by the Wire Staff, P. Chidambaram, Ravi Nair

Article 1

Modi’s Rs 20 Lakh Crore Package Will Likely Have Fiscal Cost of Less Than Rs 2.5 Lakh Crore

The Wire Analysis, 17 May 2020

The fine print of Prime Minister Narendra Modi’s Atmanirbhar Bharat Abhiyan economic package, India’s economic response to the COVID-19 disaster, was made clear in its entirety on Sunday morning when finance minister Nirmala Sitharaman announced details of the final part of the plan.

The overall package consists of three primary components – a set of measures taken by the government before Modi’s speech on May 12, the Reserve Bank of India’s liquidity measures over the last two months and the five tranches announced by Nirmala Sitharaman over the last few days.

By the government’s calculations, as shown by the table below, this comes out to Rs 20.97 lakh crore.

Even though the announcements made are worth over Rs 20 lakh crore, the actual cash outlay by the government this year and the impact on the fiscal deficit will be far less. This is because many of the government’s proposals are credit-focused or are aimed at easing liquidity concerns for many affected sectors. In some of these cases, any costs incurred will be initially covered through banks or other financial institutions and thus not result in actual cash outgo by the Centre.

Other initiatives, particularly those made in Tranche 3, may only be ramped up over an unknown period of time and therefore may not be fully relevant for the fiscal deficit calculations this year.

Accordingly, The Wire’s analysis places the additional and direct fiscal spending as a result of the Atmanirbhar Bharat Abhiyan economic package at likely less than Rs 2.5 lakh crore. As noted above, it is difficult to hone in on an exact figure as some of the spending will depend upon on the Centre’s pace of implementation and others on how many takers there are for certain programmes.

Nevertheless, the fiscal cost this financial year will likely be a little over 10% of the overall Rs 20 lakh crore package and a little over 1% of India’s GDP (FY’20 RE).

The table below gives a range of broader fiscal impact estimates that have been put out by a number of economists and market experts (Care Ratings, Emkay, SBI Research, HSBC India).

The higher range is nearly Rs 2.40 lakh crore, which includes less conservative calculations put out by a few experts. The higher numbers take into account the fiscal damage of some tax-related measures — SBI Research says the TDS/TCS reductions, for example, will have a Rs 25,000 crore impact — or assume that certain proposals will be fully implemented and their announced amounts spent this fiscal year.

On the lower range, we have estimates like that of Barclays’s chief India economist, Rahul Bajoria, chief India economist at Barclays, estimated that the actual fiscal impact of the announcements made over the last five days is Rs 1.5 lakh crore.

“…five tranches provide for Rs 10 lakh crore. The actual outflow from the Budget is not clear. It looks like that there could be Rs 75,000 -Rs 80,000 crore which could go immediately while the Tranche Three package of Rs 1.5 lakh crore would be provided for over a period of time and not immediately as the targets are fairly long term and it is not clear if organizations like NABARD would be playing a role,” Care Ratings said in a statement on Sunday afternoon.

| Economic Package Component | Announced Amount (Rs cr) | Estimated Fiscal Impact (Rs cr) |

| Earlier Stimulus Measures | ||

| Revenue lost due to tax concessions since March 22 (i) | 7,800 | |

| Pradhan Mantri Garib Kalyan Package (ii) | 1,70,000 | |

| PM’s announcement for health sector (iii) | 15,000 | |

| Total (i + ii + iii) | 1,92,000 | 85,695 to 95,800 |

| RBI’s Measures (Actual) | 8,01,603 | None |

| Tranche 1 (MSME + NBFC + Power) | 5,94,550 | 16,500 to 55,000 |

| Tranche 2 (Migrants, KCC, Nabard, MUDRA etc) | 3,10,000 | 5000 to 14,750 |

| Tranche 3 (Agriculture) | 1,50,000 | 0 to 30,000 |

| Tranche 4 + 5 | 48,100 | 48,100 |

| Total | 20,97,053 | 1,65,400 to 2,43,650 |

◆◆◆

Article 2

If There Is No Additional Borrowing, There Can Be No Additional Expenditure, No Fiscal Stimulus

P. Chidambaram, 17 May 2020

In Budget 2020-21, the Central government planned to spend Rs 30,42,230 crore in the current year. The shortfall on the revenue side would be financed by borrowing Rs 7,96,337 crore. This was the budgeted fiscal deficit, equivalent to 3.5 per cent of GDP.

Coronavirus changed all those calculations. It was evident to every economist that the borrowing could not be limited to Rs 7,96,337 crore, India must borrow more; only the government was in denial. On May 8, the government reluctantly admitted that it will borrow an additional amount of Rs 4.2 lakh crore taking the total borrowing to about Rs 12 lakh crore. The fiscal deficit (assuming no change in the estimate of GDP) would be 5.3 per cent.

Mere Gap-filling

I had pointed out that the additional borrowing would be a fiscal stimulus only if it was used to provide cash and other forms of support to the poorest families at the bottom half of the population and to re-start the completely stalled economy. Worryingly, I hear that the additional amount of Rs 4.2 lakh crore will be used for ‘gap filling’. The government expects to take a big hit on estimated tax revenues and proceeds of disinvestment. If the ‘gap’ has been estimated at about Rs 4.2 lakh crore, the additional borrowing will fill that ‘gap’. This is unavoidable, but the amount of Rs 4.2 lakh crore certainly cannot be counted as a fiscal stimulus.

Look at a simple statement of accounts:

There is no clarity whether the government will make cuts in other items of expenditure. The cuts announced so far will save the government Rs 41,490 crore and will be available for Covid-19-related expenditure. That expenditure will only restore the original level of expenditure and, therefore, will not amount to a fiscal stimulus.

Liquidity not Fiscal Stimulus

I suspect the government will count the mis-labelled Rs 1.7 lakh crore package announced on March 25 as a fiscal stimulus. Actually, the additionality was only Rs 60,000 crore in cash transfer plus Rs 40,000 crore being the value of the grain (not budgeted earlier). We can therefore count Rs 1 lakh crore as a fiscal stimulus.

