Introduction

The subject of labour reforms has been under debate over the last two decades in India. The dominant narrative is that there are too many labour laws and most of those are quite old and they are adversely affecting India’s employment potential. Liberalization of the economy started happening in 1991. In line with the changing scenario of a liberalizing economy, there was a growing demand to have broad-based labour reforms as part of the second-generation reform from the late nineties and early 2000. Thereafter, the idea of labour reform is in wide circulation evoking debates in the public domain. Although academicians, policymakers, the civil society and other stakeholders are part of this debate nothing much happened till recently when the Centre came up with the idea of four Codes in 2017 namely on four broad categories wage, industrial relation, social security and occupational safety health working condition. This Paper looks into the critical areas of the proposed Codes.

Background and Context

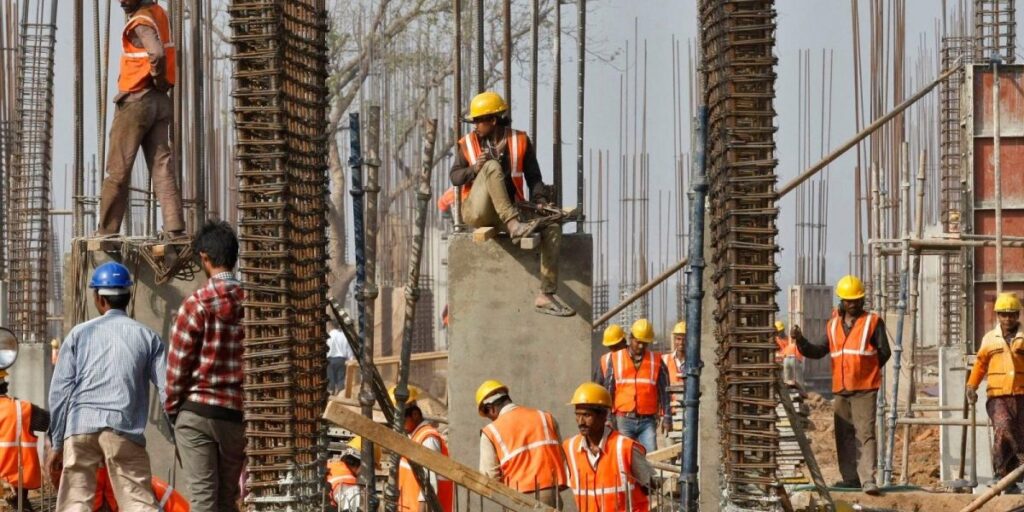

During the last two decades and a half, India has witnessed significant changes in the world of work. There has been large-scale informalization of the labour force (93 per cent being the share of informal labour) and a corresponding growth in non-standard employment, an increase in decent work deficits, a decline in social dialogue and tripartism, a weakening of trade unions, and a shift in focus from enforcement of labour laws to redistribution through various social security schemes. During the same time period, India has experienced considerable reforms in labour administration as well as labour legislation. Such reform initiatives have included increasing use of technology, a greater focus on skill development and employment generation, introduction of social security and welfare schemes, and amendments of certain provisions of labour laws. The reforms have been primarily administrative in nature. State vis-à-vis citizen client relation has already replaced the erstwhile tripartite structure (State-Employer-Employee) based on redistribution in an environment of stagnating labour market regime.

Possible repercussions these Codes might have on the working class are discussed below:

Issues with Industrial Relations Code 2020

- The obligation to seek prior permission for industrial establishments with 300 or more workers before lay-off, retrenchment or closure. The threshold has been increased from 100 to 300. That makes way for hire and fire regime as most of the units In India are small and medium-sized. Increasing threshold from 100 to 300 implies that in the majority of organizations employers would be able to lay-off/retrench/close without the concurrence of the labour administration.

- Provide for “sole negotiating union” for negotiations with 51% or more representation of workers in a trade union, in absence of which a “negotiating council” would be constituted for the purpose.

The Code provides for a negotiation union in an industrial establishment for negotiating with the employer. If there is only one trade union in an industrial establishment, then the employer is required to recognize such trade union as the sole negotiating union of the workers. In the case of multiple trade unions, the trade union with the support of at least 51% of workers will be recognized as the negotiating union by the central or state government.

