RBI Supports Frauds and Wilful Defaulters – Why?

Thomas Franco

Wilful defaulters and companies involved in fraud can go for a compromise settlement or technical write offs by banks and Non -Banking Finance Companies, as per the new RBI circular.

“A wilful defaulter is a borrower who refuses to repay loans despite having capacity to pay up” as per the definition. And “A fraudster is one who intentionally cheats the bank with false documents/information and misappropriates the money.” Both are criminal offenses.

Till 2019, the RBI had clearly instructed the Banks vide its circular notification RBI/2018-19/203, DBR No.BP.BC 45/21.04.048/2018-19 dated 7.6.2019 vide para 34 as “Borrowers who have committed frauds/malfeasance/wilful default will remain ineligible for restructuring.

This was reiteration of earlier instructions which existed for long and were in force till 8.6.2023. Shockingly, RBI/2023-24/40 DOR.STR.REC.20/21.04.048/2023-24 dated 8.06.2023 has modified the instructions to help wilful defaulters and fraudsters who are criminals. It says in para 6(ii) ‘Proposals for compromise settlements in respect of debtors classified as fraud or wilful defaulter, as permitted in terms of clause 13 of this annex shall require approval of the Board in all cases.’

Para 13 (Annex) Regulated Entities may undertake compromise settlements or technical write offs in respect of accounts categorised as wilful defaulters or fraud without prejudice to the criminal proceedings underway against such debtors.

Since 2014, the GOI has not appointed Officer Directors and Employee Directors in public owned banks and the Boards have political supporters of the ruling party. The RBI has not questioned the non- appointment of the Officer and Employee Directors.

One of the Deputy Governor of RBI recently lamented about the functioning of the boards while addressing the board of Directors of Public owned Banks.

So it’s anybody’s guess how boards will approve compromise settlements. They don’t have any accountability unlike the officers and employees. Without the watchdogs from Associations and Unions, the Boards have become opaque and their decisions are not even available under RTI.

We also know what happens to the cases once compromise settlement is arrived at.

This is going to have serious impact on the banking system. It is the depositors from the middle class whose deposits will be used for writing off loans with a small recovery. And the criminal can once again avail loan! His CIBIL rating will improve as his data will be cleansed. Naturally the good borrowers who are promptly repaying will start defaulting. This will affect the banks. Except the borrowers who have given strong collaterals others will tend to default and expect write off.

Who are the people who are going to be benefited? In 2018, it was reported that out of 5,600 wilful defaulters 15% were from Gujarat.

Here is the RBI data on top 50 wilful defaulters in 2022:

ABG Shipyard (Rishi Agarwal) Winsome diamonds (Jatin Mehta) and many of the other wilful defaulters are close to the corridors of power. Some are already abroad. ABG Shipyard’s Rishi Agarwal who cheated 28 banks to the tune of Rs.23,000 crores can now pay some pittance and have a compromise settlement.

Similarly, Jatin Mehta who is a close relative of Adani who ran away, can now return. Along with Vijay Mallaya, Meher Chokshi, Nirav Modi and others! They will fund the election campaigns.

The National Company Law Tribunals are already helping the looters and the Neo rich. Read my article from June 26, 2021 titled ‘Mallya, Choksi & Nirav Modi should have gone the NCLT Route’. Even the Parliament Standing Committee has strongly criticised NCLTs. In last 10 years NPA reduction due to write off is Rs.13,22,309 Crore.

There is going to be another bigger political gain. In the last 9 years the banks have given Mudra Loans worth Rs. 24,05,753 crores to over 42 crore borrowers (42,09,97,763 Crore) upto 9/6/2023. See year wise sanctions given below:

The Finance Minister has been giving targets to government owned Banks which are also forced to lend to Non- Banking Finance Companies for on lending and co-lending. In many places the ruling party cadres tell the borrowers that this is gift and not to be repaid. So NPAs are increasing and banks are writing off 25% and claiming 75% from the Credit Guarantee Fund. But the borrower’s CIBIL score is affected. Most of them are wilful defaulters. Now they can pay a little, clear the CIBIL score and borrow again.