I also suspect the government will count the RBI’s steps to provide additional liquidity as a fiscal stimulus. To confuse liquidity with expenditure is conceptual confusion. Liquidity works on the supply side, fiscal stimulus is needed for the demand side. Be that as it may, the RBI has provided additional liquidity support of Rs 5.24 lakh crore since March 27; in turn, the banks have parked with the RBI an additional about Rs 4.14 lakh crore since that date! By stretching the argument in favour of the government, if the additional liquidity translated into additional credit that carried a subsidised interest rate or is written off, perhaps the interest subsidy or written-off amount can be counted as fiscal stimulus. All that is in the realm of conjecture. Besides, outstanding bank credit has fallen from Rs 103.8 lakh crore on March 25 to Rs 102 lakh crore today.

On May 12, the Prime Minister grabbed the headline with the announcement of a Rs 20 lakh crore Economic Stimulus Package — but left the page blank! Beginning May 13, the Finance Minister started giving out the ‘details’ of the package. On analysing the first tranche, and giving a wide berth to the government, I concluded that Rs 3,60,000 crore may be the additional expenditure. On similar analysis, the second tranche yielded a figure of Rs 5,000 crore and the third, regretfully, nothing clear.

Expenditure sans Borrowing?

All these numbers, I am afraid, miss the central issue. Additional expenditure is possible only if there are additional revenues/resources. If not, we are stuck with the budgeted expenditure of Rs 30,42,230 crore. On additional revenues/resources, the government is ominously silent.

Let me state categorically, if there is no additional borrowing, there can be no additional expenditure and, logically, no fiscal stimulus. All over the world, additional borrowing is the key to fiscal stimulus: borrow more and spend more, and if the borrowing reached an uncomfortable level, monetise part of the additional borrowing/deficit, that is, print money.

Absent additional borrowing, there will be no fiscal stimulus to stimulate demand in the economy. The Rs 20 lakh crore will be another jumla. We will be self-reliant (Atma Nirbhar) in jumlas.

(P. Chidambaram is a former Finance Minister of the Government of India. This article has been slightly edited for reasons of space. Article courtesy: The Indian Express)

◆◆◆

Article 3

How Much is Government Actually Spending on Economic Stimulus

Ravi Nair

(This article is actually a summary of four articles by Ravi Nair that appeared in Newsclick.in, analysing the first four of the five packages of announcements made by Finance Minister Sitharaman detailing the “Rs 20 lakh crore economic package” announced by Prime Minister Narendra Modi in his address to the nation on May 12.)

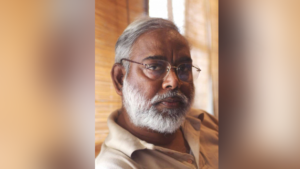

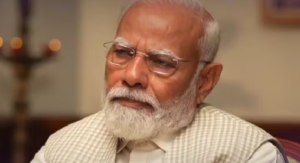

In his address to the nation at 8 p.m on May 12, Prime Minister Narendra Modi announced a “special economic package” to make Indians “self-reliant” at a time when the deadly coronavirus pandemic continues to cripple the country’s people and break the back of its economy.

He said: “This package, together with the earlier announced package by the government during the Covid crisis along with the RBI’s (Reserve Bank of India’s) decisions during the same time, is (going to be) worth approximately ₹20 lakh crore, which is nearly 10% of India’s GDP (gross domestic product).”

According to the first advance estimate of the National Statistical Office (NSO) in the Ministry of Statistics and Programme Implementation, India’s GDP at current prices in 2019-20 is likely to attain a level of ₹204.42 lakh crore against ₹190.10 lakh crore in 2018-19.

The RBI’ s Measures

The RBI, in its seventh bi-monthly Monetary Policy Statement for 2019-20, stated that following a meeting of its Monetary Policy Committee (MPC) in February, an amount of ₹2.8 lakh crore of liquidity had been injected through various instruments and schemes till 27 March. The total amount works out to around 1.4% of the country’s GDP.

The RBI stated that through Targeted Long Term Repo (repurchase option) Operations (TLTRO) and changes in the Cash Reserve Ratio (CRR) of banks and the Marginal Standing Facility (MSF), a total liquidity of ₹3.74 lakh crore (equivalent to 1.8% of the GDP) would be injected into the country’s monetary system.

[The Repo rate is the interest rate at which the central bank, or the RBI, advances loans to banks and is considered an instrument to control money supply and inflation. The CRR is the specific minimum proportion of the total deposits of customers that banks have to hold as reserves with the RBI. The MSF is a liquidity adjustment facility created by the RBI in May 2011; the MSF rate is the one at which banks borrow overnight funds from the RBI against specified government securities.]

The RBI further said that depending on the outcome of the first TLTRO auction, more auctions will be announced. The CRR and MSF windows would be open till the last week of June.

To sum up, the country’s central bank and apex monetary authority announced plans to inject liquidity equivalent to 3.2% of India’s GDP or ₹6.54 lakh crore through these measures.

On April 17, the RBI announced new refinancing facilities for All India Financial Institutions (AIFIs) by extending advances at the policy repo rate when it is being availed. Under this plan, ₹25,000 crore has been allocated to the National Bank for Agriculture and Rural Development (NABARD) to refinance rural banks, ₹15,000 crore to the Small Industries Development Bank of India (SIDBI) and another ₹10,000 crore to the National Housing Bank (NHB) to support housing finance companies, cooperative banks and microfinance institutions. The total adds up to ₹50,000 crore.

Ten days later, on April 27, the RBI announced a Special Liquidity Facility for Mutual Funds (SLF-MF) worth ₹50,000 crore. The refinancing of AIFIs and the SLF-MF together works out to around 0.5% of the country’s GDP.

Earlier, on March 27, the Union government announced a Covid-19 “stimulus” package that was said to be worth ₹1.7 lakh crore (or around 0.85% of GDP).

