Modinomics = Corporatonomics: Part I

Ever since the Congress released its manifesto promising to implement a scheme, NYAY, under which it would guarantee a transfer of Rs 72,000 per year or Rs 6,000 per month to the poorest 20% of India’s households, the BJP has gone to town claiming that the scheme is not practical, and the country has no resources to implement it. But actually, as we show below, the scheme is very much doable, the government, if it so wishes, can implement not only this but also several other much needed welfare measures for the people.

The total budgetary receipts of the government, which are equal to its budgetary outlay, include tax revenue, non-tax revenue and capital receipts. The total receipts, and hence the total budgetary outlay of the Central government in 2019–20, is Rs 27.8 lakh crore. If the government wants, it can significantly increase this by increasing its tax and non-tax revenue. Can it do so? Yes, it can.

India: Low tax revenue

Budget 2019–20 estimates the gross tax revenue of the Centre to be Rs 25.5 lakh crorel, and net tax revenue to Centre to be Rs 17.1 lakh crore. Now, the fact of the matter is, the total tax revenue of the government is very low. This can be understood by comparing the total tax revenue of the Indian Government (Centre and States combined) as a proportion of GDP with other countries. India’s tax-to-GDP ratio (taking into consideration all taxes of the Centre and states) was 17.82% in 2016–17 (BE), according to the Indian Public Finance Statistics, Government of India, 2016–17. The Economic Survey 2015–16 says that India’s tax-to-GDP ratio is lowest among BRICS countries (Brazil 35.6%, South Africa 28.8%). It is lower than both the Emerging Market Economy (EME) and OECD averages, which are about 21% and 34% respectively.

It is thus obvious that there is a huge scope for the government to increase its tax revenue. If India’s tax–GDP ratio is to be brought to 26–27% (that is, a 50% increase), and since the Central government collects the bulk of the tax and non-tax revenue in the country, this means that the Centre’s tax revenues can be increased by at least 50%.

How to increase the government’s tax revenue

According to the Global Wealth Report 2016 compiled by Credit Suisse Research Institute, India is the second most unequal country in the world, with the top 1% of the country’s rich owning nearly 60% of the country’s wealth. The cumulative wealth of India’s billionaires was $440 billion in 2018[i], which translates into Rs 31 lakh crore, more than the budgetary outlay of the government in 2019–20. On the other hand, India also has the highest number of people living in abject poverty in the world—a staggering 276 million people lived on less than $1.25 per day at purchasing power parity (PPP) terms according to the World Bank in 2011. Taking another, more stringent measure, as of 2014, 58% of the total population were living on less than $3.10 per day. That is more than 600 million people.[ii] And as we have discussed elsewhere, even these terrible figures are underestimates by a wide margin, India’s poverty levels are actually horrendous.

Therefore, a simple way to increase tax income, and simultaneously reduce the enormous inequality prevailing in India, would be to increase taxes on the rich. This is precisely what the developed countries do; inequality in those countries is much less as compared to India because of progressive tax and fiscal policies.[iii]

Presently the tax collection system in India is grossly inequitous, and overwhelmingly favours the rich. On the one hand, as we discuss below, the government gives huge tax concessions to the rich, while on the other hand, the larger portion of the taxes it collects is from the ordinary people. To understand this, let us take a look at the tax structure of the government.

There are two types of taxes, direct taxes and indirect taxes. Direct taxes are levied on incomes, such as wages, profits, property, etc., and so fall directly on the rich; while indirect taxes are imposed on goods and impersonal services, and so fall on all, both rich and poor. An equitable system of taxation taxes individuals and corporations according to their ability to pay, which in practice means that in such a system, the government collects its tax revenue more from direct taxes than indirect taxes.