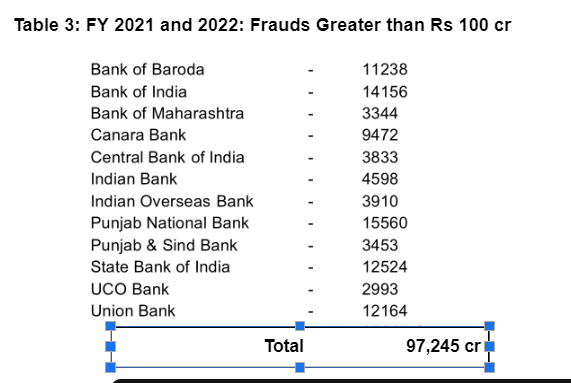

Let’s look at frauds. In 2023 alone, 13,530 frauds were reported by banks to RBI. In 2021 & 2022 Public owned Banks reported Rs. 97,245 cr frauds in accounts outstanding above Rs.100 crores alone. See Bank wise list below in Table 3:

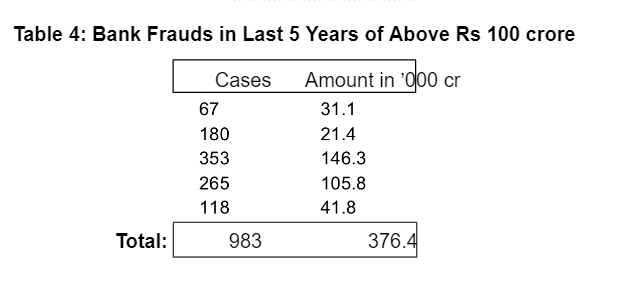

In the last 5 years banks have reported 983 frauds above Rs.100 crores to the tune of Rs. 3,76,400 crores (Table 4). Is it correct to go for compromise with these criminals?

This is a clear loot!

Through the NCLTs established under the Insolvency and Bankruptcy codes lakhs of crores of public money has been written off in the name of haircut. Banks are given some capital to carry out this siphoning off of money to few rich corporates. They in turn support the political party through electoral bonds and other ways.

The write off of smaller loans provides dividend in the elections as the number is huge.

The Bank’s balance sheets are shown as clean with high profits at the cost of depositors who get less interest, pay more bank charges and small borrowers who pay high interest.

Now it will be easy to sell them in the name of privatisation!

RBI is being used as a tool for political gain, which is a violation of law.

Section 21 of the Banking Regulation Act reads as “Power of Reserve Bank to control advances by banking companies (1) where the Reserve Bank is satisfied that it is necessary or expedient in public interest or in the interests of depositors or banking policy so to do, it may determine the policy in relation to advances to be followed by banking companies generally”.

This compromise settlement of wilful defaulters loans and fraudsters loans is neither in public interest nor in the interest of depositors. It is a violation of law. This has to be withdrawn.

All India Bank Officers Confederation and All India Bank Employees Association have strongly condemned RBI and demanded withdrawal of instructions failing which the depositors will be affected and defaults will increase and there will be no faith in the system. This may lead to a collapse! Political parties and public will have to raise to the occasion. Banks can’t be used for political gains at the cost of more than 100 crore small depositors!

(Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University. Courtesy: Centre for Financial Accountability. Centre for Financial Accountability (CFA) engages in critical analysis, monitoring and critique of the role of financial institutions – national and international, and their impact on development, human rights and the environment, amongst other areas.)

Bank Unions Oppose RBI Move to Allow Compromise Settlement for Wilful Defaulters

Courtesy: The Wire Staff

Bank unions have opposed the Reserve Bank of India (RBI)’s move to allow lenders to settle loans of wilful defaulters under compromise settlement, PTI reported.

“As key stakeholders in the banking industry, we have always advocated for strict measures to address the issue of wilful defaulters,” All India Bank Officers’ Confederation (AIBOC) and All India Bank Employees Association (AIBEA) said in a joint statement.

Allowing compromise settlement for accounts classified as fraud or wilful defaulters is an affront to the principles of justice and accountability, the statement said, adding, it not only rewards unscrupulous borrowers but also sends a distressing message to honest borrowers who strive to meet their financial obligations.

Compromise settlement refers to any negotiated arrangement with the borrower to fully settle the claims of the regulated entity against the borrower in cash. It may entail some sacrifice of the amount due from the borrower on the part of the regulated entity with the corresponding waiver of claims of the regulated entity against the borrower to that extent.

The RBI also directed banks to have a minimum cooling period of at least 12 months before making fresh exposures to borrowers who had undergone compromise settlements. This means that a wilful defaulter can get a new loan after 12 months of executing a compromise settlement, the Indian Express reported.

An official at the central bank had also raised concerns over the RBI’s move.

The official told the newspaper: “RBI nod for compromise settlement for wilful defaulters and fraud companies can lead to a tricky situation. There’s a possibility that more public money will be lost in the process. A wilful defaulter is a borrower who refuses to repay loans despite having the capacity to pay up.”

The bank unions said that the sudden change in the framework by the RBI to grant compromise settlements to wilful defaulters will not only lead to the erosion of public trust in the banking sector but also undermines the confidence of depositors.

It fosters an environment where individuals and entities with the means to repay their debts choose to evade their responsibilities without facing appropriate consequences, the joint statement said.

Such leniency serves to perpetuate a culture of non-compliance and moral hazard, leaving banks and their employees bearing the brunt of the losses, it said.

It added that it is worth noting that wilful defaulters have a significant impact on the financial stability of banks and the overall economy.