In other words, measures aggregating ₹9.24 lakh crore had already been announced before the Prime Minister’s May 12 announcement. Of this amount, the measues totalling ₹7.54 lakh crore announced by the RBI do not striclty fall within the purview of the Union government’s budget.

Tranche 1

On May 13, in a 90-minute media briefing, Finance Minister Sitharaman, along with the Minister of State for Finance Anurag Thakur, detailed what was described as the “first tranche” of the “special economic package” to build a self-reliant India or an “Atma-Nirbhar Bharat Abhiyan.”

The 15 announcements were:

- A ₹3 lakh crore Emergency Working Capital Facility for Businesses, including MSMEs.

- A ₹20,000 crore Subordinate Debt Facility for Stressed MSMEs.

- An infusion of equity capital worth ₹50,000 crore through an “MSME Fund of Funds.”

- Changes in the definitions of MSMEs.

- No issuance of global tenders for government purchases of up to ₹200 crore.

- Extending support for payments to the Employees Provident Fund (EPF) schemes for organised sector workers for an additional three months (that is, for June, July and August 2020).

- Reduction in contributions to the EPF by employers and employees for three months from 12% to 10% of wages.

- A ₹30,000 crore Special Liquidity Scheme for Non-Banking Finance Companies (NBFCs), Housing Finance Companies (HFCs) and Micro-Finance Institutions (MFIs).

- A ₹45,000 crore “partial” credit guarantee scheme for the liabilities of NBFCs and MFIs.

- A ₹90,000 crore liquidity injection scheme for electricity distribution companies or Discoms.

- A “relief” scheme for contractors by extending up to six months the time taken for completion of contractual obligations, including with respect to EPC (engineering, procurement, construction) and concession agreements.

- A relief scheme for real estate projects by extending the registration and completion dates by up to six months.

- Pending income tax refunds to charitable trusts and non-corporate businesses and professions to be issued immediately.

- A reduction in the rates of TDS (Tax Deduction at Source) and TCS (Tax Collected at Source) by 25% for the remaining period of the current financial year (FY 20-21) ending on 31 March 2021.

- Extension of deadlines and due dates for various tax related compliances.

Loan Schemes, Not Stimulus Package

The 15 schemes outlined do not constitute an “economic stimulus package” as has been claimed by a section of the mainstream media. A country’s economy can be stimulated when its government increases its spending, reduces taxes and brings down interest rates, among other measures, to boost consumer spending thereby increasing the demand for goods and services and in the process, creating jobs. Little of all this is likely to happen through the “first tranche” of measures that were announced on May 13. The additional spending from the government’s coffers would be negligible.

Through the ₹3 lakh crore Emergency Working Capital Facility for businesses, including MSMEs, the government will provide additional working capital (20% of the outstanding loan amounts as on February 29, 2020) in the form of term loans by banks/NBFCs at a lower interest rate, without any collateral, with a 12-month moratorium on repayment of the principal amount, to companies with an annual turnover less than ₹100 crore and with an outstanding credit limit lower than ₹25 crore.

The government of India will cover banks/NBFCs with a 100% guarantee (on both the interest and principal components of the loans) for these new loans, which the lending institutions can encash in the event of a default.

At first glance, this seems like a very good initiative. But its success depends on whether owners of corporate entities, notably MSMEs, will want to borrow money from banks/NBFCs at this juncture to invest in ventures for which there will be demand for the goods produced or services rendered. As far as the government is concerned, it is spending nothing immediately for building up a contingent liability for the future that has to be serviced over many years. Even in a worst-case scenario (assuming that 20% of the loan accounts default), the outflow from the government’s coffers will be a small fraction of the total amount of ₹3 lakh crore.

The ₹20,000 crore scheme for providing Subordinate Debt for Stressed MSMEs is meant for MSMEs which are functioning as well as units with stressed assets and/or NPAs. The government expects banks/NBFCs to provide subordinate debt equivalent to 15% of the promoters’ existing equity capital, subject to a limit of ₹ 75 lakh. Under this scheme, the government will support the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) to the tune of ₹4,000 crore, which is 20% of the total amount the government is expecting the banks to disburse.

In this instance as well, the government is not spending anything immediately but expecting banks and financial institutions to lend money without charging interest. As in the previous scheme, the government is building up a very limited contingent liability that is a fifth of the total expected disbursal.

The question is whether banks and financial institutions that have been reluctant to extend new credit lines because they have been doubtful if their loans would be repaid and serviced, would now come forward to lend large amounts to large numbers of corporate entities, especially MSMEs.

As far as the ₹50,000 crore equity infusion scheme through the MSME Fund of Funds is concerned, the government is planning to set up a Fund of Funds (FoF) with a corpus of ₹10,000 crore to provide equity funding support to MSMEs. The FoF, that will be operated through a Mother Fund and a few Daughter Funds, is expected to mobilise ₹50,000 crore.

This scheme, too, is one with medium-term and long-term consequences. For example, in 2016, the government had set up a Fund of Funds in SIDBI with a similar corpus of ₹10,000 crore for contribution to various Alternative Investment Funds (AIFs) registered with the Securities and Exchange Board of India (SEBI) that would extend funding support to start-ups under government’s “Startup India” scheme.

The initial plan was to build a corpus of ₹10,000 crore over the terms of the 14th Finance Commission (April 2015 till March 2020) and the 15th Finance Commission (2020-25) subject to the progress of the scheme and availability of funds. The SIDBI website shows that after nearly four years, that is, as on March 31, the Fund of Funds had committed ₹3,798 crore in 53 AIFs and had supported 338 startups with ₹3,582 crore (or over a third of the corpus).

Reduction in EPF Contributions

Considering the reduction in the contributions to the EPF by employers and employees for the next three months, the mandatory EPF contribution of 12% (for both employees and employers) has been reduced to 10% and will be paid by the Union government. According to the Finance Minister, this will provide liquidity of ₹2,250 crore per month for the next three months or a total of ₹6,750 crore.