In most developed and developing countries, the direct tax revenue as a percentage of total revenue varies from 55% to 65% and more. But in India, for every Rs 100 collected by the government as tax revenue, only around Rs 30 comes from direct taxes (and the rest, Rs 70, from indirect taxes). The government is aware of this. The Economic Survey 2017–18 admits that direct taxes account on average for about 70% of total taxes in Europe. It also admits that India has much lower proportion of direct taxes in its total tax revenue as compared to other emerging market economies (except for China, which is a non-democratic country). An article in thewire.in points out that India’s personal income tax collection both as a percentage of revenues and as a percentage of GDP is much lower than not just the USA and OECD but also the BRICS countries (as a percentage of GDP, personal income tax in USA was 10%, around 8% for the OECD countries, 5% for China, 3.6% for Russia, and 8.5% for South Africa, but was just around 1% for India.[iv]

Most of the taxes collected by the States are in the form of indirect taxes. The direct taxes are mostly collected by the Centre. In the Centre’s tax revenue, the share of direct taxes has been falling since the UPA-II regime. The share of direct taxes in Centre’s gross tax revenue fell from 61% in 2009–10 to 56% in 2013–14, the last year of the UPA Government. Under the Modi Government, this has fallen further to 54.1% in 2019–20 BE. In other words, it has fallen by a full 7 percentage points in a decade.

Therefore, if the government reduces its tax concessions to the rich, as well as increases direct taxes on them, the Centre can easily increase its net tax revenue from Rs 17 lakh crore at present (in 2019–20 BE) to Rs 25 lakh crore at the minimum. In fact, as the measures given below suggest, it can even go up to Rs 30 lakh crore!

Let us discuss some possible steps that the government can take to do so.

i) Curb illicit capital flows to increase tax revenue

One way the government can increase its tax revenue is by curbing illicit outflows and inflows of money. According to the latest report by the international watchdog Global Financial Integrity released in April 2017, between $8–23 billion was illegally taken out of India and between $39–101 billion illegally came into India in 2014, primarily through trade mis-invoicing. Even if we take the lower figures, the total illicit financial flows total $47 billion. These illegal flows primarily take place to escape taxation; had the government taken strong steps to curb these flows and tax them, they could have yielded at least $12 billion or Rs 78,000 in taxes—this amount is 6.3% of the total tax revenue for the financial year 2014–15.

Unfortunately, the present BJP Government, despite all its rhetoric against corruption and black money, is simply not interested in taking firm steps to curb these illegal flows. As we have explained in an earlier article published in Janata Weekly on demonetisation[v], all the chest thumping by the new government about fighting corruption and curbing the black economy is a lot of hot air; the truth is that it is actually diluting anti-corruption legislations.

ii) Eliminate the huge tax concessions to rich

The most important reason for the low tax revenue of the Government of India is the huge tax concessions given by it to the rich. The budget documents reveal that in its first two years in power, the Modi–Jaitley Government gave tax exemptions given to the country’s uber rich totalling a mind-boggling Rs 11 lakh crore. These tax write-offs are in corporate income tax, customs and excise duties.

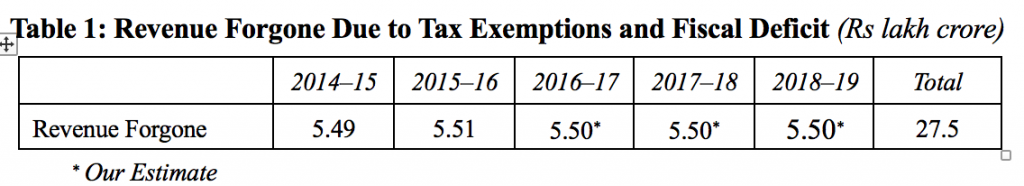

In the Union Budget 2017–18, the government changed the methodology for calculating these tax exemptions, and thus drastically lowered the estimated revenue foregone for the year 2016–17. We have calculated the revenue foregone for this year using the older methodology, to show that the revenue foregone was Rs 5.5 lakh crore for this year.[vi]

In the budget document of 2018–19, the government has not made a full estimate of the tax concessions given to the rich under excise and customs duties for 2017–18 as it said that the revenue forgone due to exemptions under GST will be calculated next year; the document calculates only the revenue foregone due to corporate tax concessions—and these have increased over the previous year. And for this year, this statement is missing, probably because it is an interim budget.