Section 14 (3) states that If more than one Trade Union of workers registered under this Code is functioning in an industrial establishment, then, the Trade Union having fifty-one per cent or more workers on the muster roll of that industrial establishment, verified in such manner as may be prescribed, supporting that Trade Union shall be recognized by the appropriate Government or any officer authorized by such Government in this behalf, as the sole negotiating union of the workers.

The implication of section 14(3) is that if there exists one big trade union (having fifty-one percent or more membership share), other smaller trade unions will become redundant as those would not be recognized by the employer. Collective bargaining will remain worryingly unitary as one big trade union will be the sole bargaining agent in all tripartite talks. Smaller trade unions will not get the opportunity to grow and prosper. Trade unions usually take time to grow within an organization. During the formation period, a trade union has fewer members. With time and through greater mobilization, membership grows. Mobilization happens through advocating workers’ rights in bargaining forums and pushing agenda that enhances compensation and welfare entitlements.

Now, under section 14(3), smaller trade unions will not get the opportunity to participate in the bargaining process and will be denied the subsequent opportunity of expanding their base. This implies that the bigger trade union, being the sole bargaining agent, will monopolize the trade union rights and continue to exist even if it is unable to protect workers’ rights.

- Prohibit strikes and lockouts (a) without giving 14 days’ notice and going for it “within 60 days” (b) “also during the pendency of conciliation proceedings” before a conciliation officer and continues through the proceedings in the tribunal, (c) “during” the pendency of arbitration or settlement or award is in operation, etc., besides providing stiff punishment for violations (fine up to Rs 10,000 and a month’s imprisonment). In such a context, a legal strike would be an impossibility as the obligation to give notice will attract intervention from the State and once there is intervention, a strike will not be legally feasible.

- The Code legalizes fixed-term employment. This may herald a move from permanent to fix-term employment.

- Fixed-term employment means the engagement of a worker based on a written contract of employment for a fixed period

Provided that

(a) hours of work, wages, allowances and other benefits shall not be less than that of a permanent workman during the same work or work of similar nature and

(b) he shall be eligible for all statutory benefits available to a permanent workman proportionately according to the period of service rendered by him even if his period of employment does not extend to the qualifying period of employment required in the statue Until now available for only the textile and garment sector.

The positive aspect of the proposed new section on FTE in the Code on Industrial Relation is that it legalizes forms of employment that are already in vogue. It will make such contracts formal and the period of employment would also be mentioned in clear terms. Those who would be employed under FTE will also enjoy benefits that are otherwise available to regular employees. Legal validation is an improvement over the present situation. This provision ensures job security during the period of employment and access to certain other benefits too including social security benefits. It further helps to avoid the engagement of contractors between employer and employees. Rather, it helps in establishing the employer-employee relationship in a context of systematic mystification of employer-employee relation.

The flip side is that the concept of regular employment might vanish in the thin air in the process. Regular employment is on the decline. There has been steady informalization of the workforce over the last three decades. This happened within the formal sector too. It’s a testimony to the fact that the labour market in India has in-built flexibility. Informalization continues to increase despite some protective labour laws being in place. Share of contract labour kept on increasing. The proportion of contract workers in organized manufacturing increased from 12 percent in 1990-91 to 33.6 percent in 2013-14. Share of contract workers’ wage out of total wage increased from 58.7 percent in 1999-00 to 81.5 percent in 2013-14. The proportion of informal sector workers out of the total workforce is more than 90 percent

- With regards to the Standing orders, all industrial establishments with at least 300 workers must prepare standing orders on matters listed in a Schedule to the Code. The central government will prepare model standing orders on such matters, based on which industrial establishments are required to prepare their standing orders. Here also, the threshold has been increased from 100 to 300. Lack of certified standing order in establishments employing up to 299 workers would be going to hurt their terms of employment and conditions of service.

Issues with Code on Wages 2019

- Floor Wage: According to the Code, the central government will fix a floor wage, considering the living standards of workers. Further, it may set different floor wages for different geographical areas. Before fixing the floor wage, the central government may obtain the advice of the Central Advisory Board and may consult with state governments.

The minimum wages decided by the central or state governments must be higher than the floor wage. In case the existing minimum wages fixed by the central or state governments are higher than the floor wage, they cannot reduce the minimum wages.

However, the rationale for having floor wages and the manner of determination of floor wages have not been defined in the draft Rules. Also, there should be clear regarding how floor wage is different from minimum wage. It seems floor wage has different connotations as opposed to minimum wage. Such distinctions should be spelt out.

