According to the currently dominant ideology, the private sector is more competent, efficient, and technologically capable than the public sector, and thus public-private partnerships save public money. The World Bank says:

Public-private partnerships (PPPs) can be a tool to get more quality infrastructure services to more people. When designed well and implemented in a balanced regulatory environment, PPPs can bring greater efficiency and sustainability to the provision of public services such as energy, transport, telecommunications, water, healthcare, and education. PPPs can also allow for better allocation of risk between public and private entities.[2]

This ideology has been embraced by India’s rulers. In February 2021, Prime Minister Narendra Modi declared, “the government has no business to be in business”:

The private sector brings in investment as well as the best global practices. It brings in top quality manpower and transforms the management. It further modernizes things and the entire sector is modernized. It also leads to rapid expansion of that sector and creates new job opportunities also. Monitoring is equally important so that the entire process remains transparent and according to the rules. That is, we can further increase the efficiency of the entire economy through monetizing and modernizing.[3]

Let us examine these claims through a case study, the case of the Delhi Airport Metro.

1.0 The Supreme Court Award

On September 9 2021, the highest court in the country upheld an earlier arbitral tribunal award directing Delhi Metro Rail Corporation (DMRC) to pay Rs 2,782 crores, with interest, to a consortium led by Reliance Infrastructure Ltd (RInfra), which had operated the line till 2013. According to estimates, along with interest and other costs, the amount will be close to Rs 5,000 crores.[4]

DMRC is the company that runs the Delhi Metro in the national capital region, by far the largest and busiest metro in the country. It is equally owned by the Central and Delhi governments. The dispute had arisen as RInfra had terminated the agreement in October 2012, citing the failure of DMRC to cure defects in the civil structure supporting the Airport Metro Express Line. The tribunal had ruled in favour of RInfra and associates in May 2017.

DMRC-RInfra was one of the early public-private partnerships for a metro rail project, initiated when Delhi was supposed to host the 2010 Commonwealth Games. The award (upheld by the recent Supreme Court order) is large: even in 2019-20, before the pandemic, the annual revenues of Delhi Metro were less than Rs 4,000 crores. Despite the size of the award, the high profile nature of the project, and the fact that this dispute has gone through various stages over the course of a decade, the award has hardly attracted any analysis in the media or academia.

The present piece is an attempt to unpack this pioneering PPP, understand what underlies the dispute, and analyse this award and its larger meaning regarding State policy and the infrastructure sector. First we will provide the bare details of the project, followed by a discussion on the DMRC-RInfra dispute and developments at various stages of the dispute resolution. In the concluding part we discuss the larger implications of the project, the dispute resolution and the award.

2.0 Background of the Project

In March 2007 DMRC invited bids for the PPP on a 23 km stretch from New Delhi Railway Station to Dwarka via Indira Gandhi International Airport, on a build-operate-transfer (BOT) basis for 30 years. This means that the private investor builds the project and operates it for 30 years to get the returns on its investment, and then transfers the asset back to the public agency.

The project was awarded in January 2008 to Reliance Energy Ltd., part of the Anil Ambani group; a few months later Reliance Energy was renamed Reliance Infrastructure. A special purpose vehicle (SPV), that is, a specific corporate entity for the purpose, by the name of Delhi Airport Metro Express Pvt. Ltd. (DAMEPL), was created with 95 per cent stake of RInfra and 5 per cent stake of Construcciones y Auxiliar de Ferrocarriles, S.A. (CAF) of Spain. DMRC and DAMEPL signed the PPP agreement in August 2008.

While DMRC was to undertake design and construction of the basic civil structure, including viaducts, tunnels, stations, etc. on which the rolling stock would move, the finance, design, procurement, installation, operation & maintenance of the Line was to be done by DAMEPL. This meant that DAMEPL was to take care of the rolling stock, electrification, track, signalling & telecom, ventilation & air conditioning, fare collection system, baggage handling, depot, etc. The total project cost was to be around Rs 5,700 crores, out of which DMRC was to invest Rs 2,800 crores for its part while DAMEPL was supposed to bring in the rest of the investment.[5]

Land acquisition for the civil works was the responsibility of DMRC. The land for the project was allocated at practically no cost by the state agencies. The Line finally started its operations in February 2011, well after the Commonwealth Games were over, and after missing multiple deadlines. In fact, DMRC slapped a penalty of Rs 60 crores on DAMEPL for the delay.[6]

In April 2012, DAMEPL claimed that the project was financially ‘nonviable’, and sought deferment of the charges that it was to pay to DMRC for their part of the investment in the project; however, DMRC did not agree to the request.[7] In July 2012, DAMEPL gave a final notice that it was stopping the line, and it terminated the contract, alleging DMRC’s failure to cure serious structural defects in the civil construction. The DMRC went for arbitration proceedings against DAMEPL’s reneging on the contract. The dispute went through multiple stages, finally resulting in the Supreme Court award in favour of RInfra in September 2021.

2.1 Project Financing

By their very nature infrastructure projects require large investments, and returns can come only over a long period of time. This is even more so if the infrastructure caters to the public in a poor country like India, as is the case with metro rail in Delhi. This is the primary reason that, before the rise of neoliberalism and the drive to make profits from everything, such projects were generally funded and operated by states all over the world.