A reduction in the EPF might give more leverage to the employer in terms of his/her monthly fixed outflow but for an employee, it is a loss in her/his savings. Moreover, in the private sector, there is no government contribution in the EPF other than the interest in the deposited amount.

In this case, a reduction from the mandated 12% will save the government money in the form of interest while the additional money in the pockets of employees that will be spent will help the government earn more by way of indirect taxes. As there is no salary slab mentioned, many people may lose a chance to save on payment of income tax because the contribution to the EPF is counted as a tax-saving instrument.

Benefits to Tata, Adani and Reliance ADAG

Coming to the ₹90,000 crore liquidity injection scheme for power distribution companies or discoms, this amount will be infused by two public sector undertakings, the Power Finance Corporation and the Rural Electrification Corporation in two equal instalments. The discoms are expected to use this money to clear their dues with power generation and transmission companies. The respective state governments should guarantee these loans to the discoms. It has been reported that the discoms owe ₹94,000 crore to electricity generation and transmission companies.

This move will provide relief to many power generation companies, such as Adani Power, Reliance Power and Tata Power. However, what is being advanced is a loan from two public sector companies that will have to be repaid. Once again, there is no government contribution here.

No New Capital Infusion

The ₹30,000 crore special liquidity scheme for NBFCs/HFCs/MFIs is being provided by the RBI. Investments will be made in primary and secondary market transactions in investment grade debt papers of these NBFCs/HFCs/MFIs and 100% guaranteed by the government of India. Yet again, there is no fresh infusion of capital from the government.

As for the ₹ 45,000 crore partial credit guarantee “Scheme 2.0” for the liabilities of NBFCs/MFIs, the government will provide 20% “first loss sovereign guarantee” to public sector banks to cover the borrowings of low-rated NBFCs, HFCs and MFIs. This scheme, too, entails no new expenditure on the part of the government.

Cut in TDS, TCS Rates Tricky

Consider now the reduction in rates of TDS and TCS by a quarter for the remaining period of the current financial year (FY 20-21). The TDS rates for all non-salaried payments to residents (that is, payments for interest, professional fees, dividend, contract, rent, brokerage, commission, etc covered under this scheme) will be reduced by 25%. The implications for individual taxpayers are a bit tricky.

TDS is basically an advance tax which gives the government an idea of the number of tax-payers in advance. However, when income tax returns are filed at the end of the year, one has to pay the actual tax according to the slab one falls under. For example, if ₹5,000 TDS was deducted on a transaction of ₹50,000 earlier, the amount deducted will now be only ₹3,750. But whether or not a taxpayer will actually save ₹1,250 on the transaction will be known only at the end of the financial year when the person files her/his income tax returns. This is because one will know the actual tax slab or bracket under which she/he will come under at that juncture. So, if a person come under the 10% income tax slab/bracket, she/he will have to fork out 10% of her/his taxable income, partially neutralising the savings made on account of a lower TDS rate.

Is this a significant benefit for income taxpayers who comprise barely 2.5% of India’s population of 135 crore? Should this change in TDS and TCS rates be included as part of a “package” of “economic stimulus” measures? Many would disagree.

Sitharaman also announced that pending income tax refunds to charitable trusts and non-corporate businesses and professions would be made immediately. This is not such a big deal as is being sought to be made out as, after all, this is money that is owed by the government in the first place.

The 15 schemes announced by Sitharaman on May 13 add up to Rs 5.94 lakh crore.

Tranche 2

The “second tranche” of announcements on the economic “package” for migrants and urban poor to build an “Atma Nirbhar Bharat”, made by Finance Minister Nirmala Sitharaman on May 14, is once again more of the same.

Let’s look at the measures announced:

- Free foodgrain supply to migrants for two months.

- Technology system to be used enabling migrants to access PDS (Ration) from any fair price shop in India by March 2021 aiming for ‘One Nation one Ration Card’

- Scheme for affordable rental housing complexes for migrant Workers and urban poor to be launched

- 2% interest subvention for 12 months for Shishu MUDRA loanees- Relief of Rs. 1,500 crore

- Rs 5,000 crore credit facility for street vendors.

- Rs 70,000 crore boost to housing sector and middle income group through extension of Credit Linked Subsidy Scheme under PMAY (Urban)

- Rs 6,000 crore for creating employment using CAMPA funds

- Rs 30,000 crore additional emergency working capital for farmers through NABARD.

- Rs 2 lakh crore concessional credit boost to 2.5 crore farmers under Kisan Credit Card Scheme.

Now, let us check the details of these measure and how much money the government is spending on this.

Free Foodgrain Supply for 2 Months

The government said 5 of kg foodgrains per migrant labourer and 1 kg chana for their families in May and June will be supplied free of cost.

As per the government’s foodgrain stocking norms, for the April to June quarter, India should have 210.4 lakh tonnes (115.80 LT rice and 44.60 LT wheat in operational stock, and 20 LT rice, 30 LT wheat in the strategic reserve).

According to the data published by Department of Food & Public Distribution, Ministry of Food & Public Distribution, as on May 6, the Food Corporation of India (FCI) had 234.64 LT rice and 92.11 LT wheat in stock. Various state agencies had 50.39 LT rice and 265.59 LT wheat stocks. Put together, the country has stocks of 285.03 LT rice and 357.70 LT wheat (total 642.73 LT) in the central pool. Beyond this, 234.29 LT unmilled paddy is in stock with FCI and various state agencies.

If the government data is accurate, at present, the FCI has additional 118.84 lakh tonne of rice stock and 47.51 LT wheat. This shows that as of now, the country has 116.35 lakh tonne foodgrains in the buffer stock.

The Annavitran portal of food department shows total Central foodgrain allocation under the Pradhan Mantri Garib Kalyan Yojana (PMGKY) for April, May and June at 102.4 LT.

So, how fair is the food distribution to the poor?