Considering the past behaviour of the government, and its overall attitude towards giving tax concessions and other subsidies to the rich, we can safely assume that the revenue foregone for 2017–18 and 2018–19 would be at least at the same level as during the first three years, which therefore means that the government must have given at least Rs 27.5 lakh crore of tax concessions in corporate taxes, excise duties and customs duties to the rich during its five years in power. (See Table 1)

But for the tax concessions given to the rich, the gross tax revenue of the government would have gone up from Rs 22.48 lakh crore in 2018–19 RE to at least Rs 28 lakh crore, an increase of 25%.

iii) Re-Impose Wealth tax

Wealth tax in India was abolished by the BJP after coming to power in 2015. As the wealth tax stood then, an assessee was required to pay 1% of the value of his assets above a certain threshold. But there were so many exemptions to this, that the wealth tax collection was only about ₹950 crore in 2014–15, a miniscule fraction of the ₹2.7 lakh crore collected by way of taxes on income on non-corporates that year.[vii] Using this as an excuse, Jaitley abolished the wealth tax.

It has been estimated by the Global Wealth Migration Review 2018 that the total wealth of India’s high net worth individuals, that is, the dollar millionaires, totals 48% of the total private wealth (total assets of private individuals less liabilities) in the country. India had a total private wealth of $8,230 billion or Rs 576 lakh crore in 2017, and of this, 48% or Rs 276 lakh crore was held by millionaires.[viii] A two percent wealth tax on this wealth would yield Rs 5.5 lakh crore. And if those with private wealth above $10 million are taxed at a higher rate, and the billionaires are taxed at a yet higher rate, this amount can be considerably increased to probably in the range of Rs 7–9 lakh crore. (Of course, this tax would have to be complemented by taxes on gifts and transfers which would be a means of evasion.)

iv) Re-impose Inheritance tax (also called estate duty)

This tax is perfectly in synchronism with the philosophy of a market economy; it was abolished in India in 1985. It is imposed by several developed countries, with rates ranging from 10% to as much as 55%. The most capitalistic of capitalist nations, the USA and the Netherlands impose a stiff inheritance tax with some states in the US impounding as much as 50 percent of one’s estate, leaving the inheritors only the remaining 50 percent. We propose a modest inheritance tax of one-third of the value of property inherited for only the country’s millionaires, whose number according to the Global Migration Review is 3.3 lakh. Assuming that every year 5% of their total wealth gets transferred to their children, or other legatees, as inheritance, then such an inheritance tax would fetch 276 x .05 x .33 = Rs 4.6 lakh crore per annum.

India: Low non-tax revenue

The non-tax revenue of the government is very low because of the huge transfers of public funds and resources to private corporations and the super-rich. But for these transfers, the government could have hugely increased its non-tax revenue, or it could have saved on its budgetary expenses. These transfers to the rich include loan write-offs, handing over control of the country’s mineral wealth and resources to private corporations in return for negligible royalty payments, transferring ownership of profitable public sector corporations to foreign and Indian private business houses at throwaway prices, direct subsidies to private corporations in the name of ‘public–private–partnership’ for infrastructural projects, and so on. These transfers of public wealth to private coffers total several lakh crore rupees. This implies that had the government not given these transfers, it could have increased the budget outlay by several lakh crore rupees. To give just two figures:

- During the first four years of the Modi Government, public sector banks have waived loans given to big corporate houses to the tune of Rs 3.1 lakh crore; additionally, they have also restructured loans of the ‘high and mighty’—which is a roundabout way of writing off loans—probably to the tune of ten lakh crore rupees (the actual amount is not known). Despite this, the total non-performing assets (that is, bad loans) of the banks had gone up to Rs 9.5 lakh crore as of June 2017; the RBI has now initiated a process of accelerated restructuring of these loans too.