Not surprisingly, the detailed project report (DPR) of the Delhi Airline Metro admits that, “Rail based systems are heavily capital intensive with long gestation periods…”, and hence, “grants and subsidies for operations as well as additional investments (by the state) are the order of the day.”[8] In fact, that is why a public agency, in this case DMRC, was willing to bear half of the investment of the project (not including land costs); and even for the rest, the tender had a provision for ‘viability gap funding’, that is, additional subsidies from the state, if the private bidder sought them. But RInfra, in all its wisdom, bid very aggressively and did not seek any further funding.[9] Additionally, as per the ‘concession agreement’,[10] DAMEPL would pay a concession fee of Rs 51 crores during the first year of operations for the investments of DMRC, and the amount payable would be enhanced at the rate of 5 per cent per annum from the second year of operations onwards. Moreover, DAMEPL was to share revenues with DMRC at the rate of 1 per cent per annum for the first 5 years of the operations of the Line, 2 per cent for the next five years, 3 per cent for the five years after that, and at the rate of 5 per cent of the annual revenues after 15 years of operations. The revenues were supposed to be maintained in an escrow account[11] that could be monitored by DMRC.

The project cost of Rs 2,885 crores by DAMEPL was supposed to be funded in the debt-equity ratio of 70:30, meaning that Rs 865 crores were to be brought in as equity by the concessionaire and the rest was to be arranged as debt.[12] The company arranged for a rupee term loan of close to Rs 1500 crores, and another foreign currency loan of $106 million (more than Rs 500 crores).[13] The amount was largely borrowed from a consortium of banks consisting of Axis Bank and some public sector banks. Though the Anil Ambani Reliance group was supposed to invest Rs 865 crores in the project as equity, even after one year of operations in March 2012, its equity capital in the project was a paltry Rs 1 lakh — the minimum stipulated under the Companies Act. It had invested another Rs 612 crores in the project, but as ‘share application money’ that was never converted into equity shares. As pointed out by an Economic Times report,[14] prolonging the holding of funds in the form of share application money is a questionable transaction: though the money is brought in, the shares are not issued for it (normally such funds would be converted into shares within a month or two of their receipt). Such an irregular practice may be used to bring in suspect money, but in this case it is a reasonable guess that Reliance was keeping open its options to walk out of the project at any moment, by keeping its actual stake at next to nothing! Later the ‘share application money’ was converted into ‘interest free unsecured subordinate debt’. We will discuss this further in the next section when we get into the details of the dispute.

Then, in April 2012, RInfra changed the ownership pattern in DAMEPL by transferring 65 per cent of the equity from RInfra, a listed company, to a trust controlled by the Anil Ambani group. Thus, DAMEPL became an ‘associate’ of RInfra, and ceased to be a subsidiary of it. Most likely the change was undertaken to evade the regulatory compliance and liability that are required of a listed company, and there was speculation that Reliance was planning an exit from the project. In fact, at this point, DMRC issued notice to DAMEPL questioning this ownership transfer, as the concession agreement stated that the concessionaire could not restructure equity for two years from the commencement of the agreement. The response of RInfra was that the PPP agreement was signed in March 2008 (though operations commenced only in 2011), but it also dismissed the DMRC objections by stating for good measure that it was a ‘mere entry in the accounting registers’![15]

3.0 The Dispute

In May 2012, after operating the Metro Line for 15 months, DAMEPL complained of serious faults in the civil construction that had been undertaken by DMRC, from faulty design/installation of viaduct bearings to girders sunk at multiple locations due to deformations/cracks that could lead to serious safety issues. Within weeks, DMRC responded that it had carried out inspection and found no bearings damaged, though it admitted that there were some related damages, advising DAMEPL on speed restrictions for safely operating the Line. It also added that many of them were ‘routine problems’. In early July, Ministry of Urban Development, GoI convened a meet of all the concerned stakeholders, including Indian Railways, and formed a joint inspection committee for the matter; the committee filed an interim report on 5th July. The report identified serious defects in the civil works and sought a more detailed examination.[16] Immediately after this, on 8th July, DAMEPL stopped operations, and by July 29 it issued a final notice to DMRC to cure the defects within 90 days from the first notice, providing a long list of major defects with the civil construction.

Developments proceeded in the same direction, with added momentum. A number of meetings were held between the concerned parties, that were also attended by SYSTRA, the original design consultant for the viaduct section of the project. According to DMRC, RInfra started talking about poor civil work only once the former refused to defer the concession fee of Rs 51 crores and other related dues of the DMRC, and hence the problem was not the defects but somewhere else. Reportedly, Reliance was losing about Rs 1 crore a day before the line was shut down, accumulating losses of Rs 341 crores in the first year of operations. At this point it sought a five-year moratorium on the payments to DMRC.[17] DAMEPL stuck to its position, and on October 8, 90 days after it stopped operations, on October 8 it issued a notice terminating the agreement accusing DMRC of defaulting.

In response, almost immediately, DMRC invoked arbitration proceedings as per the agreement. Six months later, in January 2013, after some repairs were done by DMRC and a safety certificate was issued by the safety commissioner, the operations were resumed by DAMEPL. But it made it clear that it started the line as per “instructions of DMRC” as “an agent in public interest”[18]. The DMRC once again did not agree with DAMEPL, and insisted on a speed limit of 40 kmph and regular monitoring for safety. Six months later, on June 30, DAMEPL unilaterally stopped the operations once again and handed over the Line to DMRC this time.