In a recent study, economists Jean Dreze and Reetika Khera estimated that more than 100 million people are excluded from the public distribution system or PDS because the Centre’s PDS allocation to states are calculated on the basis of Census 2011. The introduction of biometric-based ration distribution has made the situation worse for the poor.

The National Food Security Act or NFSA website shows there are 80.54 crore beneficiaries under the Act. But, data released by the Centre on May 5, 2020, shows, only 60.33 crore beneficiaries under the PMGKY scheme in April, leaving out 20 crore people.

Considering these factors, how adequate are these allocations?

Affordable Rental Housing Complexes

Under Pradhan Matri Awas Yojna (Urban), government-funded housing in cities will be converted into Affordable Rental Housing Complexes (ARHCs). This scheme will be implemented by a public-private partnership (PPP) model, worked out through concessionaires. State and Central government agencies, private institutions, manufacturing units, industries and associations will be incentivised to develop and operate ARHCs on their land. Guidelines are yet to be announced for this long-term project.

But, will this really benefit migrant workers? Here’s what government figures speak.

When PMAY (U) was launched on June 15, 2015, it subsumed the numbers from existing schemes, such as Rajiv Gandhi Awas Yojana (RAY), Rajiv Rinn Yojanaa (RRY) etc. PMAY(U) has a sub-component called In-Situ Slum Redevelopment (ISSR), meant for the urban poor. Government data shows that five years after the scheme’s launch after subsuming the numbers of the then existing schemes, only 4.62 lakh houses were completed in the entire country under PMAY (Urban) till April 20, this year.

Considering these statistics, it is difficult to believe that this measure will provide any relief to migrant workers. Also, counting this in the Rs 20 lakh crore ‘economic package’ to revive the economy sounds farfetched, as the government doesn’t need to spend anything on this in the near future.

One Nation, One Ration Card

Once again, there is nothing new in this announcement. The pilot scheme on this has been running since months. The aim was to ensure that the scheme covered the entire country by June this year. Now that deadline has been extended to March 2021, how can an existing scheme, with no or minimal investment from the government, become a part of an ‘economic package’ to revive the economy?

2% Interest Subvention for 12 Months

The Mudra Shishu scheme enables loans up to Rs.50,000. Public sector State Bank of India (SBI) charges a minimum of 10.15% interest on this loan. The Mudra annual report 2018-19 says slightly over 86% loans disbursed under the Mudra scheme fall under the Shishu category, and the average loan size under the Shishu category is Rs. 27,640. Most of the loanees are from poor or economically backward sections.

Now, here’s the catch. In the “economic package”, the government has announced interest subvention of 2% for 12 months for “prompt payees”, which, in effect, means that the interest subvention scheme will be applicable to only those who are paying their installments regularly.

This implies that the government is virtually asking the poor to pay back the loans as soon as possible to banks at a time when they are uprooted and are facing livelihood uncertainties. Had the government given moratorium on interest for 12 months and was willing to pay a part of it to banks on behalf of loanees, this would have been considered a part of an “economic package”. Not otherwise.

Rs 5,000 Crore Credit Facility for Street Vendors

Street vendors are the worst hit by the countrywide lockdown, something that the government itself acknowledges. But, this again is a credit scheme (yet to be launched). Under the scheme, banks will provide loans up to Rs.10,000 to street vendors. The government expects 50 lakh vendors to avail this facility. Hence, it has been estimated that Rs.5,000 crore will go to vendors.

But, where is the government’s contribution in this? And how can it be considered part of a special “economic package”?

Rs 70,000 Crore Under PMAY (Urban)

This, too, seems an extension of an existing scheme being passed off as part of the “economic package.”

If a dwelling unit’s carpet area is between 160 to 200 sq mtr, that unit is considered an MIG (middle income group) under PMAY(U). The Credit Linked Subsidy scheme (CLSS) for MIG (having income between Rs 6 to 18 lakh per annum) was introduced in PMAY(U) in January 2017.

According to the CLSS portal, anyone who avails a home loan of Rs.12 lakh under the scheme for a tenure of 20 years, will save Rs.230,156 in the entire period. (around Rs.2,200 per month. Interest rate is calculated at 10% per annum)

The scheme portal suggests that since its inception, the CLSS has provided approximately Rs.7,000 crore benefits to 3.3 lakh home buyers and mobilised Rs.75,000 crore in investment. By extending the scheme, the government expects 2.5 lakh families to invest in new homes in 2020-21, mobilising Rs.70,000 crore in the same period for the real estate sector, which will have a cascading effect on related industries, like cement, steel, glass, goods transport etc.

There are two things to be noted here. (a) From January 2017 to April 2020, only 3.3 lakh houses were booked and Rs.75,000 crore investment was mobilised. So, the Narendra Modi government is presuming that in the remaining 10 months of 2020-21, as many as 2.5 lakh houses will be booked and Rs.70,000 crore investment will be mobilised, especially when jobs are lost and market uncertainties are worrying the middle class?

(b) Where is the immediate government investment in this case? If the government’s dream of 2.5 lakh people booking new homes in the next 10 months under the scheme comes true, it will have to pay the subvention over a long period – by 2040-41. By the way, in the 2020-21 budget, government had allocated only Rs.500 crore for this scheme.

The Reserve Bank of India or RBI has noted that on an average, 39% of a home buyer’s income goes towards paying EMIs (equated monthly installments) of home loans. This burden is sure to pinch the lower and middle income groups, especially when the market conditions are volatile.

And, in the current situation (lockdown and a stalled economy), there are more chances of missing or defaulting EMIs. Though banks have deferred the EMIs till May 31, that will burden the customers heavily. SBI, in its Covid-19 relief measure notification says: the Impact in case of deferment of home loan, if the loan amount is Rs.30 lakh and tenure is 15 years, will be 2.34 lakh, which is equal to 8 EMIs.”

This will wipe out most of the benefit of the interest subvention scheme. In fact, the scheme would have been considered an “economic package” if the government said it was ready to waive the interest for these three months.