- Fixing minimum wage: Minimum wage is a dynamic concept. But there must be a provision for revising the ’basic’ component of minimum wage also. This aspect is missing in the Rule. A new section should be introduced to provide the mechanism to redefine the ’basic’ part based on the periodic survey on family budget expenditure. Consumption pattern changes over time. Certain products lose their relevance whereas certain new products come into existence. The consumption basket should change accordingly. Family budget expenditure survey should happen every 5 year and ’basic must be revised accordingly. Otherwise, minimum wage revision through periodic DA adjustments will not suffice to maintain sustainability over time.

- Inspectors-cum-facilitators: The Code provides for the appointment of inspectors-cum-facilitators and their powers. These authorities would have a dual function — providing compliance advisory to employers and workers and conducting inspections.

Further, as per the Code, the appropriate Government may lay down an inspection scheme, which may also contain web-based inspection processes.

In that Inspection matrix, the inspection schedule of each inspector cum facilitator is to be determined through randomization under ordinary circumstances.

Proposed formulations pre-suppose certain things which violate ILO’s principle of inspection norm (Convention 81). Inspector/facilitator should have the sovereign power to inspect any premises if s/he thinks it appropriate. The inspection mechanism should not be diluted under any circumstances.

- Issues in calorie determination: The determination of minimum wages crucially depends on calorie requirement. In the new enacted Code on Wages 2019, the specified energy requirement is 2700 Kcalories. As per the convention, the standard working-class family includes a spouse and two children apart from the earning worker; and the equivalent of three adult consumption units.

However, standard working-class families should be equivalent to 3.5 consumption units. The present calculation is based on 1+.8+.6+.6=3. It should be 1+1+.75+.75=3.5. Gender discrimination in the form of lower consumption (.8 instead of 1) of the female adult member of the family should be avoided. Further, child calorie requirement is not as low as .6 and should be at least enhanced to .75. Children require greater calories during their growing-up period.

- The relative importance of non-food items: Existing practice is that non-food consumption is taken as a dependent on food expenditure. Food consumption is given paramount importance in the consumption basket and non-food consumption is taken as a residual and derivative. Non-food consumption is taken as 25 per cent of food consumption. However, the consumption pattern has undergone significant changes over the years and non-food items are presently important in their own rights and no longer are derivative demand. Quantum of non-food items should be determined independently. With the increase in income, the importance of non-food items has increased.

- Spread over an urban-rural categorization: Code on Wages Rules 2019 proposes that the number of hours of work that shall constitute a normal working day inclusive of a period of rest should not exceed twelve hours.

If this is implemented, there is a possibility that certain employers would take advantage of such an expanded window and reduce three shifts to two shifts. Given the exploitative nature of Indian employers and labour market imbalances where supply far exceeds demand, hours of work including spread-over should not exceed more than ten and half hours. Twelve hours will detain the workers unnecessarily and provide scope for rampant misuse. Already in the number of instances, three shifts have been converted into two shifts for all practical purposes.

Code on Wages Rules 2019 suggests that the Central government shall divide the concerned geographical area into three categories that say the metropolitan, non-metropolitan and rural. So far the practice was to divide regions into categories is rural and urban. Dividing urban areas into subcategories metropolitan and non-metropolitan should be avoided. It will unnecessarily complicate the scenario. Other data and information are collected based on urban-rural classification only.

Issues with Social Security Code 2020:

- The definition of employees should be broadened. The following may be added.

IT and ITES organizations, Private educational institutions, private hospitals and nursing homes, NGOs, charitable societies and trusts

- Definition of ‘unorganized worker’ should be broad-based to include all forms of workers as far as possible:

‘Unorganised Worker’ means a home-based worker including domestic worker, self-employed worker, commission-based worker including gig and platform workers, or a wage worker in the unorganised sector and includes a worker in the organized sector who is not covered by the Industrial Disputes Act, 1947 or Chapter III to VI;

- Overall threshold limits in terms of the number of employees remain with regards to provident fund, gratuity and maternity. As a result, an opportunity to make social security universal is lost.

- Registration of Establishments: It seems State Government has no role in the registration of factories and establishments. The question remains what happens to factories and establishments for which appropriate government is State Government. Will they also register with Central Government?