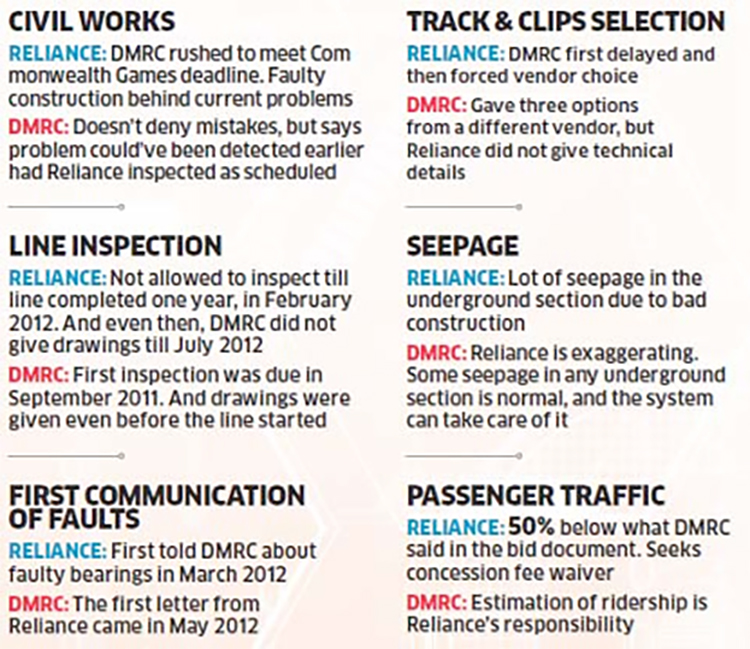

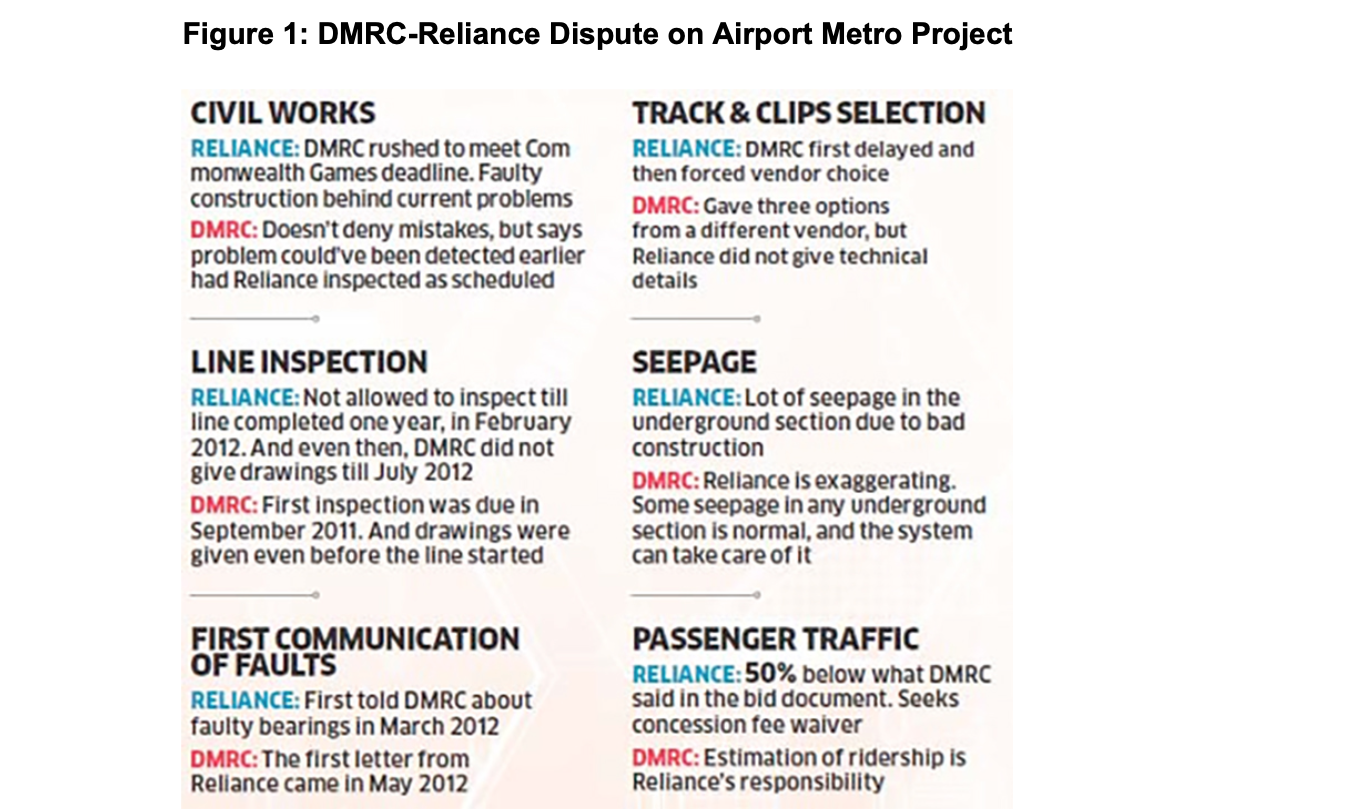

Once the two parties went for arbitration and the dispute was out in the open, media reports make it obvious that there was little ‘partnership’ in this PPP, and the two parties were at loggerheads right from the start of the project, from civil works, to selection of equipment, to inspection and maintenance, to assessment of market potential of the project, to sharing of revenues. The last item finally led to withdrawal of the concessionaire, as they could not find the returns that they were seeking. Apparently the two parties exchanged about 160 letters in just the three months before the closing of the Line concerning all the issues that have been flagged above, trading charges and counter charges (see the Figure below) [19]. The reports are revealing and demonstrate the divergence of perspectives. While the investments are shared and it is difficult to divide and hence fix individual responsibilities for specific tasks, it is difficult to make a joint project tick when immediate returns are simply not possible for the private investor.

3.1 Tribunal Award

The dispute was referred to three arbitrators selected from a panel of engineers with relevant experience belonging to the government and/ or PSUs, serving or retired, as per the provisions of the concession agreement. The key issue of dispute between the two parties was the validity of the termination notice and the real motive behind it. Both the parties filed claims and counterclaims worth more than Rs 3,000 crores plus interest.

The Tribunal declared its award in May 2017, and ruled that the defects adversely impacted the integrity of the civil structure; it further opined that there were twists in the girders that were not rectified by DMRC. Additionally, it proclaimed that the defects were not addressed by DMRC within 90 days of identification by DAMEPL, and hence the former was in breach of the agreement. Thus the tribunal ruled that the termination notice issued by DAMEPL was valid.

Moreover, the tribunal ignored the distinction between the shares converted into equity and share application money as discussed in Section 2.1 above, and considered all of the share application money of Rs 612 crores as ‘equity’. As per the relevant provisions of the concession agreement, it further worked out the ‘Adjusted Equity’ at Rs 983 crores and awarded a total amount of Rs 2782.33 crores, plus further interest, as Termination Payment to DAMEPL.[20]

3.2 Appeal of DMRC in the Delhi High Court (HC)

In March 2018 a single judge bench of the Delhi HC dismissed the appeal by DMRC against the tribunal award. But a division bench of the same court reversed the judgment in January 2019 and upheld the contention of DMRC. At the heart of the division bench judgment on the civil defects, and whether they were addressed appropriately or not by DMRC, was the fact that the Airport Line was being successfully and continuously operated by the DMRC since it was handed over to them by DAMEPL in 2013.

The court noted: “The fact that speeds were increased from time to time and numbers of trips and passengers had increased were spurned and discarded (by the Tribunal). During this period of over four years there were no problems, issues and even one accident.” In the period since DMRC took over, “no accident and damage to life and property has been reported and alleged.”