In the present scenario, the government presented an extension of an existing scheme with an allocated budget of Rs. 500 crore as a part of economic package worth Rs.70,000 crore, without having to spend anything immediately.

How can this be considered as a measure to stimulate the economy or part of the Rs 20 lakh crore economic package?

Creating Jobs Using CAMPA Funds

The Compensatory Afforestation Fund Act, 2016 came into effect on September 30, 2018. It created a National Compensatory Afforestation Fund (NCAF) under the Public Account of the government of the India and State Compensatory Afforestation Fund (SCAF) under the Public Account of each state, under the regulation of state and national CAMPA. Compensatory afforestation funds are deposited into this account, which are divided between the state concerned and the Centre at 90:10 ratio.

According to Ministry of Environment, Forest and Climate Change, Rs.54,685 Crore from ad-hoc CAMPA has been brought under the control of the Government of India and Rs.47,000 crore has been released to various states.

In 2013, a CAG report pointed out that CAMPA funds were underutilised. Some reports mentioned that most of the CAMPA funds are parked in government securities and it was worth approximately Rs.50,000 crore. In April this year, it was reported that many cash-strapped state governments asked the Centre to release the CAMPA funds or provide soft loans from the fund.

Sitharaman’s announcement says that Rs. 6,000 crore from this fund will be utilised for artificial regeneration, assisted natural regeneration, forest management, soil & moisture conservation works, forest protection, forest and wildlife related infrastructure development, wildlife protection and management etc, and it will provide employment opportunities, especially in tribal areas.

Whether the Centre will oversee the implementation or the funds will be transferred to states is not clear. If it is transferred to states, how these funds are utilised remains to be seen.

Working Capital for Farmers Through NABARD

Under this scheme, NABARD will provide Rs. 30,000 crore to 33 state cooperative banks, 351 district cooperative banks and 43 Regional Rural Banks (RRB), which will lend money to small and marginal farmers. This is, therefore, another loan scheme and there is no direct monetary contribution from the Centre in this. Hence, it cannot be called a part of the economic or stimulus package of the government.

Kisan Credit Card Scheme

This is yet another loan scheme for farmers. Here too, banks /financial institutions will provide loans to farmers at a lower rate of interest. Monetary contribution from the government, like in almost all the other measures announced under the economic package, is zilch.

Tranche 3

Finance Minister Nirmala Sitharaman announced on May 15, the “third tranche” of the “Rs 20 lakh crore economic package” announced by Prime Minister Narendra Modi in his address to the nation on May 12. Just like the announcements made in first two ‘tranches’, in the third one, too, the Narendra Modi government announced a lot of credit/loan measures and policy decisions as a stimulus package to revive the economy.

First, let’s take a look at the measures were announced in the “third tranche”:

Rs 1 lakh crore Agri Infrastructure Fund for farm gate infrastructure for farmers: This fund will be created for financing Agriculture Infrastructure Projects at farm gate and aggregation points (Primary Agricultural Cooperative Societies, Farmers Producer Organisations, Agriculture entrepreneurs, Start-ups, etc.) to develop post-harvest management infrastructure for farm gate aggregation easier.

The Modi government has presented this idea in every Union Budget since it assumed office in 2014. Agricultural Marketing Infrastructure (AMI) was launched as a sub-scheme of the Integrated Scheme for Agricultural Marketing (ISAM) w.e.f October 22, 2018 with validity till March 31, 2020.

Some of theobjectives of this sub-scheme were to promote innovative and latest technologies in post-harvest and agricultural marketing infrastructure, creation of scientific storage capacity for storing farm produce, processed farm produce and agricultural inputs etc. to reduce post-harvest & handling losses, promote pledge financing and market access. The National Bank of Agriculture and Rural Development (NABARD) was the nodal agency.

In her 2019-20 Budget speech, Sitharaman said: “We will invest widely in agricultural infrastructure. We will support private entrepreneurships in driving value-addition to farmers’ produce from the field and for those from allied activities..” The same document says “D/o Agriculture Cooperation and Farmers Welfare (DAC&FW) is implementing Agricultural Marketing Infrastructure (AMI), a sub-scheme of the Integrated Scheme for Agricultural Marketing (ISAM). The Scheme includes storage and other than storage infrastructure projects.”

This shows that the announcement made as a part of an ‘economic package’ is an extension of the existing scheme. In the existing schemes, NABARD is the funding agency. Because of the same reason, the finance minister did not divulge more details on the subject.

Rs 10,000 crore scheme for formalisation of micro food enterprises (MFE):Women and Scheduled Caste/Tribe owned micro food enterprise units’ have been assured financial assistance for technical upgradation to attain food safety standards, brand building and marketing.

This one also is a loan scheme under Make in India, wherein the government has identified the food processing industry (FPI) as a priority sector. Women and SC/STs are categorised under weaker section and are eligible for priority sector lending.

A bulletin issued by the Reserve Bank of India (RBI), dated March 11, this year explains the available credit facility to the FPI sector: “To boost credit disbursement at affordable rates to the food processing sector, a special fund of Rs 2,000 crore has been set up in National Bank for Agriculture and Rural Development (NABARD). Under this, loans are extended up to 95 per cent of the project cost for setting up, modernisation and expansion of food processing units…”

So, when there is an existing fund for the food processing sector, it is highly unlikely that the government will create another fund to promote women and SC/ST-owned micro food enterprise units. Probably, the government might ask NABARD to increase the fund limit from Rs.2.000 crore to Rs.10,000crore.

Rs 20,000 crore for fishermen through Pradhan Mantri Matsya Sampada Yojana (PMMSY): PMMSYwas first announced by the Finance Minister in her Budget speech of 2019-20 to promote the Blue Revolution. She had said: “Fishing and fishermen communities are closely aligned with farming and are crucial to rural India. Through a focused Scheme – the Pradhan Mantri Matsya Sampada Yojana (PMMSY) – the Department of Fisheries will establish a robust fisheries management framework. This will address critical gaps in the value chain, including infrastructure, modernization, traceability, production, productivity, post-harvest management, and quality control.”