- No mechanism to report Interstate accidents exist at present: There is a large number of footloose workers crisscrossing the length and breadth of the country in search of livelihoods. The majority of unorganized sector workers are also migrants.

- Central Government may empower a Nodal Officer under the State Government to make correspondences with other State Governments in cases involving migrant workers and take appropriate actions to resolve the matter within a definite time frame.

- Existing Schemes run by the State governments: Needs continuation of existing schemes formulated by the State Government. The eighth Schedule may be added to list out existing Schemes by State Governments.

These sections do not talk about existing social security scheme(s) run by State Government. There is a need for clarification on how existing schemes be integrated within this Code.

Along with the continuation of existing beneficiaries, the minimum age for registration should be 18 instead of 16 because to be qualified as an adult worker one should be at least eighteen years.

- Review before appellate authority: Where an order under sub-section 121(1) is passed against an employer exparte, he may, within three months from the date of communication of such order, apply to the Authorized officer who conducted the inquiry for setting aside such order and if the Authorized Officer is satisfied that the show cause notice was not duly served or that such employer was prevented by any sufficient cause from appearing when the inquiry was held, the Authorized Officer shall make an order setting aside his earlier order and shall appoint a date for proceeding with the inquiry.

- Making a review application before the same authority who has passed an exparte order is a roundabout process and possibly drag the entire thing.

Under Section 91 of this Code, officers of the Labour Commissionerate can be entrusted with the duty of taking hearings & issuing order/findings concerning the matters related to employees’ compensation. It is already prevalent in many states in India.

- There is overlap in defining unorganized workers, gig and platform workers and construction workers. Unorganized workers are the broad set, within that gig/platform and construction workers are sub-set. Unorganized workers change place and change occupations very frequently based on availability.

- Unorganized workers have been included within the broad social security framework but that is restricted to inclusion within social security schemes. However, social security scheme is not comparable with institutional social security. Unorganized sector workers remain outside the purview of institutional social security.

Issues with Occupational Safety Health and Working Conditions:

- Certain workers not covered under the Code: The Code covers establishments with 10 or more workers. It excludes establishments with less than 10 workers. This raises the question of whether workers in smaller establishments should be covered by health and safety laws.

It has been argued that the application of labour laws based on the number of employees is desirable to reduce the compliance burden on infant industries and to promote their economic growth. To promote the growth of smaller establishments, some states have amended their labour laws to increase the threshold of their application. For instance, Rajasthan has increased the threshold of applicability of the Factories Act, 1948, from 10 workers to 20 workers, and from 20 workers to 40 workers. Note that a similar amendment was proposed in the Factories (Amendment) Bill, 2014, which lapsed with the dissolution of the 16th Lok Sabha.

- Civil Court barred from hearing matters under the Code: Under the existing health and safety laws, claims which affect the rights of workers such as wages, work hours, and leave, are heard by labour courts and industrial tribunals. However, the Code bars the jurisdiction of civil courts and does not specify that such disputes arising under it may be heard by these labour courts and tribunals.

Further, there may be other health and safety-related disputes. For example, an employer/employee may wish to challenge an order passed by an Inspector which identified certain safety violations at the workplace. In such a case, the employer/employee may file a case in the civil court for seeking remedy against the orders passed by the Inspector. An appeal may be filed before the High Court and ultimately before the Supreme Court. However, the Code bars civil courts from hearing any dispute under the Code. As a result, employers/employees who are aggrieved by the orders of the Inspector and by the notified administrative appellate authority will not be able to challenge it in a civil court. The only recourse available to them would be to directly file a writ petition before the relevant High Court. It can be argued that the bar on civil courts from hearing matters under the Code may deny aggrieved persons an opportunity to challenge certain issues before a lower court.

- Wages not defined in the Code: The Code refers to “wages” in provisions relating to overtime work and calculation of leave. However, it does not define the term. Different laws contain varying definitions of the term ‘wages’. For instance, the Code on Wages, 2019 defines ‘wages’ to include basic pay, dearness allowance and retaining allowance, whereas the definition of wages in the Payment of Gratuity Act, 1972 does not include retaining allowance. It is unclear as to which definition of ‘wages’ will apply to the Code. This may lead to uncertainty in the interpretation of the term to calculate overtime wages and earned leave.