The HC bench further added that the Tribunal committed a serious error by holding, without “reason”, that the vital evidence of the sanction granted by the Chief of Metro Rail Safety (CMRS) for resumption of commercial operations of the Airport Line was inconsequential. It observed that the “certification/permission was granted by CMRS after due verification of the civil structure including the defects in girders.” It questioned the conclusion of the Tribunal that a speed limit imposed by the CMRS had such an adverse impact on the concessionaire that it walked away from the project. The bench observed that the findings of the award by the Tribunal ‘shocked the conscience of the court’ and it declared the arbitral award “perverse, irrational and patently illegal”.21]

The HC further observed that the Tribunal’s reasoning was “completely flawed and perverse” on computation of ‘Adjusted Equity’. The High Court bench raised objection to the treatment of Rs. 612 crores as ‘Equity’ by the Tribunal on the ground that such a project could not have been executed with only Rs 1 lakh as equity funded by DAMEPL’s promoters (in terms of share capital). The court ruled that the ‘Adjusted Equity’ under the Concession Agreement did not contemplate funds recognised as subordinated debt to be treated as ‘Equity’.

3.3 The Supreme Court Judgment

Reliance filed an appeal in the highest court against the Delhi High Court ruling. Eventually a two-judge bench of the Supreme Court decided in favour of the appeal in September this year. The Court at length explains the significance and nature of the Arbitration and Conciliation Act 1996, and that with the recent amendments the Act encourages arbitration and decision by the tribunals in such cases of civil disputes between two business entities, as in this case of warring parties involved in a PPP. The bench emphasised that courts should refrain from reopening or fresh appraisal of matters of fact as well as law in such cases. It further adds that the permissible grounds for interference are only when the tribunal award defies even common sense, as “when the arbitrator takes a view which is not even a possible one, or interprets a clause in the contract in such a manner which no fair-minded or reasonable person would.” The highest court further declares that, “If an arbitral award shocks the conscience of the court, it can be set aside as being in conflict with the most basic notions of justice.”[22]

The bench in its wisdom decided to focus on the validity of the DAMEPL notice and developments that took place in the 90 days of notice period since the July 2012 notice till October 8 (that was the focus of the Tribunal too, based on which it gave its final award). In the opinion of the Supreme Court, the Arbitral Tribunal framed issues for consideration and answered the said issues satisfactorily for this period. And later events like safety clearance and operating the Line successfully by DMRC since 2013 need not be taken into account. The court further averred that the whole issue is technical in nature and the Tribunal members were best placed to decide on that. It refused to bring in “legal issues” to double guess the decision of the Tribunal. Thus it also ignored the clearance given to DMRC by the safety commissioner. And hence the court ruled that the conclusion of the division bench of the High Court that the award of the Arbitral Tribunal suffered from patent illegality and shocked “the conscience of the court” was “erroneous”. Further, the court decided to go with the assessment of the Tribunal on adjusted equity too, and thus essentially upheld the Tribunal Award to DAMEPL.