(Courtesy: The Wire.)

RBI’s Revised Framework for Compromise Settlements and Technical Write-offs Compromises the Integrity of the Banking System

E.A.S. Sarma

To

Shri Shaktikanta Das

Governor, RBI

Dear Shri Das,

I refer to RBI’s latest guidelines issued on 8-6-2023 (Notification No.RBI/2023-24/40

DOR.STR.REC.20/21.04.048/2023-24 8-6-2023) on Framework for Compromise Settlements and Technical Write-offs, modifying the earlier guidelines issued on 7-6-2019 (Notification RBI/2018-19/203 DBR.No.BP.BC.45/21.04.048/2018-19 7-6-2019).

Para 34 of the 2019 notification stipulated,

“Borrowers who have committed frauds/ malfeasance/ wilful default will remain ineligible for restructuring. However, in cases where the existing promoters are replaced by new promoters and the borrower company is totally delinked from such erstwhile promoters/management, lenders may take a view on restructuring such accounts based on their viability, without prejudice to the continuance of criminal action against the erstwhile promoters/management”

In contrast, the latest notification dated 8-6-2023 reads as follows:

“Para 6 (ii): proposals for compromise settlements in respect of debtors classified as fraud or wilful defaulter, as permitted in terms of clause 13 of this Annex, shall require approval of the Board in all cases.

Para 13 (Annexe): REs (regulated entities) may undertake compromise settlements or technical write-offs in respect of accounts categorised as wilful defaulters or fraud without prejudice to the criminal proceeding underway against such debtors“

In other words, RBI has, for reasons best known to it, made a volte-face and abruptly relaxed the 2019 stipulation that no “compromise settlement” would be permitted in the case of “borrowers who have committed fraud/ malfeasance/ wilful default“, implying that a borrower who has committed fraud or one against whom criminal proceedings for fraud are ongoing, in respect of funds borrowed from a bank, would hereafter be eligible for loans from that bank. Fraud implies a promoter falsifying accounts and syphoning off the borrowed money for personal gains. It may also involve laundering of the borrowed money to overseas shell companies either for tax evasion or for misusing it to manipulate the domestic stock market, as has been the case with several wilful defaulters in recent times.

Allowing wilful defaulters charged with violating the law of the land and misappropriating funds already borrowed from the banks, to borrow additional amounts from the same banks, would amount to outright condonation of fraud and making a mockery of the legal system we have.

Compromise settlements such as this one, which amount to condoning fraud, not only expose the hard-earned savings of the banks’ depositors to considerable risk but also encourage wilful defaulters to take further risks including committing acts of malfeasance, at the cost of the banking system. It is clearly a case of undue risks being taken by borrowers, with the corresponding costs inflicted on depositors.

Does not the RBI have the statutory obligation, as the banking regulator, to safeguard the interests of the depositors and the interests of the government which holds dominant shareholding in PSU banks? By issuing such an imprudent set of guidelines, is not the RBI triggering yet another crisis of non-performing assets that plagued the banking system during the last decade?

Section 21 of the Banking Regulation Act in pursuance of which the RBI issued the above 2023 notification reads as follows:

“Power of Reserve Bank to control advances by banking companies.—(1) Where the Reserve Bank is satisfied that it is necessary or expedient in the public interest or in the interests of depositors or banking policy so to do, it may determine the policy in relation to advances to be followed by banking companies generally.”

Since the 2023 notification is neither in the interests of the depositors nor in the public interest, strictly, it violates the letter and the spirit of the above statutory requirement.

While the banks are encouraged to “technically write-off” bad loans from their financial statements to provide false comfort to the government and the public at large, according to statements originating from the Finance Ministry (https://economictimes.indiatimes.com/industry/banking/finance/finance-ministry-wants-state-run-banks-banks-to-enhance-recovery-rate-from-written-off-accounts-to-about-40/articleshow/99908818.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst), the rate of recovery from written-off loans is hardly 15%, suggesting that the so-called “technical write-off” of loans reflects that most of those loans cannot be recovered, which shows that there is no case whatsoever for condoning wilful default by borrowers, more so, no case for providing any leeway to those who commit fraud.

The PSU banks, forced to extend credit to the private corporate sector in the name of facilitating economic growth, already face a wide range of problems, such as asset-liability mismatch, unfair competition with private banks etc. RBI’s latest compromise settlement guidelines will only exacerbate the health of the PSU banks by sowing the seeds of yet another NPA crisis, which can cripple the economy.

I feel that the RBI should revisit the 2023 compromise settlement framework and rescind it. Instead, there is a strong case for RBI to tighten the restrictions on wilful defaulters.

Regards,

Yours sincerely,

E.A.S. Sarma

Former Secretary to the Government of India

Visakhapatnam

(Courtesy: Countercurrents.org.)