- Several matters left for notification by the government: The Code makes provisions for various welfare facilities, health and safety standards, and work hours for workers. However, it does not specify the standards but empowers the appropriate government to notify them. The Acts which are being subsumed by the Code specify these standards. For example, the Acts governing factories, mines, and beedi workers specify maximum work hours of 9 hours per day and 48 hours per week. Similarly, some of these laws make provisions for drinking water, washrooms, and first aid facilities. The question is whether minimum requirements should be specified in the Code itself on matters such as work hours, safety standards, and working conditions (e.g. washrooms and drinking water).

- The rationale for some special provisions is unclear: The Code contains general provisions which apply to all establishments. These include provisions on registration, filing of returns, and duties of employers. However, it also includes additional provisions that apply to the specific type of workers such as those in factories and mines, or as audio-visual workers, journalists, sales promotion employees, contract labour and construction workers.

It may be argued that special provisions on health and safety are required for certain categories of hazard-prone establishments such as factories and mines. It may be necessary to allow only licensed establishments to operate factories and mines. Similarly, special provisions may be required for specific categories of vulnerable workers such as contract labour and migrant workers. However, the rationale for mandating special provisions for other workers is not clear.

For example, the Code requires that any person suffering from deafness or giddiness may not be employed in construction activity that involves a risk of an accident. The question is why such a general safety requirement is not provided for all workers. Similarly, the Code provides for registration of employment contracts for audio-visual workers, raising the question of why there is a special treatment for this category.

Further, the Code specifies additional leave for sales promotion employees. It also specifies that working journalists cannot be made to work more than 144 hours in four weeks (i.e. an average of 36 hours per week). For all other workers covered under the Code, the minimum leave and maximum work hours are prescribed through rules. The rationale for differential treatment concerning working conditions between working journalists and sales promotion employees on the one hand, and all other workers, on the other hand, is unclear.

Conclusion

Formulation of Codes is a step in the right direction. There are too many labour laws. Basic definitions are different in different acts. These cause lots of confusion among the stakeholders. Most of the labour laws are old and some of the provisions do not fit into contemporary reality. Also, the world of work has undergone significant changes over the years. The Indian labour market too had undergone structural transformations. However, certain limitations and rigidities still remain. Code is being construed at a very critical juncture. It’s not a mere reformulation of existing labour laws but it is an opportunity to address various fundamental issues confronting the Indian labour market. However, Codes as proposed (Code on Wages already passed) have certain prominent shortcomings in many aspects like ensuring minimum job security, trade union participation in collective bargaining, fixation of minimum wages, gender discrimination in calorie entitlement, universalization of social security and occupational safety and health. To make Codes more balanced, robust and aligned to prevailing labour market realities in India and the world, more deliberations and fine-tuning are needed. Codes in their present proposed forms fall significantly short of the aspirations.

Bibliography

- Alessandrini, M., (2019), Jobless Growth in Indian Manufacturing: A Kaldorian Approach, accessed 31 Jan 2019 at https://www.researchgate.net/publication/255611152.

- Govt of India, (2002), Report of the National Commission on Labour (2nd), Ministry of Labour & Employment, Govt. of India, New Delhi.

- Govt of India (2015), Unemployment Employment Survey 2013-14, Labour Bureau, Ministry of Labour & Employment, New Delhi.

- Heyes J., and Rychly L., (eds.), (2013) Labour Administration in Uncertain Times, Policy, Practice and Institutions, ILO, Edward Elgar. Publishing: London.

- ILO (2011), Labour Administration and Labour Inspection, Report V, International Labour Conference, 100th session, Geneva.

- Sarkar K., (2016), ‘Enhancing Labour Administration’s Performance in India’, NLI Research Study Series, 118/2016, VVGNLI, Noida, India

- Sen Gupta, A. K. (2003), ‘Decline of Trade Union Power in India’, The Indian Journal of Labour Economics, 46 (4), 685-701.

- Ventakanarayan M and Naik, Suresh V. (2013), ‘Growth & Structure of Workforce in India’, MPRA Paper, XXI (52) accessed 30 January 2019 at https://mpra.ub.uni-muenchen.de/id/eprint/48003

(Dr. Kingshuk Sarkar is an associate professor at the Goa Institute of Management and also worked as a labour administrator with the Government of West Bengal. He earlier served as a faculty of the V V Giri National Labour Institute, Noida and NIRD, Hyderabad. Courtesy: Mainstream Weekly.)