3.4 CAG Report on the Airport Metro Express Project

Based on the audit of the project, the Comptroller and Auditor General (CAG) of India tabled its report in the Parliament in August 2013.[23] It passed severe strictures against the concessionaire, the supervisory role of DMRC and the drafting of the agreement. Interestingly, however, the immediate reporting of the report in the media had little mention of the CAG audit. The latest Supreme Court judgment too does not even mention the CAG audit, though the CAG report deals with issues that are central to the dispute. The CAG report records a very long list of transgressions by DAMEPL, and faults the DMRC for allowing DAMEPL to get away with these transgressions. Here we list a few of the most important ones in brief.

According to the audit, the DMRC failed to keep a proper vigil of the key escrow account, and allowed DAMEPL to dilute its equity stake and take multiple other liberties with the accounts. The provision for debt:equity of 7:3 was “neither incorporated in the concession agreement (as required by the government for such projects), nor complied with”. DMRC merely asked DAMEPL about it in June 2012, about 15 months after conversion of the share money worth Rs 612 crores to subordinate debt. The CAG raised serious concerns about the fact that the concessionaire was running a project worth Rs 5,697 crores with “an insignificant risk of Rs 1 lakh”. Among the many other issues that the audit flagged, the following are more noteworthy:

- DMRC suffered losses worth Rs 57 crores due to non-realisation of the annual concession fee and subsequent interest.

- During 2009-12, DAMEPL ‘released’ Rs 285 crores to other Reliance Group companies, while in 2010-11 Rs 59 crores were released from the escrow account to Utility Tech, renamed later as Reliance Utility Engineers.

- DAMEPL got a customs waiver worth Rs 29 crores in March 2009 on the recommendation of the chief project manager (DMRC) at the Airport Express Line, for which there was no provision, as the initial cost approved was inclusive of taxes & duties.

Moreover, CAG castigated DMRC for shoddy drafting of the agreement, and allowing the concessionaire to contribute only 46 per cent to the project costs as against the minimum requirement of 60 per cent as per the guidelines of the Ministry of Finance for PPP projects. Additionally, the, CAG highlighted that there was complete absence of any penal clause in the concession agreement.

According to the CAG report, the concessionaire was to provide trained personnel for operation and maintenance (O&M) activities at all times, undertake routine maintenance, including prompt repair of any wear or damage, and undertake major maintenance work such as track replacement, repair of structures, etc., while DMRC was to inspect at least monthly and send its O&M inspection report to the concessionaire; the concessionaire was supposed to remedy the defects and deficiencies within 30 days of its receipt and submit a compliance report to DMRC. But CAG discovered that DMRC wrote to DAMEPL that they failed to carry out (till May 2012) any inspections (Routine, Principal or Special) of the viaduct and bearings, and that the concessionaire was not equipped with inspection infrastructure required as per the O&M manual. It appointed a consultant, viz. M/s Shirish Patel & Associates (SPA), with the approval of DMRC to investigate the defects. It was on the basis of defects as brought out in the June 2012 report of SPA that DAMEPL suspended the metro services from 8th July 2012. For its part of construction, though DMRC carried out monthly inspection, CAG observed that it failed to detect any major defects in civil construction and at best issued only notices to its contractors and consultants for poor work and inspection.

4.0 Making Sense of the Delhi Airport Metro PPP

As we have discussed above at some length, this project involved huge investment connecting the heart of the nation’s capital with the busiest international airport in the country, that too at the time of a mega event like the Commonwealth Games. And yet the project fell apart in no time; some will say it was designed to fail right from its inception. How do we make sense of it and what can we learn from the whole process?

4.1 What does Big Capital bring?

It is repeated ad nauseam that only big business can provide ‘development’.[24] According to the dominant ideology, only big business can bring in capital, competence, efficiency, so on and so forth, and it has the deep pockets needed to persevere in projects such as infrastructure. Indeed, according to this ideology, the State has no business to be undertaking any commercial activity whatsoever. What we discover in this case is exactly the reverse of this rhetoric!

- Private capital of course wants all the control and returns, but is absolutely loath to invest a substantial stake of its own in such risky projects. Perhaps this is best epitomised in what CAG discovered in its audit, that in a project of close to Rs 5500 crore, Reliance had an equity stake of only Rs 1 lakh!

- Note also the very long list of other kinds of monetary manipulations that CAG flagged, which have been summarised above in Section 3.4.

- Further, we need to remember that within a year of commencing operations, once Reliance found that it did not receive the anticipated response from the commuters, its first step (in the name of ‘public interest’) was to demand exemption from paying the sums due to DMRC on the large investment that the latter had made in this project (half the project cost).

