Banks have written off bad loans worth Rs 10,09,511 crore during the last five fiscals, Union Finance Minister Nirmala Sitharaman told the Rajya Sabha on December 13.

The banks recovered an aggregate amount of Rs 6,59,596 crore, including the recovery of Rs 1,32,036 crore from the written-off loan accounts, during the said period, she said.

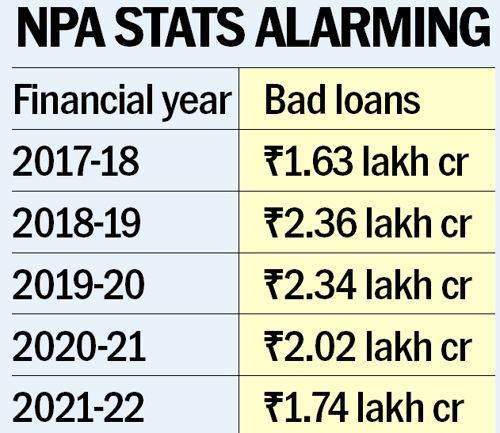

The maximum amount written off in a year from 2017-18 till 2021-22 was Rs 2.36 lakh crore in the pre-Covid 2018-19 fiscal, followed by Rs 2.34 lakh crore in 2019-20, Rs 2.02 lakh crore in 2020-21 and Rs 1.74 lakh crore in 2021-22.

In contrast, recoveries in cash were measly. The maximum amount recovered in a year was Rs 33,534 crore in 2021-22, followed by about Rs 30,000 crore each in 2019-20 and 2020-21. “As the borrowers of written-off loans continue to be liable for repayment and the process of recovery of dues continues. Write-off does not benefit the borrower,” said Sitharaman. As per inputs received from public sector banks, staff accountability in respect of NPAs had been fixed against 3,312 bank officials of AGM and above rank during the same period, and suitable punitive actions had been taken commensurate with their lapses.

Asked about the details of accounts in which loans worth Rs 10 crore and above were written off and the names of the top 25 defaulters, the RBI informed the Centre that under the provisions of Section 45E of the RBI Act, it was prohibited from disclosing borrower-wise credit information.

Sitharaman said NPAs were removed from banks’ balance sheets by way of write-off.

❈ ❈ ❈

Another article in fortuneindia.com, “Banks Wrote Off ₹10 Lakh Cr in Last 5 Yrs: FM”, adds:

In a separate reply on the non-performing assets of the public sector banks, minister of state in the finance ministry Bhagwat Karad said public sector banks’ (PSB) NPAs have dipped from Rs 8,95,601 crore as on March 2018 to ₹5,40,958 crore as on March 2022, primarily due to multiple factors, including NPA write-offs.