Under the scheme, the government has created a fund to develop to fishing industry related infrastructure. The objective behind the fund was creation of fisheries infrastructure facilities both in marine and inland fisheries sectors. In the 2019-20 Union budget, Rs.560 crore was allocated for the Blue Revolution. This year it was increased by Rs.10 crore to Rs.570 crore. Co-incidentally, the Blue Revolution website clearly mentions all the objectives the finance minister mentioned in her media briefing on third tranche of the “economic package”on May 15.

These details shows, the finance minister presented an ongoing scheme with budget allocation since years, as a new one.

National Animal Disease Control Programme: Under this, Rs 13,343 crore would be spent to ensure 100% vaccination of cattle, buffalo, sheep, goat and pig population (total 53 crore animals) for Foot and Mouth Disease (FMD) and for brucellosis

Now, rewind to June 25, 2019. The Ministry of Fisheries, Animal Husbandry & Dairying put out a Press Release 11 months ago, that reads: “The National Animal Disease Control Programme for Foot and Mouth Disease (FMD) and Brucellosis has been approved by the Cabinet on 31.05.2019 as a new Central Sector Scheme for a total outlay of Rs.13,343 crore for five years (2019-24). An amount of Rs.2,683.00 crore is proposed for the Financial Year 2019-20. It has the following components:

Foot and Mouth Disease (FMD) control programme: The programme envisages 100% vaccination coverage of cattle, buffaloes, sheep, goats and pigs at six months interval in the entire country. Further, animals will be identified using unique animal identification ear tags. The programme also includes de-worming of targeted population of livestock twice a year as one of its activities.”

It’s anybody’s guess how this scheme has become a component of the “Rs 20 lakh crore economic package”?

Animal Husbandry Infrastructure Development Fund: Rs. 15,000 crore to support private investment in dairy processing, value addition and cattle feed infrastructure.

Once again, rewind to March 10, 2018, when the Ministry of Agriculture & Farmers Welfare minister Radha Mohan Singh, announced that the government had set up an Animal Husbandry Infrastructure Development Fund (AHIDF) with a corpus of Rs.2,450 crore.

So, basically, an existing interest subvention scheme implemented through NABARD has been projected as a ‘new’ scheme under the “economic package”.

Promotion of Herbal Cultivation:An outlay of Rs. 4,000 crore has been announced in the third tranche. Recall that it is the National Medicinal Plant Board that is overseeing the National Mission on Medicinal Plants (NMMP) since 2008-09. The main objective of NMPB is to encourage cultivation of medicinal plants and its sustainable management across the country and to reduce pressure on collection from wild habitat in forests.

This is an ongoing programme since over a decade. How does this fit in the “economic package” in 2020?

Beekeeping initiatives: Outlay Rs 500 crore. The money will go towards infrastructure development related to Integrated Beekeeping Development Centres, collection, marketing and storage centres, post-harvest and value addition facilities etc; capacity building with thrust on women; development of quality nucleus stock and bee breeders among other things.

Now, the National Bee Board exists since 1993. Its website clearly states all objectives mentioned by the Sitharaman in her media briefing. A centrally-sponsored scheme, Sweet Revolution was started in 2017-18 with the same objectives.

Another existing scheme has been introduced as part of the economic package,

From ‘TOP’ to TOTAL (Rs 500 crore): “Operation Greens”, run by Ministry of Food Processing Industries (MOFPI), will be extended from tomatoes, onion and potatoes to all fruit and vegetables.

Operation Greens had the same Rs.500 crore budget outlay in 2018-19. The extension of the scheme is on pilot basis as of now. Hence, how this will revive the economy now?

Tranche 4

This was announced on May 16. Unlike the previous three “tranches”, the fourth tranche’s announcements did not consist of any loans, loan subventions or loan guarantee schemes. The announcements were all policy decisions about structural reforms in eight sectors namely, mining, coal, mineral, civil aviation, Defence Production, power, atomic energy and space.

The key highlights of the fourth tranche announcements were:

- Commercial Mining introduced in Coal Sector

- Diversified Opportunities in the Coal Sector

- Liberalised Regime in the Coal Sector

- Enhancing Private Investments and Policy Reforms in the Mineral Sector

- Enhancing Self Reliance in Defence Production

- Policy Reforms in Defence Production

- Efficient Airspace Management for Civil Aviation

- More World-Class Airports through PPP

- India to become a global hub for Aircraft Maintenance, Repair and Overhaul (MRO)

- Tariff Policy Reform in Power Sector; Privatization of Distribution in UTs

- Boosting private sector investment through revamped Viability Gap Funding Scheme in Social Sector

- Boosting private participation in space activities

- Reforms in the Atomic Energy Sector

Firstly, Commercial mining in the coal sector was announced as a measure in the 20 lakh crore economic package to address a stalled economy! Under this “reform”, companies from across the world, without prior experience in coal or mining other minerals, can participate in the auction and there will not be any eligibility criteria to participate in the auction.

This announcement actually has nothing to do with the economic package announced by the PM. In fact, parliament passed the Mineral Laws (Amendment) Bill, 2020 in the Budget Session of the Parliament this year (on March 12). What the FM announced was a copy-paste job from the bill.

How can this be a measure of the economic package worth Rs 20-lakh crore?

Diversified Opportunities in the Coal Sector covers Coal Gasification / Liquefaction; Rs 50,000 crore worth infrastructure development in private coal blocks, including Rs 18,000 crore worth of investment in mechanised transfer of coal (conveyor belts) from mines to railway sidings. The Government’s plan for the liquefaction of coal is nothing new. The guidelines for the allocation were issued six years ago, in September 2014.