- Also note that, apart from DMRC’s investment, a sizeable part of the remaining project cost was covered by loans from PSU banks.

- Further, land was acquired by State agencies and provided practically free.

In brief, the project is predominantly funded by public money. To what end did it receive public funding, if it is to be reigned by the whims and fancies of private capital and its promoters?

Moreover, as per the agreement, if the agreement were terminated due to DAMEPL’s fault, DMRC would have to pay 80 per cent of the debt, while, if the contract were terminated due to DMRC’s fault, then it would have to pay 100 per cent of the debt and 130 per cent of the equity.[25] So either way all the risk is being borne only by the public body. This we call risk taking and entrepreneurship by the private sector!

Even in terms of knowhow, one needs to ask: what does Reliance contribute to the commissioning and running of a metro rail? Reliance had never run anything even remotely similar to a metro before bagging this project. All the technology that mattered was ‘imported’:

- CAF Spain, the junior partner in the project, supplied rolling stock

- MTR Hong Kong were engineering/ management consultants

- Siemens, Germany, supplied signalling systems, electrification and baggage logistics for EUR 34 million[26]

- RHEDA-2000 tracks were ordered from RailOne AG, Germany for very high-speed corridors, which could run at speeds of 350-400 kmph. This was very expensive track – about Rs 250 crore/km against Rs 175 crore/km for other Delhi metro lines.[27]

DAMEPL and the Delhi Airport Metro epitomise the ambitions of India’s ruling classes, who aspire to be ‘world class’ on wholesale, repetitive imports of technology.

The media speculated that, given that RInfra had no background in operating a metro, they were even likely to poach personnel from DMRC! In fact, in an interview, E. Sreedharan, the then MD of DMRC, repeatedly said that they had to train the DAMEPL personnel.[28]

Thus the private partners contributed neither technological know-how, nor capital, nor competence in estimating demand, nor competence in operating and maintaining the infrastructure.

Though we do not hold any brief for DMRC, contrast the experience of the Airport Metro with their own track record. Even the World Bank, no friend of the public sector, in one of its reports confesses that “Delhi’s metro was widely regarded as a tremendous success” and that it was one of the only five metro systems in the world that did not need operating subsidies.[29]

4.2 The Structural Issues Plaguing the Indian Economy

In their fanciful world of hi-tech and high speed, Big Capital and its army of advisors and consultants conjure up, and perhaps come to believe in, their own cooked-up stories of a massive middle class, with corresponding demand projections.[30] Of course they are eventually hit by the harsh reality of the real India, where the common folk have little money in their pockets to spend on the fancy projects of Big Capital. The failed airport metro is another grim reminder of the real India.

According to the CAG audit, against a ridership of 42,500 per day projected in the DPR for the year 2011, actual average ridership in the first 17 months of operations for the Line ranged between 5,500 and 18,000. In all its wisdom, DAMEPL had priced the premium ticket fare at almost 10 times of the normal metro fare. The DAMEPL had plans to generate 75 per cent of revenue through non-fare businesses like retail, property development, advertising, etc. However, in a note to DMRC in April 2012, it accepted that the planned retail/commercial activities along the metro corridor were not earning substantial yields, due to lack of passengers. In fact it managed to close deals on only 5 per cent of the real estate that it held.[31]

But once the Line was taken over by the DMRC in 2013, the fares were drastically cut, and a range of other measures were taken to improve accessibility. These led to a rapid rise in ridership, and helped it overturn operating losses. This resulted in the airport line breaking even by April 2016, a study in the Economic and Political Weekly (EPW) found.[32] From July 2013 to April 2016, daily ridership rose from 10,000 to close to 36,000, resulting in demand growth being faster than the fall in fares; thus despite lower fares, traffic earnings grew by 82 per cent.

It was precisely due to these kinds of structural constraints that the 12th Five Year Plan (2012-17) document cautioned that metro rail is a ‘public good’ that is capital intensive, with little scope for immediate returns. It pointed out that worldwide, out of 132 cities where metros operated, 113 were in the public mode.[33] Hence it should not be surprising that there were all of two bids for the Delhi metro project; and we call it a market-based system!

4.3 The State and Big Capital

It has become a mantra that almost every other activity, but for the police and military, should be taken up by Big Capital, and all that the State needs to do is create conditions for them to thrive – this is what ‘ease of doing business’ is supposed to be all about. Additionally, all that the State needs to do is have an effective ‘regulatory mechanism’, whatever that means. This project once again reminds us that such ideas are a lie. As already said in 4.1 above, first, Big Capital simply does not have the stomach to stay in projects like metro rail, if there is no scope for quick returns.

Second, as the discussion here once again brings out in all its horror, individual State agencies and institutions of various kinds, whether they be government bodies, PSUs like DMRC, tribunals or the courts, finally are simply incapable of holding private corporate bodies accountable for their acts of omission and commission, given the overall frame of State policy. If anything, it is private corporations that can hold specific State agencies and institutions to ransom once they corner public assets and are supposedly in the business of delivering public utilities such as metro services. Big Capital shaped State policy throughout, right from the manner in which the concession agreement was drafted, treating the concessionaire with kid gloves; the blind eye turned to the private partner’s financial machinations, lack of any sort of competence for running a project like this, and absence of managerial and engineering resources for timely trouble shooting; to finally exiting the project on some pretext or the other when the public bodies did not do their bidding. This role of State institutions extends to the judiciary as well: How else do we explain a Rs 5,000 crore compensation for operating a service for hardly one year with a mere Rs 1 lakh equity?