- In the five budgets presented by it, that is, upto 2018–19 RE, the Modi Government has allocated a total of Rs 2.7 lakh crore just for construction of roads and highways. The government no longer constructs highways. They are now constructed by private corporations, who collect toll from the users to recover their investment. Then why is the government allocating so much money for construction of roads and highways? This is the subsidy being given by the government—not as loan but as grant—to private corporations as an ‘incentive’ so that they invest in construction of highways; it is another matter that apart from this subsidy, which is as much as 40% of the project cost, they get to keep the earnings from the toll as well.

It is because of this vampyrean plunder of the country’s wealth and resources by corporate houses that India now has the third largest number of billionaires in the world. This plunder has reached such rapacious proportions that even the RBI Governor Raghuram Rajan, himself an ardent votary of neoliberalism, has lambasted the collusion between “venal politicians” and “crony capitalists”. After observing that India has the second highest number of billionaires in the world per trillion dollars of GDP (after Russia), he pointed out that “three factors—land, natural resources, and government contracts or licenses—are the predominant sources of the wealth of our billionaires. And all of these factors come from the government.”

India: Low general revenue

These huge concessions / subsidies / transfers being given to the rich, both in the form of tax concessions and non-tax concessions, are responsible for the government’s low revenues and low budgetary outlay. Readers will be surprised to know that India’s total government revenue as percentage of GDP is amongst the lowest in the world. It is more than 40% for most countries of the European Union, going up to above 50% for countries like Belgium, France, Denmark and Finland. It is 29.7% for South Africa, 36.6% for Argentina and 31.6% for Brazil. The world average is 30.2%. But India ranks far below—the Indian Government’s total revenue is only 20.8% of GDP (this is total government revenues, Centre + States combined).

From the data given above about government’s tax revenue as compared to other countries, or from the data on government’s total revenue as compared to other countries, it is obvious that there is huge scope for increasing total government revenues in India.

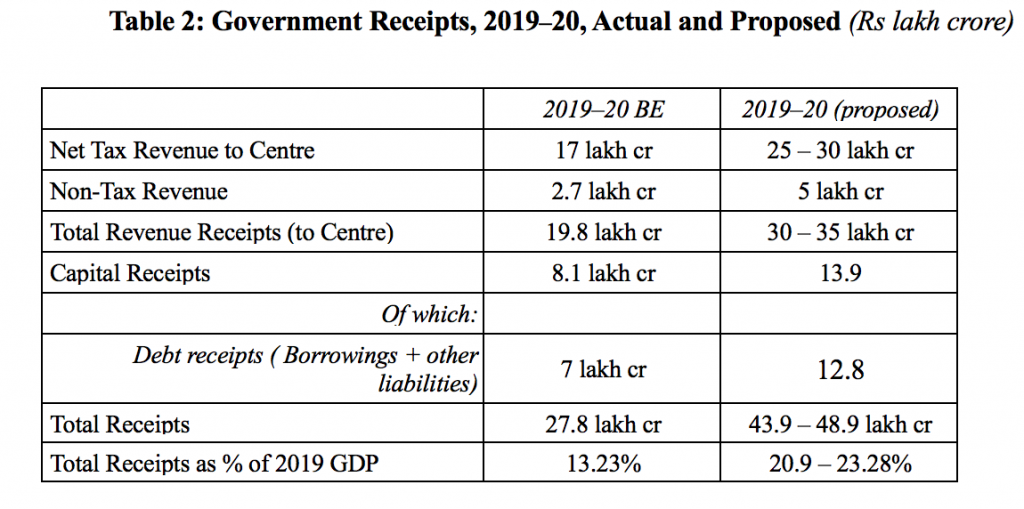

As discussed above, the government’s tax revenues (net tax revenue to Centre) can easily go up to Rs 25 lakh crore, or even Rs 30 lakh crore, from the Rs 17 lakh crore at present. The government’s non-tax revenue is Rs 2.7 lakh crore, it can also easily go up to Rs 5 lakh crore if some of the huge subsidies being given to the rich are eliminated. Therefore, this means that total non-debt revenue of the Centre can go up from Rs 20 lakh crore at present to at least Rs 30–35 lakh crore (see Table 2), and probably even more if the government develops the political will to increase taxes on the rich and reduce subsidies to corporate houses.

