget speech.

References

1. “Developments in India’s Balance of Payments during the Third Quarter (October–December) of 2022–23”, 31 March 2023, https://rbidocs.rbi.org.in; “India’s Foreign Trade: December 2022”, 16 January 2023, https://pib.gov.in; “Handbook of Statistics on Indian Economy, 2021–22, Table 128: India’s Overall Balance of Payments–US Dollar”, 15 September 2022, RBI publication, https://www.rbi.org.in; “Developments in India’s Balance of Payments during the Second Quarter (July–September) of 2022–23”, 29 December 2022, RBI, https://www.rbi.org.in.

2. Ibid.

3. “Rupee Falls Over 11% in 2022 — Worst Since 2013”, 1 January 2023, https://economictimes.indiatimes.com.

4. “Forex Reserves at $562.9 bn; Fall by $70 bn in 2022”, 9 January 2023, https://currentaffairs.adda247.com.