No doubt, along the way, there are apparent exceptions to the above rule, with specific State bodies criticising or obstructing particular firms; this can be seen, for example, in the CAG report or the high court ruling (discussed above). Whatever the reasons for these phenomena, these exceptions are not ultimately decisive. At the end of the process, the result is consistently the same: Big Capital dictates its terms.

What accounts for these temporary disputes, hurdles or exposures that large corporate firms occasionally encounter, due to one or the other State agency or body? How should we understand these phenomena? The following are some of the reasons:

1. The State claims to be impartial and above specific class interests. So its stated laws and policies necessarily contain some formal provisions for the regulation of private capital in the public interest. While in the normal course these provisions lie unused, from time to time one or the other honest officer or judge acts on them. This gives rise to a temporary dispute between private corporate capital and a specific State agency/court. By and large such officers or judges get weeded out before they rise too high in their respective hierarchies. Hence, even when such a dispute arises at a lower level, it generally gets resolved in favour of private corporate capital at a higher level.

2. There are also contradictions between different State agencies, and between the individuals leading these agencies. In these power struggles, one or the other side may decide to target some powerful or wealthy person.

3. Further, there are contradictions between different sections of the ruling classes (and even between giant Indian firms and specific foreign firms). For example, different companies may battle for shares of the Indian market (e.g., Jio vs Airtel/Voda Idea, Reliance vs Amazon), or rivals may struggle for control of a single firm/group (e.g., Mukesh vs Anil Ambani, Ratan Tata vs Cyrus Mistry), and so on. Both sides have contacts and influence among politicians, bureaucrats, judges and the media to one extent or the other. As a result, much information emerges in the course of their struggles. The final result, however, is in line with the respective strengths of the warring private corporate entities, irrespective of the evidence in favour of one or the other.

Contrast the airport metro case with the repeated ‘adjusted gross revenue’ (AGR) rulings of the Supreme Court against the telecom operators. There was much hue and cry that this would lead to monopolisation of the telecom sector. However, the end result was very much on the anticipated lines: finally the State refused to enforce the Supreme Court judgment because it went against the interests of Big Capital![34] While in the AGR case, the corporate media cried itself hoarse against the SC ruling, in this case no such hearts bleed for DMRC. All that the media have to say is that it is a great relief for the junior Ambani group in the midst of their bankruptcy crisis; going further, they remark that it is good for PSU banks too, as (they presume) the group will use this money to repay the banks!

4.4 It is Business as Usual for the Rulers

We may talk of the airport metro as a fiasco, but the rulers do not see it as one. Rather, they are in a frenzy of incentivising and providing public resources for private profiteering, whether by the sale of Air India, the productivity linked incentives (PLI) across industries for Big Capital, the asset monetisation pipeline of the PSUs or the giving away of the oilfields of ONGC to private operators. Big Capital increasingly occupies even more of the centre stage in the economy and polity of the nation.

Welcome to the New India, which is seriously bidding to host the 2036 Olympic Games! India’s representation in the International Olympic Committee is led by none other than Mrs Nita Ambani.

Notes:

[1] Comments and suggestions of RUPE editors and Manali on earlier drafts are gratefully acknowledged.

[2] World Bank, “Public-Private Partnerships”, https://www.worldbank.org/en/topic/publicprivatepartnerships/overview#1

[3] English rendering of PM’s address at the webinar on privatisation and asset monetisation, February 24, 2021, https://www.pib.gov.in/PressReleseDetail.aspx?PMO=3&PRID=1700558

[4] Megha Manchanda, “RInfra wins big, SC upholds Rs 5,000 cr arbitral award against Delhi Metro”, Business Standard, September 10, 2021. https://www.business-standard.com/article/companies/sc-admits-rinfra-plea-challenging-high-court-order-in-delhi-metro-case-121090901179_1.html, accessed on November 12, 2021.

[5] Kumar V Pratap, “Delhi Airport Metro Fiasco: What Can Be Done to Redeem the Project?” Economic and Political Weekly, December 7, 2013, Vol. 48, No. 49, pp. 18-20.

[6] John Samuel Raja D & Shreya Jain, “Fissures between Delhi Metro and Anil Ambani group pose grim questions about PPP model”, Economic Times, Sep 13, 2012. https://economictimes.indiatimes.com/industry/transportation/railways/fissures-between-delhi-metro-and-anil-ambani-group-pose-grim-questions-about-ppp-model/articleshow/16376010.cms, accessed on November 13, 2021.

[7] Sagnik Dutta, “End of the line?”, Frontline, November 30, 2012, https://frontline.thehindu.com/the-nation/article30189530.ece, accessed on November 13, 2021.

[8] Quoted in: Sidharth Sinha, “Delhi Airport Metro: PPP in Distress”, IIM Ahmedabad, IIMA/F&A0522, 2015.

[9] L&T was the only other bidder for the project, and it sought either an outright grant of Rs 346 crores a year or an interest free loan of Rs 1440 crores for 25 years. See footnote 3 above.