Increase borrowings

Apart from this, another way in which the government can raise money for increasing welfare expenditures is by indulging in deficit financing! The theory, that high levels of fiscal deficit relative to GDP will adversely impact growth, is humbug. John Maynard Keynes, one of the greatest economists of the 20th century, had debunked it long ago. He had argued that in an economy where there is poverty and unemployment, the government can, and in fact should, expand public works and generate employment by borrowing, that is, enlarging the fiscal deficit; such government expenditure would also stimulate private expenditure through the ‘multiplier’ effect. All developed countries, when faced with recessionary conditions, have implemented Keynesian economic principles and resorted to high levels of public spending and high fiscal deficits.

Then why have all our Finance Ministers—from Arun Jaitley to his predecessors—been harping on the need to curb the fiscal deficit? It is a part of the neoliberal economic model being implemented in the country. In the lexicon of this humbug economics, the concessions given to the poor, which are aimed at making available essential welfare services like education, health, food, transport and electricity to the poor at affordable rates, are given the derisive name of ‘subsidies’ and are being drastically reduced in the name of reducing the fiscal deficit. That this theory is a fraud is obvious from another simple fact: as mentioned above, the BJP has also been giving enormous subsidies to the rich, and these are much more than the few subsidies being given to the poor. If Jaitley was indeed so concerned about the fiscal deficit, he could have reduced these subsidies to the rich. But in the jargon of neoliberal economics, these subsidies to the rich are called ‘incentives’ and are considered to be essential for growth.

The total government borrowings as a percentage of non-debt receipts has fallen from 62% in the decade of the 1980s to only 39% during the five years of the BJP rule (2014–19). Assuming that the government borrows in the same proportion as the 1980s, the government borrowings can go up from Rs 7 lakh crore proposed in the 2019–20 budget to Rs 12.8 lakh crore.

Enough resources to finance NYAY and more

This would mean that the budgetary outlay of the Centre can easily go up to Rs 44 lakh crore or even Rs 49 lakh crore from the Rs 27.8 lakh crore budgeted in 2019–20 (see Table 2). That is an increase of Rs 16–21 lakh crore, which works out to between 7.6–10% of the GDP. That’s huge.

In its election manifesto for 2019 Lok Sabha elections, the Congress has promised to implement a scheme for guaranteed income support, NYAY, if voted to power. This scheme promises a transfer of Rs 72,000 per year or Rs 6,000 per month to the poorest 20% of India’s households. The BJP has criticised this scheme, saying that the country does not have resources to implement it. Now, the estimated number of households in India in 2018 is 25 crore; 20% of this number is five crore families. Five crore families multiplied by Rs 72,000 per family per year works out to an annual bill of Rs 3.6 lakh crore. Considering the huge amount of resources that can be raised, to the tune of Rs 15–20 lakh crore, if the government reduces the huge concessions being given to foreign and Indian corporate houses, and marginally increases the taxes on them rich, this guaranteed income transfer scheme is clearly doable.

In fact, the government if it so wishes can implement so many schemes to guarantee the poor a life of dignity, including good quality and free education and health care, decent old age pensions to all, and guaranteed jobs at minimum wages to all at decent wages, and also enormously increase its investment in agriculture to bring it out of the deep crisis that it is facing. The resources for all these investments can easily be raised—what is needed is the political will to increase the taxes on the rich.