Liberalised Regime in the Coal Sector was another point raised by the FM. The Mining Laws (Amendment) Ordinance, 2020, was promulgated by the President of India on 10 January, 2020. The legislative department of the Ministry of Law and Justice published the ordinance in the Gazette of India on the same day. In the Budget Session of the Parliament in March, the Bill was passed in both Houses and the Mineral Laws (Amendment) Act, 2020 came into force from March 13. The Act intended to liberalise the coal sector. The Amendment allowed participation of multinational companies in coal block auctions and the end use restrictions on the mined coal were removed, along with many other changes.

The Finance Minister did not explain how this became a part of the economic package.

Enhancing Private Investments and Policy Reforms in Mineral Sector was the next point made during the media briefing. Mineral Auction Rules were amended in July 2015 and twice (1st and 2nd amendment) in March this year. The National Mineral Policy, 2008, was changed and a new policy was introduced in 2019. Whatever the FM said the government would do had already been done.

After the Coal and Mineral sectors, the FM spoke about Defence Manufacturing. She said that the Foreign Direct Investment (FDI) limit under the automatic route will be raised from 49% to 74% in the sector. She added that there would be a Project Management Unit (PMU) to support contract management; a Realistic setting of General Staff Qualitative Requirements (GSQRs) of weapons/platforms and overhauling Trial and Testing procedures.

Setting up of a PMU realistic setting of GSQR and overhauling the trial/testing procedures have nothing to do with stalling the economy or reviving it. Even increasing the FDI limit will not bring in any relief to the economy in the near future. Why did the FM announce these yet to be taken steps as a measure to revive the economy is another mystery!

The FM also spoke about the various measures government that the government was planning to introduce in the Civil Aviation Sector. The only major announcement in this segment was the privatisation of the airports controlled by Airport Authority of India (AAI) under a Public Private Partnership (PPP) Model.

The move for an Efficient Airspace Management for Civil Aviation which the FM announced was already established a year ago.

As with the earlier announcements, this effort cannot be considered as a part of an economic package to revive the economy at present or in the immediate future.

Whatever FM Nirmala Sitharaman announced for the Power sector were all policy decisions which are not connected to the economic package in any way. The only major announcement related to the sector was the privatisation of Discoms in Union Territories.

The FM also announced Viability Gap Funding (VGF) with a cap of 30% in social infrastructure development projects. Rs 8,100 crore was the mentioned budget for the exercise, which is, again, an old move. In this year’s Budget Speech, the Finance Minister said: “It is proposed to attach a medical college to an existing district hospital in PPP mode. Those states that fully allow the facilities of the hospital to the medical college and wish to provide land at a concession would be able to receive Viability Gap Funding. Details of the scheme would be worked out.”

It has to be remembered now because, during a pandemic, when the public health care system has been left crippled under the pressure of a high number of patients, and when complaints of private hospitals fleecing patients for even simple check-ups, the Modi government, instead of supporting states to invest more in public health care, wants to hand over the existing public health care facilities to the private players and is offering VGF to top it as well!

The next point was about allowingprivate participation in space programmes and allowing private players to use ISRO facilities for future projects. What has the current economic package got to do with this? The FM did not elaborate.

Reforms in the Atomic Energy Sector: The Finance Minister said that the research reactor shall be established in PPP mode for the production of medical isotopes for the welfare of humanity through affordable treatment for cancer and other diseases.

There is an independent unit called the Board of Radiation & Isotope Technology (BRIT) within the Department of Atomic Energy. Its function is to “provide products and services based on radiation & isotopes for applications in healthcare, agriculture, research and industry.”

When a good government institution already exists, why does the government want to go for a new one using the PPP Model? And how it is related to the economic package?

An economic package to give a stimulus to the economy should have a good amount of immediate spending from the government. The announcements made in this tranche were policy decisions, those about existing projects, a re-announcement of already existing schemes and the Government’s plan to support private entities if they invest money. It is basic economic knowledge that private businesses will not invest capital in a sluggish economy where demand has slowed down.

No one knows how the policy decisions became a part of the Rs 20 lakh crore economic package. In other words, how will these announcements revive the economy when the Government is unwilling to invest?

(Ravi Nair is an independent journalist.)

◆◆◆

Editorial addition: In another article, “How Modi’s ‘Stimulus’ Packages Will Destroy, Not Boost, India”, Subodh Varma writes:

Will Farmers Benefit?

In the slew of measures announced on May 15, a complete overhaul of the agricultural produce trade has taken place. Sale and trade of key food items used to be controlled by law, because in a country the size of India, with its vast impoverished population, traders couldn’t be allowed to control the flow of essential cereals and other produce. They would manipulate prices and make profit out of the hunger and misery of people – indeed they still manage to do so. So, there were caps on prices and also on how much stock a trader could hold. All that has gone now.

This measure is being posed as liberation for farmers, but in effect it will mean a free for all in which the big traders will monopolise the market and ultimately determine prices and supply itself. Those with deep pockets – and this includes foreign companies – will out-compete local traders, and crush the farmers’ interests.

The infrastructure that is proposed to be set up, is the deal sweetener for these big private players in agri-commodities. Better marketing hubs, e-marketing, better connectivity – all this will help these lobbies.

So, the farmers who were struggling to sell their produce at remunerative prices and vainly demanding a support price that was 50% higher than cost of production, will now have to just wait and sell to whichever big trader comes and offers to buy up their standing crop, bribing them with advances and concessions. The assurance of a designated market place – despite all the corruption and perversions there – will now be gone, because the government has also declared that the law concerned will be changed and a new legal framework brought in.

In short, these measures will open up the agri-commodities sector to a free market regime, which will be integrated to the global markets, as is likely to happen in future. Indian farmers will sell their wheat or millets to global traders but at onerous terms, and no oversight.

The consumers – all of India – will no longer have the assurance of having adequate food stocks. It was these stocks that came in handy and saved millions of lives in the past two months. Once the whole system is privatised, only private companies may hold stocks. Otherwise, India will import foodgrain, like it did half a century ago.

(Subodh Varma is a senior Indian journalist. Article courtesy: Newsclick.in.)