[10] Such PPP agreements are called ‘concessions’ as the state is granting a monopoly right to a private entity to operate a public asset for making part of the investment, and in turn to profit from it for a certain period of time. The private entity is also called ‘concessionaire’.

[11] An escrow account is a third party account that is visible to both the parties involved. The idea is that this will make any manipulation of the books difficult. Note that in this case the returns that DMRC gets for its investments depend upon the revenues that are shown by DAMEPL.

[12] The idea is that the private investor should have some minimum stake in such a project, hence a cap on the debt to equity ratio.

[13] Sidharth Sinha, op. cit.

[14] RInfra and this project is not an exception and this ET report cites many instances including companies at that time involving Mr. Nitin Gadkari. See John Samuel Raja D, “How companies are misusing ‘share application money’ to guise questionable financial practices, Economic Times, Dec 1, 2012. https://economictimes.indiatimes.com/news/company/corporate-trends/how-companies-are-misusing-share-application-money-to-guise-questionable-financial-practices/articleshow/17382029.cms?from=mdr, accessed on November 14, 2021.

[15] Anupam Chakravartty, “High-speed derailment,” Down to Earth, September 30, 2012. https://www.downtoearth.org.in/news/highspeed-derailment-39093, accessed on November 14, 2021.

[16] Ibid.

[17] John Samuel Raja D & Shreya Jain,op. cit. Until otherwise stated, much of the details in the following passage have been taken from this report.

[18] Supreme Court of India, DAMEPL vs. DMRC, judgment on Civil Appeal No. 5627&28 of 2021, September 9, 2021. https://main.sci.gov.in/supremecourt/2019/3712/3712_2019_35_1501_29929_Judgement_09-Sep-2021.pdf accessed on November 18, 2021.

[19] Reproduced from John Samuel Raja D & Shreya Jain, op. cit.

[20] The details are from Supreme Court, op. cit.

[21] Abhinav Garg, “Metro safety is not negotiable, says Delhi high court”, Times of India, 26/01/2019. https://timesofindia.indiatimes.com/city/delhi/metro-safety-is-not-negotiable-says-delhi-high-court/articleshow/67695415.cms, accessed on November 20, 2021.

[22] Supreme Court judgment, op. cit.

[23] Implementation of Airport Metro Express Line Project through Public Private Partnership, Report no. 13 of 2013, Comptroller and Auditor General of India, Ministry of Urban Development, Chapter XV. https://cag.gov.in/uploads/download_audit_report/2013/Union_Compliance_Commerical_Audit_Observations_13_2013_chap_15.pdf, accessed on November 21, 2021.

[24] Note for instance the response of the business media to the recent announcement by the Prime Minister regarding repeal of the three farm laws: there is wide consensus among the commentariat that this is a huge setback for the economy, as only big business can do something about the present farm crisis.

[25] Sidharth Sinha, op. cit.

[26] “Siemens to equip new metro link to New Delhi airport”, transportweekly, 15.05.2009, http://www.transportweekly.com/pages/en/news/articles/61244/, accessed on November 23, 2021.

[27] “New technology for faster travel at the Metro Airport Express Link”, The Hindu, August 25, 2009, https://www.thehindu.com/news/cities/Delhi/New-technology-for-faster-travel-at-the-Metro-Airport-Express-Link/article16876648.ece, accessed on November 23, 2021. [28] Sudheer Pal Singh & Jyoti Mukul, “Q&A: E Sreedharan, MD, Delhi Metro Rail Corporation, ‘Our PPP experience with Reliance hasn’t been happy’,” Business Standard, January 20, 2013 https://www.business-standard.com/article/companies/q-a-e-sreedharan-md-delhi-metro-rail-corporation-111011700023_1.html, accessed on November 23, 2021.

[29] O.P. Agarwal & Jose A. Gomez-Ibanez, Delhi Airport Metro Express, World Bank, 2010. https://ppiaf.org/documents/2059?ref_site=kl, accessed on November 23, 2021.

[30] For an actual assessment of the size of India’s middle class, see this analysis by RUPE: “A middle-class India?” Aspects of India’s Economy, 58, Sep. 2014, https://www.rupe-india.org/58/introduction.html, accessed on November 23, 2021.

[31] John Samuel Raja D & Shreya Jain, op. cit.

[32] Sunil Ashra, Sharat Sharma, Narain Gupta, “Sensitivity of Traffic Demand to Fare Rationalisation: The Case of Delhi’s Airport Metro Express Link,” EPW, Vol. LIII, No. 49, December 15, 2018.

[33] Sagnik Dutta, op. cit.

[34] Rounak Jain, “Indian government dials M for moratorium – Airtel, Vodafone Idea get a four-year relief on AGR dues,” Business Insider, Sep 15, 2021, https://www.businessinsider.in/business/telecom/news/telecom-relief-package-airtel-vodafone-idea-get-four-year-moratorium-on-agr-dues/articleshow/86227218.cms, accessed on 24/11/2021.

(Rahul Varman is Professor, Department of Industrial and Management Engineering, IIT Kanpur. Article courtesy: Research Unit for Political Economy, a Mumbai based trust that analyses economic issues for the common people in simple language.)