Then, why is the BJP not doing it?

The reason is simple: the BJP is the most pro-big corporate government that has come to power at the Centre since independence. It must not be forgotten that in 2014 elections, India’s leading corporate houses had openly supported the BJP. That is because Modi had a very successful record of favouring corporates during his Chief Ministership of Gujarat. At an investor meet in Ahmedabad, Ratan Tata drenched Modi in praise saying that a state would normally take 90 to 180 days to clear a new plant but, “in the Nano case, we had our land and approval in just two days.” Modi’s ability to run the economy such that corporate houses can rake in big profits is best exemplified by the rapid rise of Gautam Adani from a small-time Gujarati businessman to one of India’s richest corporate honchos in a little over a decade—during the very years Modi was Chief Minister of Gujarat.[ix]

And so, as the 2014 Lok Sabha elections approached, India’s top corporate houses gradually came to the opinion that Modi should be backed for Prime Ministership. Anil Ambani stated: “Narendrabhai has done good for Gujarat and [imagine] what will happen if he leads the nation.” While his brother Mukesh Ambani gushed, “Gujarat is shining like a lamp of gold and the credit goes to the visionary, effective and passionate leadership provided by Narendra Modi.”[x] They liberally poured money into Modi’s election campaign, making Modi’s campaign expenditure the highest ever in India’s election history. It was an unprecedented election campaign, what with 3D holographic rallies, extensive use of the social media as never before, and a mesmerising media campaign.

After coming to power, the BJP has been running the economy solely to benefit India’s biggest corporate houses and the uber rich, because of which the wealth of the richest 1% in the country has zoomed to mindboggling levels. The number of dollar billionaires in the country has doubled during the first four years of Modi rule: in 2014, the Forbes list of billionaires had the names of 56 Indians; by 2018, this number had more than doubled to 119. The richest 1% have cornered most of the wealth being created in the country: Oxfam reported that in 2017, the richest 1% population cornered 73% of the country’s wealth generated in that year, because of which it estimated that the cumulative wealth of India’s billionaires rose 35% from $325 billion in 2017 to $440 billion in 2018![xi]

There is little room for doubt: the BJP is the most pro-corporate government to have come to power since independence. No wonder that it is raising the bogey of lack of resoures to criticise Rahul Gandhi and Congress’ NYAY scheme. The fact of the matter is, the country has enough resources not just for this guaranteed income transfer scheme, but to implement other welfare measures too that would provide all its citizens all the basic necessities required for people to live like human beings—healthy food, best possible health care, invigorating education, decent shelter, security in old age and clean pollution-free environment.

“India’s Billionaires Added $308 million a Day to Their Wealth in 2018”, January 20, 2019, https://qz.com.

[ii] “Poverty in India”, Wikipedia, https://en.wikipedia.org.

[iii] Rajul Awasthi, “India’s ‘Billionaire Raj’ Era: Time to Reform Personal Income Tax”, September 20, 2017, https://thewire.in.

[iv] Ibid.

[v] Neeraj Jain, “Demonetisation: One Year Later”, Janata Weekly, November 12, 2017, https://janataweekly.org.

[vi] Neeraj Jain, “Pandering to Dictates of Global Finance”, Janata Weekly, February 19, 2017, https://janataweekly.org.

[vii] “Why Jaitley Decided to Scrap Wealth Tax”, March 8, 2015, https://www.thehindubusinessline.com.

[viii] “Global Wealth Migration Review”, February 2018, https://samnytt.se.

[ix] Siddharth Varadarajan, “The Cult of Cronyism”, March 31, 2014, http://newsclick.in; Lola Nayar, Arindam Mukherjee, Sunit Arora, “All Along the Waterfront”, March 10, 2014, http://www.outlookindia.com.

[x] Siddharth Varadarajan, ibid.

[xi] “India’s Billionaires Added $308 million a Day to Their Wealth in 2018”, op. cit.

Read more